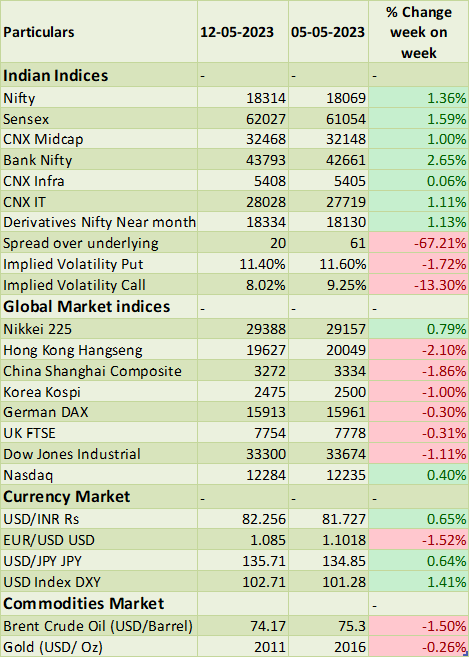

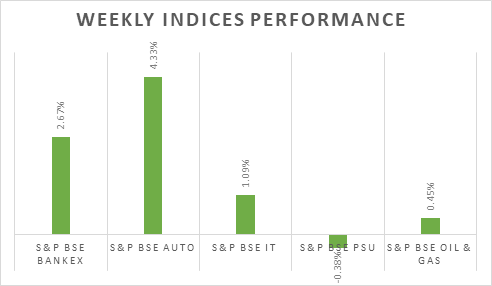

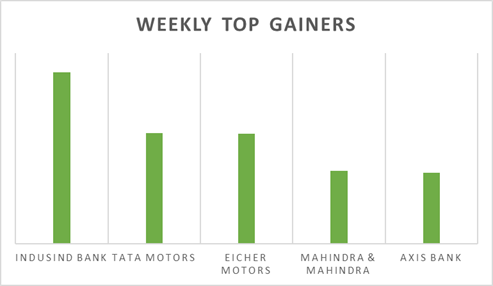

Sensex & Nifty gained by 1% during last week, Banking, Auto and IT sectors were top gainers. On domestic macro-data front, Industrial production in India went up 1.1% YoY in March 2023, missing market expectations of a 3.3% rise and easing from a 5.6% increase in the previous month. It was the lowest growth in industrial activity since October 2022. India’s CPI slowed sharply to 4.7% in April 2023, the lowest since October 2021, from 5.7% in March 2022, and slightly below forecasts of 4.8%.

In the coming week, investors will watch out for Fed official speeches, industrial production data from China and Q4 earnings from corporates. FIIs/FPIs domestic inflows stood at Rs. 85 billion YTD.

Equity Market Summary:

o Wallstreet indices were traded on flat note and key macro-economic data points which will be released this week will set trend for Dow Jones, Nasdaq and S&P 500.

o In the global market indices, the Nikkei 225, Nasdaq, and German DAX have shown a positive trend, whereas the Hong Kong Hangseng, China Shanghai Composite, Korea Kospi, and Dow Jones Industrial have shown a negative trend.

o In the currency market, the USD/INR has increased by 0.65%, whereas the EUR/USD and USD/JPY have decreased by 1.52% and 0.64%, respectively. The USD Index DXY has increased by 1.41%.

o Bank of England raised the bank rate by 25bps to 4.5% in May 2023, marking the 12th consecutive rate increase, in line with market expectations.

o In the commodities market, Brent Crude Oil decreased by 1.50%, whereas Gold decreased slightly by 0.26%.