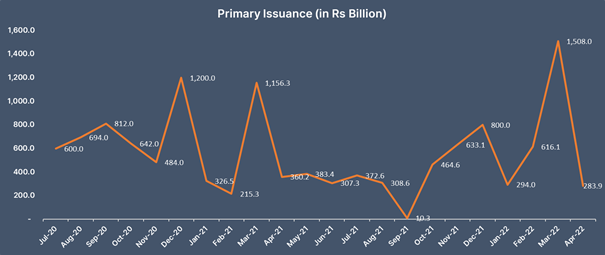

Private Placements – Apr 2022

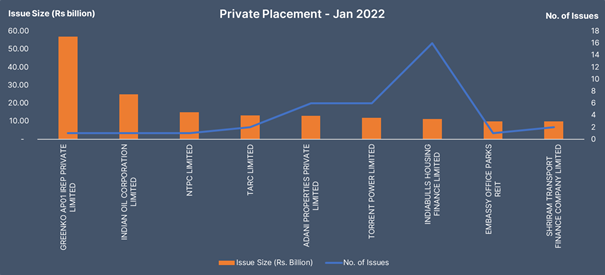

During Apr 2022, 172 issuers in total raised Rs 283.87 billion through private placements. Greenko raised Rs 57 billion by issuing 1 bond with 15 years maturity bonds. IOCL raised Rs 25 billion by issuing 1 bond with 2 years of maturity. NTPC raised Rs 15 billion by issuing 1 bond with 2 years of maturity.

Rating Updates – Apr 2022

During Apr 22, India Rating affirmed credit rating of KCT Trading Pvt Ltd, R V Plastic Limited, Gallantt Metal Limited, Anand Motor Agencies Limited, Ghaziabad Nagar Nigam, Sudarshan Chemical Industries Limited, Avla Nettos Exports etc while it assigned credit rating to Suzlon Energy Limited, Willowood Chemicals Private Limited, Aparna Packaging Co. Private Limited, Safal Gladeone Estate etc. The rating agency also downgraded credit rating of issuers including Perfect Infracorp Private Limited, Punjab Renewable Energy Systems Private Limited etfc.

During above month, ICRA affirmed Bharti Realty Limited, Dedicated Freight Corridor Corporation of India Limited, Eastern India Biofuels Private Ltd, Mahindra CIE Automotive Limited, Parmanand and Sons Food Products Private Limited, Repco Micro Finance Limited, Sterlite Technologies Limited, Jyothy Labs Limited etc it assigned rating to issuers including DP Jain Datia Bhander Toll Road Projects Pvt Ltd, Dinara Datia DPJ Pathways Pvt Ltd etc.