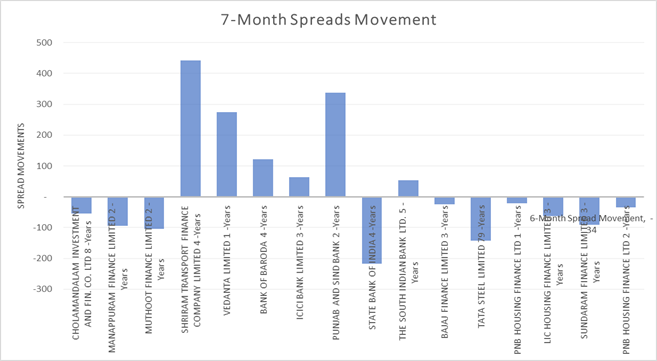

Pre-COVID spread and current spread comparison show that the spread has largely contracted for strong NBFCs, HFCs and Banks while for the weaker issuers, the spread is still at higher levels. Muthoot Finance and Manappuram Finance spreads of a 2-year maturity bonds have contracted by 95bps and 104 bps respectively. PNB Housing 2-year maturity bond spread contracted by 34 bps and Sundaram Finance 3-year bond spread contracted by 91 bps.

Perpetual bonds spread movement shows that the spread of lower-rated private sector banks such as Punjab & Sind Bank and The South Indian Bank has widened while the spread of big private sector banks and public sector banks has contracted from the levels seen in March 2020 but witnessed an uptick in spread during the month of September 2020. SBI 4-year YTC spread contracted by 217 bps while the spread for Bank of Baroda 4-year YTC has gone up by 121 bps. Among private sector banks ICIC Bank 3-year YTC bond spread widened by 64 bps. The spreads of smaller banks such as Punjab and Sind Bank and The South Indian Bank have widened by 337 bps and 53 bps respectively.

Private Placements � August 2020

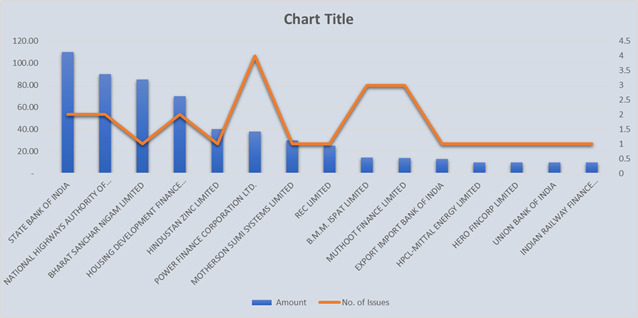

During September 2020, 151 issuers in total have raised Rs 812 billion through private placement. State Bank of India has raised Rs 110 billion by issuing 2 bonds. NHAI has raised Rs 90 billion by issuing 2 bonds with 13 years maturity and 20 years maturity with spread of 55 bps and 37 bps, respectively. Bharat Sanchar Nigam Ltd has raised Rs 85 billion by issuing a 10-year maturity bond, at a spread of 69 bps. HDFC Ltd has raised Rs 70 billion by issuing 2- and 5-years maturity bond, the spreads were at 42 bps and 95 bps, respectively.

Rating Updates - September 2020

During September 20, India Rating Ltd has reaffirmed ratings of major issuers such as L&T Housing Finance Ltd, L&T Infrastructure Finance Ltd etc. while assigned ratings to Adani Ports & SEZ, SP Jammu Uhampur Highway Ltd etc. CRISIL reaffirmed ratings of major issuers like Cholamandalam Investment and Finance Company Ltd, Mannapurum Finance, JK Lakshmi Cement Ltd, Muthoot Fincorp Ltd etc.