Tata Steel Ltd. (TSL), founded in 1907, is the flagship company of the Tata Group. The company operates in 26 countries and has a commercial presence in more than 50 countries. The product mix of the company includes flat steel products such as HR Coils, CR Coils, Galvanized Steel, Long Products such as Wire Rods, Rebars, Ferro Alloys, Tubes, Bearings, Wires, etc. The company also owns coal, iron ore and manganese & chrome mines at various locations. In June 2016, the company sold its UK longs business including Scunthorpe Steel Works (with a capacity of 4.5 MTPA) to Greybull Capital. Currently, the company has two prime facilities in Netherlands and UK with a total steel production capacity of 12.6 mtpa. Tata Steel has acquired Bhushan Steel Ltd. in May 2018 having installed capacity of about 5.6 mtpa). Moreover, it has completed the acquisition of Usha Martin's steel business through Tata Sponge Iron Limited, a subsidiary of Tata Steel, for a cash consideration of Rs. 40.94 billion. Usha Martin Steel Business has specialized 1 MTPA alloy-based manufacturing capacity in long products segment based in Jamshedpur and captive power plants.

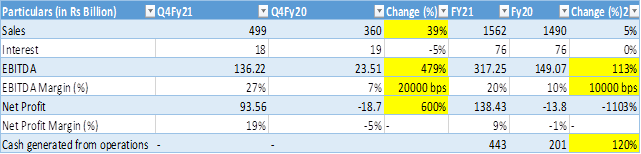

Performance in Q4FY21 & FY21

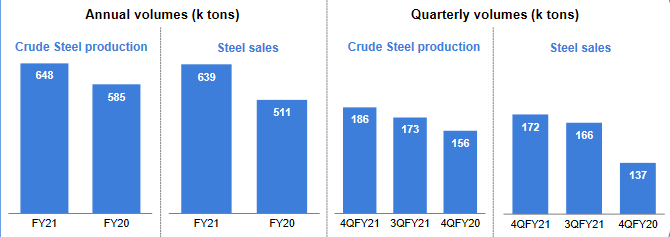

- Q4FY21 domestic sales volumes increased by 38% (Y-o-Y) & 49% (Y-o-Y) up for FY21 on the back of strong commodity prices rally.

- Quarterly deliveries grew 10% ( (Y-o-Y) and declined slightly for Fy21 due to lockdowns during Q1FY21 and Q2FY21.

- Net debt reduced by Rs. 293 billion for FY21.

- Net debt to EBITDA declined to 2.4x

- Generated cashflow of Rs. 237 billion for Fy21

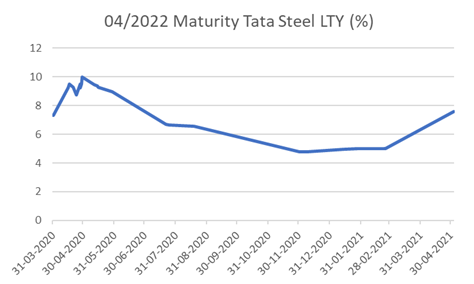

Tata Steel Traded Bond

Strong earnings with a better than business environment have resulted in a fall in yields for Tata Steel Bond. Credit spread with benchmark G-sec has come off sharply for shorter-end maturity bonds. However, longer-end maturity bonds have not seen much change in yield levels as the markets are yet to factor on the sustainability of the current commodity prices rally. Following image shows a fall in yield for 04/2022 maturity bond (ISIN - INE081A08181)

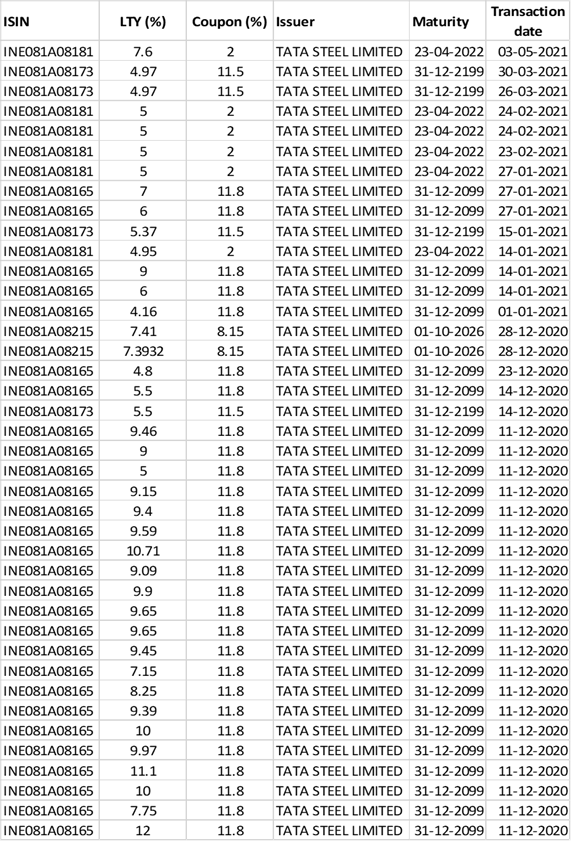

Latest trading data across all maturities given in below table. Please contact us if you want more data.

Credit Rating-

Tata Steel Ltd has been rated as BB-(Stable) and A1+ to its short term borrowing by S&P while CARE rate AA (stable).

Professional Management and Group Support-

Tata Steel is a listed entity, part of the famous Tata Group, which has a track record of servicing borrowings and access to financial markets. The company is led by experienced and qualified management professionals.

Diversified product mix-

The product mix of the company includes flat products such as hot-rolled coils, cold-rolled coils, galvanized steel, and long products such as wire rods, rebars; ferroalloys, tubes, bearings, wires, etc. The product segments cater to agriculture, automotive, construction, consumer goods, energy and power, engineering, material handling, etc.

Improving profitability-

Tata Steel profits surged during the quarter from that of the previous quarter due to steel prices upswing. The company's EBITDA came surged by 479% on a yearly basis during Q4FY21. Rise in profitability can be attributed to factors such as buoyant demand, rise in metal prices, and better capacity utilization.

Deleveraging Balance-sheet-

Tata Steel's gearing ratio declined to 0.44x during Q4FY21 from 3.6x during Q1Fy20.

Liquidity-

Tata Steel generated strong cashflows from operations and current cash levels stood at Rss. 131billion. Free Cashflow generation driven by stronger operating performance and company is focusing on working capital control.