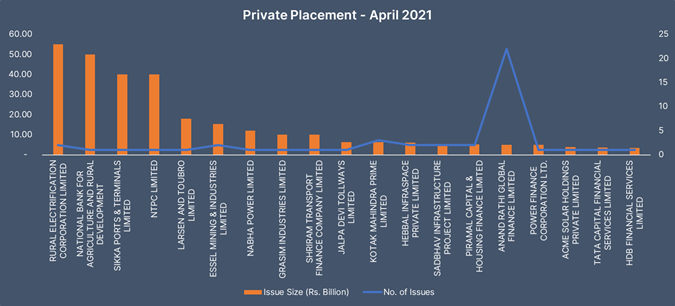

Private Placements – April 2021

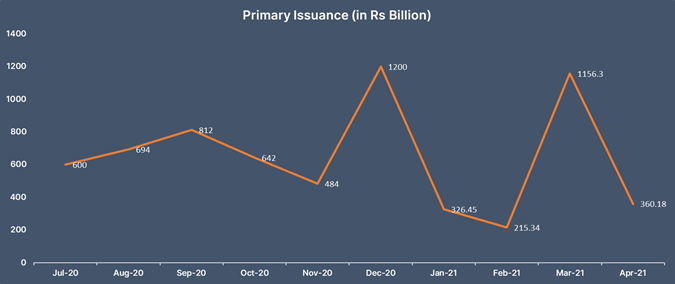

During April 2021, 84 issuers in total raised Rs 360.18 billion through private placements. REC raised Rs 55 billion by issuing 2 bonds with 3 and 5-years maturity. NABARD raised Rs 50 billion by issuing 1 bond with 3-years maturity at a spread of 104 bps. Sikka Ports & Terminals Ltd raised Rs 40 billion by issuing 1 bond with 5-years of maturity at a spread of 121 bps. NTPC has raised Rs 39.96 billion by issuing 1-bond with 15-years of maturity.

Rating Updates – April 2021

During April 2021, India Rating affirmed credit rating of issuers including Dr. Reddy’s Laboratories Limited, Gujarat Gas Limited, L&T Finance Holdings Limited, Kotak Mahindra Bank Limited, Tata Steel Long Products Limited, Adani Ports and Special Economic Zone Limited, Aditya Birla Housing Finance Limited while it assigned rating to issuers including India Grid Trust, Bangalore International Airport Limited, North Eastern Electric Power Corporation Limited, LC Infra Projects Private Limited.

During the mentioned month, ICRA affirmed credit rating of issuers including Gujrat Energy Transmission Corporation Ltd, Gujrat State Electricity Board Ltd, Jyoti Lab Limited, KFin Technologies Private Limited, MAS Financial Services Limited, Bank of India, Sterlite Technologies, Natco Pharma Limited while it upgraded rating of suers like Hindustan Aeronautics Limited, Ramco System Limited.