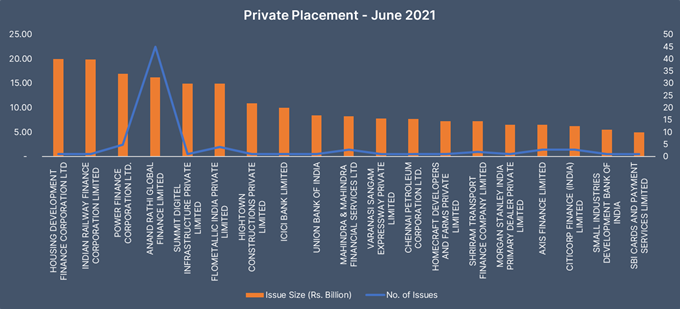

Private Placements – June 2021

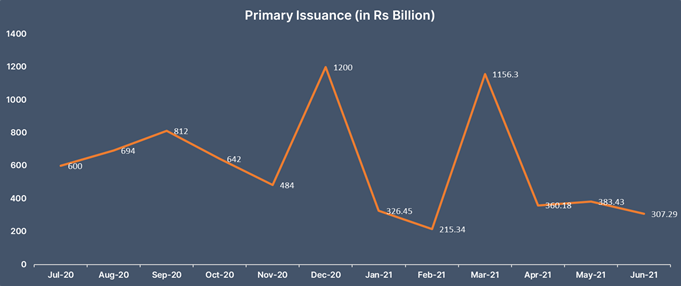

During June 2021, 115 issuers in total raised Rs 307.29 billion through private placements. HDFC Ltd. raised Rs 20 billion by issuing 1 bond with 10-years maturity at a spread of 74 bps. IRFC raised Rs 19.94 billion by issuing 1 bond with 20-years maturity. Power Finance Corporation raised Rs 17 billion by issuing 5 bonds with 4,5,7, & 15-year of maturity.

Rating Updates – June 2021

During June 2021, ICRA affirmed ratings of HDFC Life Insurance Company Limited, IDFC First Bank Limited , National Housing Bank , Edelweiss Retail Finance Limited, AU Small Finance Bank Limited, Edelweiss Housing Finance Limited, Lendingkart Finance Limited, Bajaj Electricals Limited, Cholamandalam Investment and Finance Company Limited, TeamLease Services Limited, DLF Promenade Limited , Bank of Baroda, SBI Global Factors Limited, Hindustan Media Ventures Limited, Mahindra Logistics Limited, L&T Interstate Road Corridor Limited , upgraded ratings of Tata Coffee Limited, Five-Star Business Finance Limited etc.

During the mentioned month, India Rating affirmed credit rating of issuers including Indian Oiltanking Limited, Pune Municipal Corporation, Purba Bharati Gas Private Limited, Himachal Energy Private Limited, Rajiv Petrochemicals Private Limited, Heritage Finlease Limited, Athani Sugars Limited while assigned rating to issuers including Aditya Birla Money Limited, South West Mining Limited, Ganges Green Energy Private Limited, Spandana Sphoorty Financial Limited, Midas Projects Private Limited etc.