COVID-19 significantly impacted Tata Motors Ltd (TML) in India, demand was already seen adversely impacted by the general economic slowdown, liquidity stress and stock corrections due to BSVI transition, was further affected by the lockdown. However, pent demand during the festive season was good for auto industry as the sales rose in double digits. Second wave of Covid-19 which had hit US, UK & Europe is hampering JLR sales. PV segment has seen its market share improve to about 7.9% in the first half of FY21 from 4.8% in FY20.

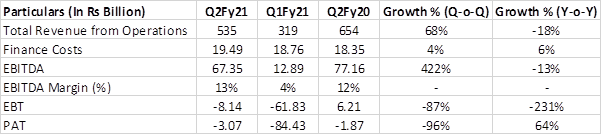

Q2Fy21 revenues rose on the back of pent-up demand. Revenues rose substantially on quarterly basis but below Pre-Covid levels. Due to cost optimisations EBITDA margins expanded on yearly basis. Jaguar Land Rover returned to profit with significant positive cash flow in the quarter as sales and revenue recovered from the impact of Covid-19. JLR has strong liquidity profile with 3 Billion GBP cash and 1.9 Billion GBP undrawn credit facility.

During FY20, the consolidated net revenue of Tata Motors declined by 13.54% to Rs 2610.68 billion from Rs 3019.38 billion during FY19. EBITDA contracted 60 bps to 8.4% and loss was at Rs 105.80 billion. Finance costs increased by Rs 14.85 billion to Rs 72.43 billion during FY20 due to higher gross borrowings. Free cash flow, was negative Rs 920 billion reflectings lower profitability and adverse working capital, primarily in India business. Borrowings rose 17.65% to Rs 833.15 billion. Due to lower sales, JLR suffered a loss of GBP 422 million for the FY20 on revenues of GBP 23 billion.

Tata Motors Ltd Credit Note-

Tata Motors Ltd has Long term rating of CRISIL AA- and Short term rating CRISIL A1+.Incorporated in 1945, Tata Motors Limited is Indias largest automobile company and the market leader in the domestic CV industry and one of the top five manufacturers of PVs in India. In the domestic CV industry, TML has one of the most diversified product portfolios with a presence spanning across light, medium and heavy-duty segments of the CV industry. The companys product portfolio in the PV segment also spans passenger cars, UVs and multi-purpose vehicles (MPVs). In June 2008, TML acquired Jaguar Land Rover (JLR) from Ford Motor Company for USD 2.3 billion. Following the acquisition, TMLs business profile underwent a significant change from being a predominantly India-centric OEM to one with presence in the premium and luxury segment cars and SUVs across multiple markets in Europe, North America, China, Russia, and Brazil. Apart from JLR, which is wholly-owned by TML ,the company has also historically expanded its operations in India as well as overseas through strategic alliances and mergers and acquisitions. Some of its key subsidiaries include Tata Motors Finance Limited (vehicle financing subsidiary), Tata Technologies Limited (a software firm engaged in providing IT solutions to the automotive industry), Tata Daewoo Commercial Vehicles Company Limited (CV operations in South Korea) and TML Drivelines Limited (its captive auto component manufacturer). The company also operates JVs with Marcopolo (for building bodies for buses and coaches) and Fiat (for PVs, engines and transmissions).

TML has six manufacturing plants in India at Pune (Maharashtra), Lucknow (Uttar Pradesh), Jamshedpur (Jharkhand), Pantnagar (Uttaranchal), Dharwad (Karnataka) and Sanand (Gujarat). In addition, the companys key subsidiary, JLR, operates three manufacturing facilities and two design centres in the UK. In FY13, JLR also formed a 50-50 JV with China-based Chery Automobiles to set up a manufacturing facility in China, which commenced operations from H2 FY2015. JLR has also announced its plans of setting up a manufacturing unit in Slovakia, which will gradually expand JLRs 5 total production capacity over the medium-term. Moreover, as a Group, TML also operates assembly operations at multiple locations, globally through its subsidiaries and JVs.

Credit Positives and Negatives

Positives- Strong Parentage Support

- Robust product portfolio and strong brand in the global luxury automotive segment

- The management commitment to deleveraging the balance sheet by divesting some of its non- core investments and trimming overall working capital cycle.

Negatives

- The slowdown in the sales for Jaguar Land Rover Globally and Aversion to Diesel Cars in Europe

- JLRs lower operating scale, a higher concentration in Britain and lack of manufacturing in the US and uncertainty due to Brexit

- Intense Competition in the domestic CV and PV segment of the Auto industry

- Rising borrowings and finance cost

TMLs credit profile continues to benefit from being part of the Tata Group, comfortable capital structure and strong liquidity position, aided by large cash and liquid investments.

Tata Motors has lost significant market share in its standalone Commercial vehicle (CV) segment from 58% in 2011-12 to 43% in 2019-20, largely driven by delays in addressing product gaps, and issues related to products and distribution channels.

Focus on improving Free Cash Flow-

Jaguar Land Rover reduced capex by 40% to GBP 2.5 bn in FY21 while TML India reduced by 66% to Rs 15 bn.Total free cash outflow limited to GBP 1.5b in April and May, including one-time working capital outflow from the plant shutdowns of GBP 1.2bn,free cash outflow in Q1 FY21 expected to be less than GBP 2 bn

Borrowing Profile-

Jaguar Land Rover liquidity of GBP 5.6 billion and TML India has liquidity position of Rs 67 billion as on FY20.