Indian corporate raise Rs 642 billion in Private Placements of Debt in October 2020, at lowest yields on record

When issuers enjoy cheap rates, investors get hit in the longer term

PSUs, NBFCs, HFCs and other issuers are taking full advantage of RBI ultra loose monetary policy and are raising funds at cheapest levels on record. Investors are investing heavily in bonds to earn higher returns but when the interest rate cycle turns, they see high capital loss.

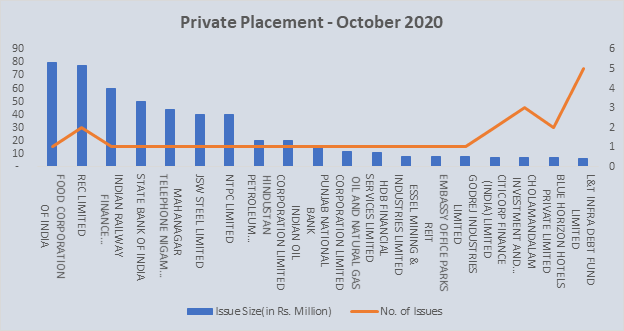

Private Placements October 2020

During October 2020, 100 issuers in total have raised Rs 642.55 billion through private placement. Food Corporation of India has raised Rs 80 billion by issuing 1 bond. REC Ltd. has raised Rs 78 billion by issuing 2 bonds with 5 years maturity and 10 years maturity with spread of 61 bps and 82 bps, respectively. Indian Railway Finance Corporation Ltd has raised Rs 60 billion by issuing a 20-year maturity bond, at a spread of 6 bps. State Bank of India has raised Rs 50 billion by issuing 10-years maturity bond at a yield of 5.83%.

Rating Updates - October 2020

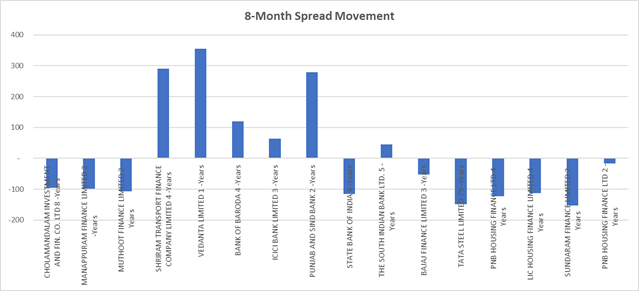

In October India Rating ratings reaffirmed rating of major issuers like National Housing Bank, Nirma Ltd, Aadhar Housing Finance Ltd, Tata Sons Private Ltd. CRISIL reaffirmed rating of JM Financial Products Limited, Union Bank of India, The South Indian Bank Limited, City Union Bank Limited, TMF Holdings Limited etc while it assigned rating to issuers like Muthoot Fincorp Limited, Indian Phosphate Limited. During the month, CRISIL downgraded the rating of Vedanta.