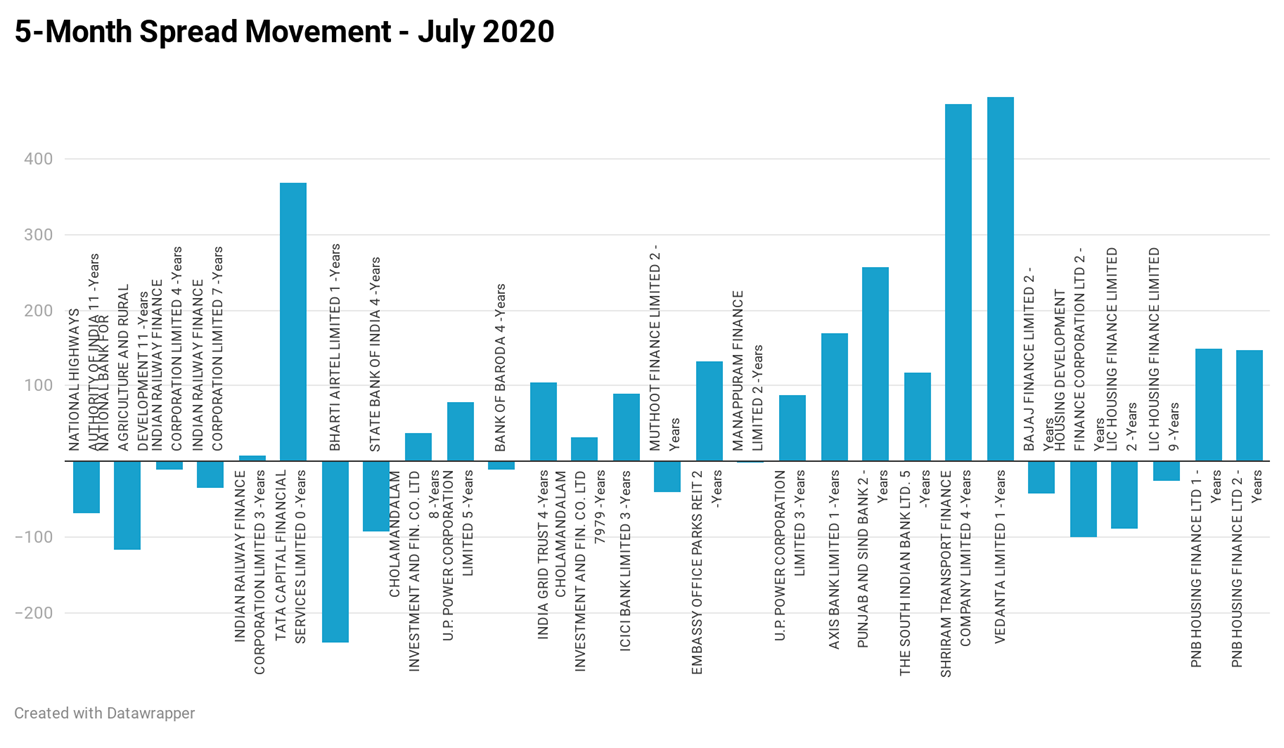

Pre-COVID spread and current spread comparison show that the tax-free bond spread has contracted across maturities and across issuers. Perpetual bonds spread movement shows that the spread of private banks has widened while the spread of public sector banks contracted, Bank of Baroda 4-year YTC spread contracted by 12 bps while SBI 4-year YTC spread contracted by 93 bps. Among private sector banks ICIC Bank 3-year YTC widened by 89 bps and Axis Bank 1-Year YTC spread widened by 169 bps. The spreads of smaller banks such as Punjab and Sind Bank and The South Indian Bank have widened by 256 bps and 118 bps respectively.

NBFCs and Corporates have seen a sharp upward movement in spreads amid weak economic activity. However, the spread of Bharti Airtel Ltd has contracted by 240 bps. Embassy Reits spread has widened by 133 bps as there are concerns on REITS given the work from home trends that will hurt commercial real estate.

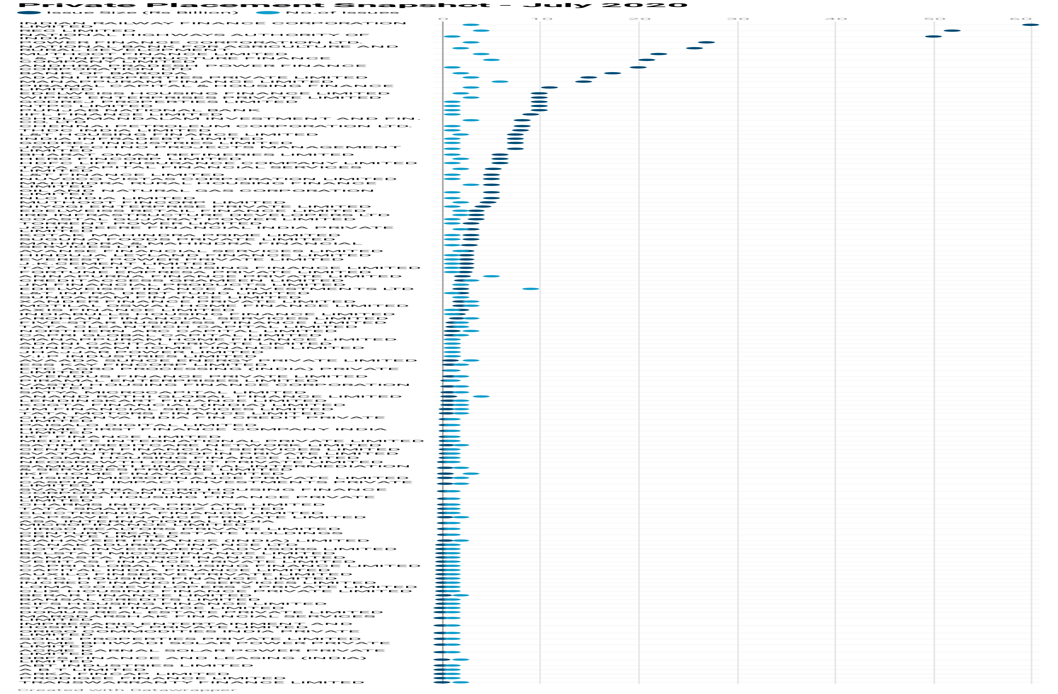

Private Placements - July 2020

During July 2020, 226 issuers in total have raised Rs 600.15 billion through private placement. IRFC has raised Rs 60 billion by issuing 5, 11, and 15-year maturity bonds at a spread of 80 bps, 37 bps and 32 bps respectively. Muthoot Finance Ltd. has raised Rs 22 billion by issuing 4 bonds with 2 & 3 years maturity, the spreads were in the range of 415 bps - 420 bps. NHAI has raised Rs 50 billion by issuing a 5-year maturity bond at a spread of 80 bps. Manappuram Finance Ltd. has raised Rs 14.5 billion by issuing 6 bonds with 2 and 10 years maturity, the spreads were at 412 bps and 320 bps.

Rating Updates - July 2020

During July 20, India Rating Ltd has reaffirmed ratings of major issuers such as HPCL, Bharati Airtel(short term) while downgraded issuers like West Bengal State Electricity Transmission Company, Go Airlines (India) Limited etc. CRISIL reaffirmed ratings of major issuers like Alembic Pharmaceuticals Limited, Manappuram Finance Limited, Tata Industries Limited, Muthoot Finance Limited, NTPC-SAIL Power Finance Company Limited while assigned ratings to Bank of Baroda BASEL III-tier bonds. ICRA reaffirmed ratings of issuers like Bharat Aluminium Company Limited, Jindal Steel & Power Limited.