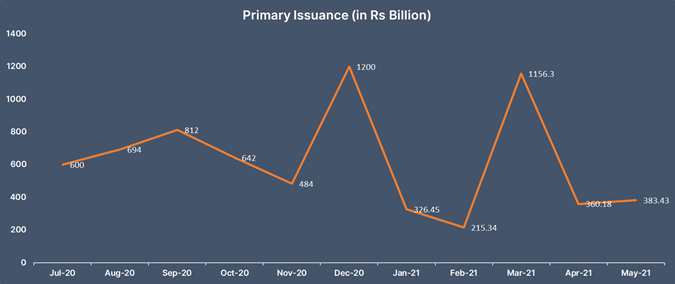

Indian corporate raise Rs 383.43 billion in Private Placements of Debt in May 2021.

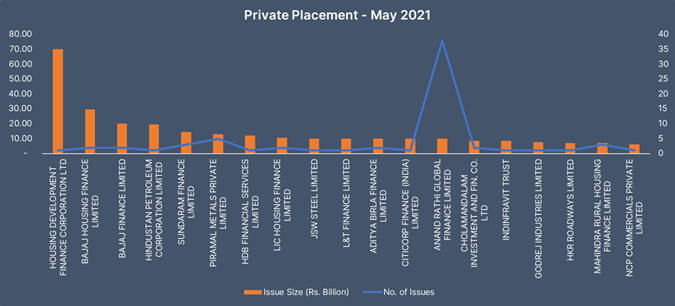

Private Placements � May 2021

During May 2021, 151 issuers in total raised Rs 383.43 billion through private placements. HDFC Ltd. raised Rs 70 billion by issuing 1 bond with 5-years maturity at a spread of 57 bps. Bajaj Housing raised Rs 29.5 billion by issuing 2 bonds with 3-years maturity at a spread of 157 bps. Bajaj Finance raised Rs 20 billion by issuing 2 bonds with 2-year & 3-year of maturity at a spread of 92 bps & 152 bps respectively. HPCL has raised Rs 19.50 billion by issuing 1-bond with 10-years of maturity.

Rating Updates � May 2021

During May 2021, India Rating affirmed credit rating of issuers including GAIL (India), Greater Visakhapatnam Municipal Corporation,� Wind Energy Private Limited,� IL&FS Transportation Networks Limited, Criyagen Agri & Biotech Private Limited, Mahira Ventures Private Limited, Artson Engineering Limited,� Omni Auto Limited while it assigned rating to issuers including Coastal Gujarat Power Limited, Fortum Solar Plus Private Limited, Bharuch District Cooperative Milk Producers� Union Ltd, Varanasi Sangam Expressway Private Limited, Solar Edge Power and Energy Private Limited, MFL Securitisation Trust C etc.

During the mentioned month, ICRA assigned credit rating to issuers including Bateli Tea Company Limited, Ashoka Banwara Bettadahalli Road Private Limited, reaffirmed rating of issuers including Il&fs Tamil Nadu Power Company Limited, PTC India Limited, Godrej Agrovet Limited, Pibco Enterprises Pvt. Ltd, Antique Cottex Private Limited, Shreeji Cotton Industries, Muthoot Homefin (India) Limited, Haldia Energy Limited, India Infoline Finance Limited, ICICI Home Finance Company Limited, Muthoot Microfin Limited, Kotak Securities Limited while upgraded ratings of issuers like Mindspace Business Parks Private Limited etc.