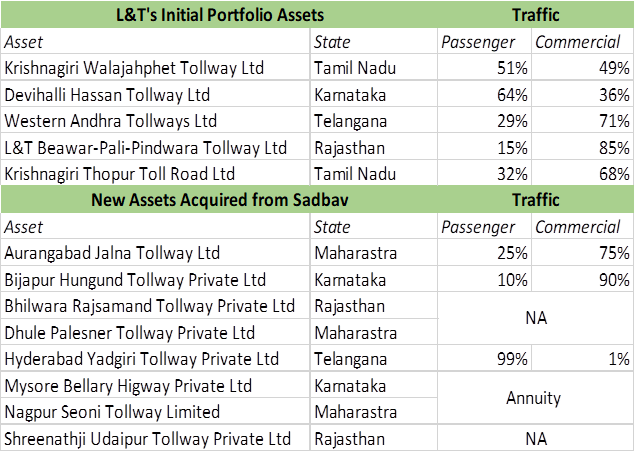

IndInfravit has 11 toll projects and 2 annuity projects located in Maharashtra, Telangana, Karnataka and Rajasthan.� The growth in traffic in the overall portfolio in passenger car unit (PCU) terms stood at 4.5% between October 2020 and February 2021 compared with the traffic during the same period a year ago, supported by robust growth in passenger vehicle category. With the second wave of Covid-19 impacting traffic across the country, the toll collections in IndInfravit toll road assets have also witnessed a decline in April and May 2021.

Sponsor of the IndInfravit is L&T Infrastructure Development Projects Ltd and investment manager is LTIDPL INDVIT Services Ltd, who has 2 decades of experience in managing infrastructure projects. IndInfravit trust has been rated AAA by ICRA. Debt repayment for 2-3 years stood at Rs. 3000 million p.a.

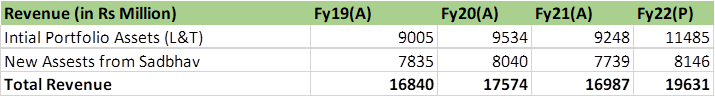

Revenues from the initial projects reported at Rs. 9248 in Fy21 and projected revenues for Fy22 are to reach Rs.11485 million, 24% growth YoY. With the second wave of Covid-19 impacting traffic across the country, the toll collections in IndInfravit toll road assets have also witnessed a decline in April and May 2021.

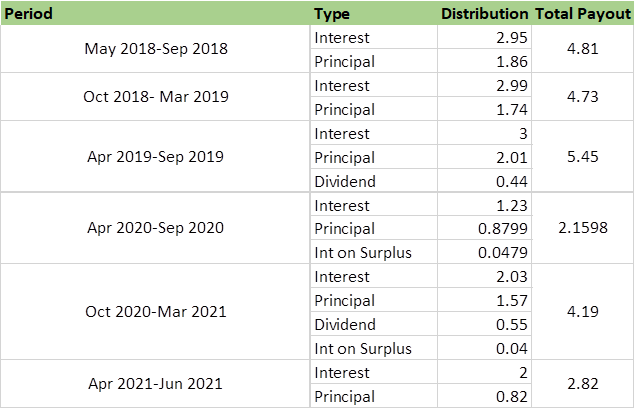

Dividend and interest pay-out history

Credit Positives

� Liquidity profile of the trust

� Operational collection

Credit Negatives

� Higher maintenance costs & periodic capex

� Rising inflation & fuel cost (lower traffic)

� Further leverage

Distribution of income mechanism to Unit holders

� Distributed of income will be in form of interest, dividend and capital repayment.

� 90% of net distributable cash flow will be distributed to unit holder.

Tax Treatment

� Any dividend or interest income from an InvIT is completely taxable as per income tax slab rate.

� Dividend payment by SPVs to InvITs are exempted from TDS.

� If unit holder sells InvIT units and earns capital gain, then unit holder has to pay tax.