- 3 and 12 Months CDF yields fell by 5-9 bps.

- 3 and 12 Months NBFC CP yields fell by 10-18 bps.

- Magma Housing Finance Ltd, AA-, issued Rs 1.4 billion, 1.5-year bond at 8.48%, 436 bps spreads

- SBI Cards and Payments Services Ltd, AAA, issued Rs 5 billion, 3-year bond at 5.75%, 140 spreads

- FII debt utilization status stood at 32.32% of total limits. FIIs investment in bonds came down by Rs 9.17 billion

Government bond yields rose sharply last week on hawkishinflation comments by MPC members including the RBI Governor even as supply remained high thorough Rs 320 billion G-sec auction and Rs 200 billion of Switch/Conversion auction of G-secs. AAA Credit spreads rose while HFCs spreads declined. In the last week, AAA PSU 3-10 years spreads rose by 7-22 bps at the short end of the curve. HFCs spreads fell by 1-26 bps. AAA NBFC spreads for 3-10 years rose by 10-32 bps.

As per SEBI data ,in FY21 as on June 2020, total corporate bonds outstanding rose yearly by 7.79% to Rs 33.22 trillion and by 2.10% against March 2020.

During the week, Sundaram Finance 10 year bond was trading at 7.64%, at spreads of 156 bps. Muthoot Finane 1.25 year bond was trading at 7.25%, at spreads of 315 bps, L&T LTd Ltd 2 year bond was trading at 4.70%, at spreads of 60 bps

| PSU- G-sec (Spread) | Current Spread | 1-Day Change | 1-Week Change | 1-Month Change |

|---|---|---|---|---|

| 1 Year | 39 | -13 | -7 | -14 |

| 2 Year | 56 | -0 | 0 | -2 |

| 3 Year | 82 | 5 | 7 | 5 |

| 5 Year | 32 | -9 | 22 | -20 |

| 10 Year | 60 | -2 | 8 | 4 |

| NBFC - Gsec (Spread) | Current Spread | 1-Day Change | 1-Week Change | 1-Month Change |

| 1 Year | 136 | -7 | -6 | -7 |

| 2 Year | 123 | 10 | -10 | -17 |

| 3 Year | 155 | 13 | 10 | 18 |

| 5 Year | 107 | 0 | 32 | -8 |

| 10 Year | 141 | 6 | 32 | 14 |

| NBFC - PSU (Spread) | Current Spread | 1-Day Change | 1-Week Change | 1-Month Change |

| 1 Year | 97 | 6 | 1 | 7 |

| 2 Year | 67 | 10 | -10 | -15 |

| 3 Year | 73 | 8 | 3 | 13 |

| 5 Year | 75 | 9 | 10 | 12 |

| 10 Year | 81 | 8 | 24 | 10 |

| HFC-Gsec(Spread) | Current Spread | 1-Day Change | 1-Week Change | 1-Month Change |

| 1 Year | 69 | -4 | -26 | -25 |

| 2 Year | 93 | -3 | 0 | -12 |

| 3 Year | 113 | -0 | -2 | 8 |

| 5 Year | 63 | -9 | -5 | -17 |

| 10 Year | 98 | -2 | -1 | 6 |

| HFC - PSU (Spread) | Current Spread | 1-Day Change | 1-Week Change | 1-Month Change |

| 1 Year | 30 | 9 | -19 | -11 |

| 2 Year | 37 | -3 | 0 | -10 |

| 3 Year | 31 | -5 | -9 | 3 |

| 5 Year | 31 | 0 | -27 | 3 |

| 10 Year | 38 | 0 | -9 | 2 |

| Dates | - | 21-08-20 | 14-08-20 | Change(%) |

| Weekly FII Investment | (Rs billion) | -9.17 | -7.58 | -20.98% |

| - | - | - | - | Change in bps |

| AAA PSU yields (%) | 3 Years | 5.17% | 5.05% | 12 |

| 5 Years | 5.80% | 5.40% | 40 | |

| 10 Years | 6.78% | 6.56% | 22 | |

| AAA HFC yields (%) | 3 Years | 5.48% | 5.43% | 5 |

| 5 Years | 6.11% | 5.98% | 13 | |

| 10 Years | 7.16% | 6.98% | 18 | |

| CD yields (%) | 3 months | 3.20% | 3.29% | -9 |

| - | 12 months | 3.85% | 3.90% | -5 |

| CP yields (%) | 12 Months | - | - | - |

| - | Manufacturing | 4.10% | 4.20% | -10 |

| - | NBFC | 4.30% | 4.40% | -10 |

| - | 3 Months | - | - | - |

| - | Manufacturing | 3.27% | 3.35% | -8 |

| - | NBFC | 3.40% | 3.58% | -18 |

| FPI limit utilization | (In %) | 32.32% | 32.43% | -11 |

Weekly Issuers

| Name of Issuer | Face Value (Rs mn) | Issue Size (Rs mn) | Maturity (Years) | Coupon Rate (%) | Credit Rating | Business Sector | Type of Issuer-Nature | Spreads (bps) |

|---|---|---|---|---|---|---|---|---|

| ABANS FINANCE PRIVATE LIMITED | 0.1 | 24.3 | 1 | 13% | Finance | NBFC | 986 | |

| BELSTAR MICROFINANCE LIMITED | 1 | 250 | 1 | 9.50% | CARE-A+ | Finance | Other | 571 |

| PNB HOUSING FINANCE LTD | 1 | 11150 | 2 | 7.75% | IND-AA/Stable | Finance | Other | 363 |

| IIFL HOME FINANCE LIMITED | 1 | 1000 | 2 | 8% | CRISIL-AA/Negative | Finance | Other | 388 |

| IIFL FINANCE LIMITED | 1 | 6000 | 2 | 8% | CRISIL-AA/Negative | Finance | Other | 388 |

| MANAPPURAM FINANCE LIMITED | 1 | 3000 | 2 | 8.35% | CRISIL-AA/Stable | Finance | NBFC | 423 |

| JM FINANCIAL CREDIT SOLUTIONS LIMITED | 1 | 1000 | 2 | 8.75% | ICRA-AA/Stable | Finance | Other | 463 |

| DVARA KSHETRIYA GRAMIN FINANCIAL SERVICES PRIVATE LIMITED | 1 | 250 | 2 | 10.90% | CARE-BBB | Finance | Other | 678 |

| MUTHOOT FINCORP LIMITED | 1 | 3250 | 2 | 9.35% | CRISIL-A/Stable | Finance | Other | 545 |

| IKF FINANCE LIMITED | 1 | 300 | 2 | 9.10% | CARE-A | Finance | Other | 529 |

| SAMBANDH FINSERVE PRIVATE LIMITED | 1 | 50 | 2 | 12.50% | BWR-BBB- | Finance | - | 898 |

| PIRAMAL CAPITAL & HOUSING FINANCE LIMITED | 1 | 500 | 2 | 7.85% | CARE-AA | Finance | Other | 373 |

| MAGMA HOUSING FINANCE LIMITED | 1 | 1400 | 2 | 8.48% | CARE-AA- | Finance | Other | 436 |

| INDOSTAR CAPITAL FINANCE LIMITED | 1 | 2000 | 2 | 8.95% | CARE-AA- | Healthcare | NBFC | 483 |

| MAS FINANCIAL SERVICES LIMITED | 1 | 1000 | 2 | 9% | CARE-A+ | Finance | Other | 488 |

| SVATANTRA MICROFIN PRIVATE LIMITED | 1 | 250 | 2 | 9.20% | CRISIL-A+/Stable | Utilities | Other | 508 |

| ESS KAY FINCORP LIMITED | 1 | 300 | 2 | 9.25% | CRISIL-A/Stable | Finance | Other | 513 |

| SBFC FINANCE PRIVATE LIMITED | 1 | 250 | 2 | 9.30% | IND-A/Stable | Finance | Other | 518 |

| FIVE-STAR BUSINESS FINANCE LIMITED | 1 | 500 | 2 | 9.50% | ICRA-A/Stable | Finance | Other | 538 |

| KOGTA FINANCIAL (INDIA) LIMITED | 1 | 250 | 2 | 9.50% | CARE-A- | Finance | NBFC | 538 |

| AYE FINANCE PRIVATE LIMITED | 1 | 100 | 2 | 10% | IND-A-/Stable | Finance | Other | 588 |

| SATIN CREDITCARE NETWORK LIMITED | 1 | 500 | 2 | 10.25% | CARE-A- | Finance | NBFC | 613 |

| MADURA MICRO FINANCE LIMITED | 1 | 500 | 2 | 10.50% | ICRA-BBB+ (Under rating watch with positive implications) | Finance | NBFC | 638 |

| AROHAN FINANCIAL SERVICES LIMITED | 1 | 500 | 2 | 10.50% | ICRA-A-/Stable | Finance | NBFC | 638 |

| PIRAMAL CAPITAL & HOUSING FINANCE LIMITED | 1 | 1500 | 2 | 7.85% | CARE-AA | Finance | Other | 388 |

| TOYOTA FINANCIAL SERVICES INDIA LIMITED | 1 | 1750 | 2 | 5.65% | ICRA-AAA/Stable | Finance | NBFC | 165 |

| BAJAJ FINANCE LIMITED | 1 | 3500 | 2 | 5.20% | CRISIL-AAA/Stable | Finance | NBFC | 118 |

| P.N.R. HOUSING LIMITED | 0.1 | 1 | 2 | 12% | Utilities | Other | 843 | |

| BAJAJ FINANCE LIMITED | 1 | 20000 | 3 | 5.70% | CRISIL-AAA/Stable | Finance | NBFC | 135 |

| VEDIKA CREDIT CAPITAL LTD | 1 | 200 | 3 | 13% | ACUITE-BBB+ (Under rating watch with negative implications) | Utilities | Other | 865 |

| POWER FINANCE CORPORATION LTD. | 1 | 5000 | 3 | 5.47% | CARE-AAA | Finance | NBFC | 124 |

| KHUSH HOUSING FINANCE PRIVATE LIMITED | 1 | 100 | 3 | 11.25% | CARE-BBB | Finance | Other | 690 |

| CAPSAVE FINANCE PRIVATE LIMITED | 1 | 200 | 3 | 9.18% | ACUITE-A-/Stable | Finance | NBFC | 515 |

| SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA | 1 | 5000 | 3 | 4.90% | ICRA-AAA/Stable | Finance | Bank | 64 |

| KOTAK MAHINDRA PRIME LIMITED | 1 | 1000 | 3 | 5.50% | CRISIL-AAA/Stable | Finance | NBFC | 127 |

| AADHAR HOUSING FINANCE LIMITED | 1 | 3000 | 3 | 8.20% | CARE-AA | Finance | Other | 385 |

| PRISM JOHNSON LIMITED | 1 | 750 | 3 | 9.75% | IND-A | Industrial | Other | 540 |

| SBI CARDS AND PAYMENT SERVICES LIMITED | 1 | 5000 | 3 | 5.75% | ICRA-AAA/Stable | Finance | NBFC | 140 |

| NANDINI BUILDHOME CONSORTIUM PRIVATE LIMITED | 5 | 600 | 3 | 16.73% | Utilities | Other | 1373 | |

| LENDINGKART FINANCE LIMITED | 0.5 | 225 | 4 | 12.39% | ICRA-BBB+/Stable | Finance | Other | 769 |

| SAMUNNATI FINANCIAL INTERMEDIATION & SERVICES PRIVATE LIMITED | 0.005 | 506.25 | 5 | 12.39% | CRISIL-BBB+/Stable | Utilities | Other | 729 |

| STATE BANK OF INDIA | 1 | 89310 | 15 | 6.80% | CRISIL-AAA | Finance | Bank | 25 |

| TMF HOLDINGS LIMITED | 1 | 1000 | Perpetual | 8.76% | CRISIL-AA-/Negative | Finance | NBFC | 256 |

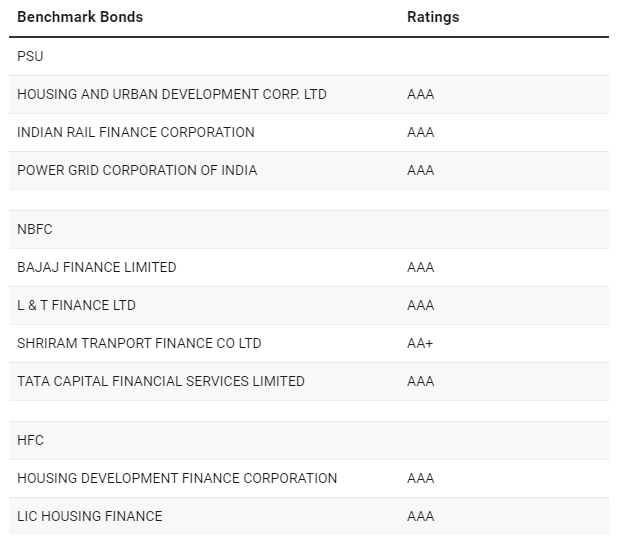

Benchmark Bonds

<