Tanglin Development Ltd

Name of Issuer | Tanglin Development Ltd |

Short term rating | - |

Long Term rating | BWR A+ (Stable) |

Financials Snapshot | FY 2018 (Rs) |

Revenue | 1.34 Billion |

PAT | 0.11 Billion |

Gearing Ratio | 3.43 times |

Tangible Net-Worth | 5.75 Billion |

The bond of the issuer is protected from many different fronts, inherent operating business of the issuer and four types of guarantees, two of which are pledged shares of listed entities.

Tanglin is rated A- and issue is secured by way of overall security cover of 3 times, consisting of pledge of listed equity shares of Sical Logistics aggregating to 1 time of principal amount, pledge of listed equity shares of Coffee day enterprises aggregating to 0.5 times of principal amount and pledge of unlisted equity share of CGDL aggregating to 1.5 times of principal amount. Additionally, the NCDs are secured by personal guarantee of the promoter, Mr. V.G.Siddhartha and corporate guarantee by Tanglin Retail Reality Development Ltd.

Tanglin Development- Founded in 1995 as the developer of technology parks and SEZs for the Coffee Day Company, Tanglin Developments offers bespoke infrastructural facilities for Technology enterprises. TDL has two technology parks, Global Village and Tech Bay, situated in Bengaluru and Mangaluru respectively.

Office space absorption is a domain that is expected to grow, owing to robust demand from IT/ITeS companies in key markets such as Bengaluru. Tanglin offers customised office spaces for various multi-national technology enterprises in Bengaluru and Mangaluru.

A steady and sustained demand from technology companies during the year resulted in Tanglin recording a gross revenue of Rs 1.5 billion in FY18. Over the next 8-12 months, an upcoming metro station close to the Global Village property in Bengaluru will boost the demand for the location and provide faster connectivity to the city centre. As per management, revenues from Tanglin are expected to cross Rs 2 billion in the next 12-15 months.

Coffee Day Enterprises– Is the listed holding company for various companies of the Coffee Day Group.

Coffee Day Enterprises is present across the following sectors: Coffee, logistics, financial services, leasing, commercial space and hospitality. However, 50% of the consolidated Gross revenue of the CDE was contributed by the coffee business during FY18, followed by 31% from the logistics business and 13% from financial services.

Coffee Day Enterprises Financials

Rs Million | FY18 | FY17 |

Revenue | 43,305.00 | 35,519.00 |

Finance Charge | 3,491.00 | 3,172.00 |

Depreciation | 2,604.00 | 2,268.00 |

PBT | 2,251.00 | 1,371.00 |

Income Tax | 768.00 | 555.00 |

Profit | 1,063.00 | 470.00 |

D/E | 1.32 | 1.31 |

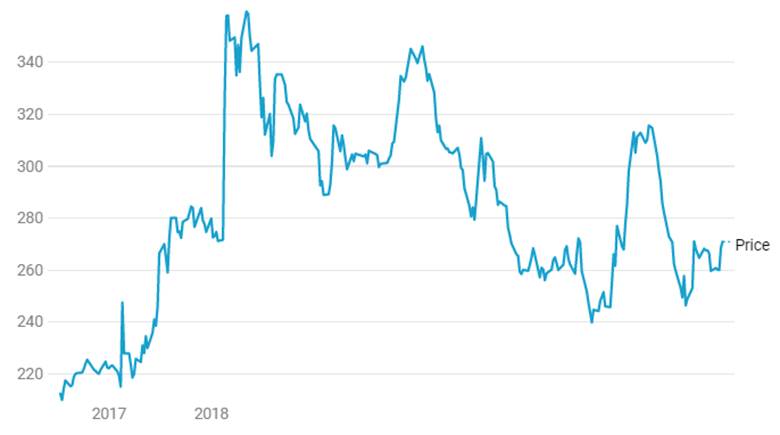

Coffee Day Enterprises Stock Price

Sical Logistics Ltd- Sical Logistics Limited is rated BBB+ (Stable) and is involved in the business of Mining, multi-modal logistics for bulk and containerized cargo port terminals, port handling, trucking and warehousing, ship agency, customhouse agency, offshore supply logistics and retail logistics. On a consolidated basis, SLL has investments in infrastructure including a port terminal, container freight stations, container rail and a dredger.

Sical Logistics Financials

s Million | 2018 | 2017 |

Sales | 9,746.20 | 7,521.50 |

Profit before Interest Tax and Depreciation | 1,283.10 | 1,246.60 |

Interest | 331.60 | 234.90 |

Depreciation | 439.50 | 272.00 |

PBT | 512.00 | 739.70 |

PAT | 286.60 | 455.40 |

PAT Margin% | 2.94 | 6.04 |

D/E | 1.44 | 1.54 |

Sical as an integrated multimodal logistics player in areas of port handling, trucking and shipping services in India. Sical is also increasing its footprint in Mining segment and execution of overburden/coal removal contracts in the last few years has led to healthy revenues and profitability from the segment. The company currently holds two Mine Development and Operations (MDO) contracts, which provides revenue visibility over a longer period of time.

Logistics is regarded as the backbone of the economy as it ensures the efficient and cost-effective flow of goods and another commercial sectors dependant on it. The logistics industry in India is evolving rapidly. It is the interplay of infrastructure, technology and new types of service providers, which defines how the logistics industry will be able to help its customers reduce their costs and provide effective services. Despite a weak response, the logistics industry continues to witness growth owing to the progress in retail, e-commerce and manufacturing sectors. The logistics industry is expected to reach over USD 2 billion by 2019. The rise of e-commerce logistics and increased domestic consumption will pave the way for the industry to grow further in the future

Sical is in operation of surface mining of coal and transportation at mines in Odisha and M.P. and currently executes overburden/coal removal contracts for Coal India and its subsidiaries. Sical holds two Mine Developer and Operator contracts with long project tenures and substantial revenue potential. Robust unexecuted order book position indicates healthy revenue visibility for the Mining segment. However, the MDO projects typically involve considerable capex, long gestation periods, land acquisition and approval risks which would stress the Sical financials.

Port Handling- This division performed stevedoring activity at the ports of Chennai, Tuticorin, Mangalore, Vizag and Ennore. Sical handled coal and other bulk commodities at these ports. Volume handled during FY18 was 15.05 million tons.

Integrated Logistics- The contract for movement of coal from Mahanadi Coal Fields in Odisha to the power plant of NLC at Tuticorin through road, rail and sea is continuing

Supply Chain Logistics- This division of Sical offers various services to consumer goods industry, cold chain, warehousing and industry distribution logistics. In FY18, Sical acquired the controlling stake in Patchems Private Ld. Which has wide experience in the handling and distribution of pharma and FMCG products

Revenue growth is expected to be higher going forward aided by higher revenues from Mining and Integrated Logistics contracts and revenue growth in retail logistics segment further fueled by acquisitions during FY2018.

Sical Logistics Share Price

Coffee Day Global– is engaged in coffee business. Coffee Day Global Limited was earlier known as Amalgamated Bean Coffee Trading Company Limited. CDGL operate a highly optimised and vertically integrated coffee business, which ranges from procuring, processing and roasting of coffee beans, to retailing of coffee products.

Coffee Day Global Limited flagship cafe chain brand Cafe Coffee Day (CCD) owns 1722 cafes in 245 cities and 532 CCD Value Express kiosks. The coffee beans and powder are marketed through 403 Fresh and Ground Coffee retail stores. There are 47,747 vending machines that dispense coffee in corporate workplaces and hotels under the brand. The division serves more than 2 billion cups of coffee per annum. Internationally, CCDs are present in Vienna, Czech Republic, Malaysia Nepal and Egypt.

Coffee Day Global Financials

Rs Million | FY18 | FY17 |

Revenue | 20,161 | 17,728 |

Finance Charge | 683 | 479 |

Depreciation | 1,743 | 1,633 |

PBT | 647 | 498 |

Income Tax | 276 | 230 |

Profit | 370 | 264 |

Coffee Business– According to TechSci Research report, India Coffee Shops/Cafe Market Forecast, Consumer Survey and Opportunities, 2021, coffee shops / cafe market in India is projected to grow at a CAGR of over 11% during 2017-2021, because of the growing coffee culture among young population, increasing urbanisation, rising disposable income levels and changing eating and drinking preferences of consumers. Changing work patterns of business executives is also driving the demand for such coffee shops/cafe, as these outlets offer services such as free Wi-Fi, entertainment zones, etc. In India, coffee shops/ cafe market is in the developing stage, with most of the demand for coffee beverages emanating from urban centres such as New Delhi, Mumbai, Bengaluru, Chennai, Hyderabad and Kolkata. In addition to metros and Tier I cities, new companies and leading market players are targeting expansion to Tier II and Tier III cities. This coupled with the implementation of various government plans to develop smart cities, etc., is projected to drive growth in the Indian market for coffee shops/ cafe over the next five years.