Equity Markets Snapshot For The Week

- FED, ECB & RBI will publish policy-meeting minutes.

- Japan will publish Q2 GDP growth & inflation figures.

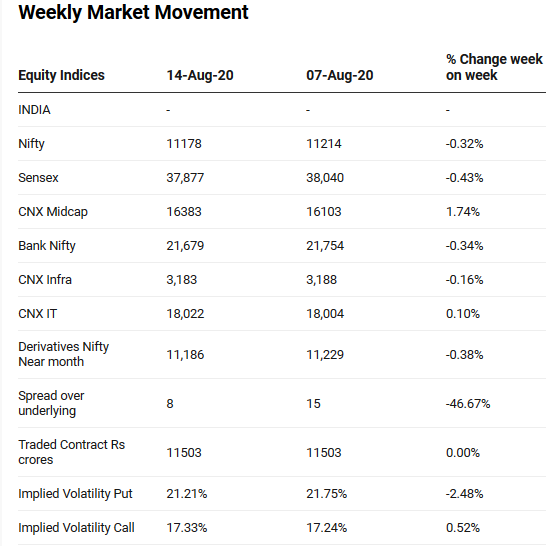

- Implied volatility (IV) for put and call at the money options stood at 21 and 17 levels respectively.

FIIs/FPIs have bought Indian equity shares worth Rs. 75 billion in July 2020 and bought shares worth Rs. 261 billion in August 2020 (till 09th August 2020). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Futures, Index Options, and Stock Futures.

The Nifty Index futures witnessed fall in open interest by 3% for the August series and 24% rise for the September series. Implied volatility (IV) fell for put option and rose for call option in the last week. Fall in IV for put option and rise in IV for call option shows steady support for Nifty at present levels.

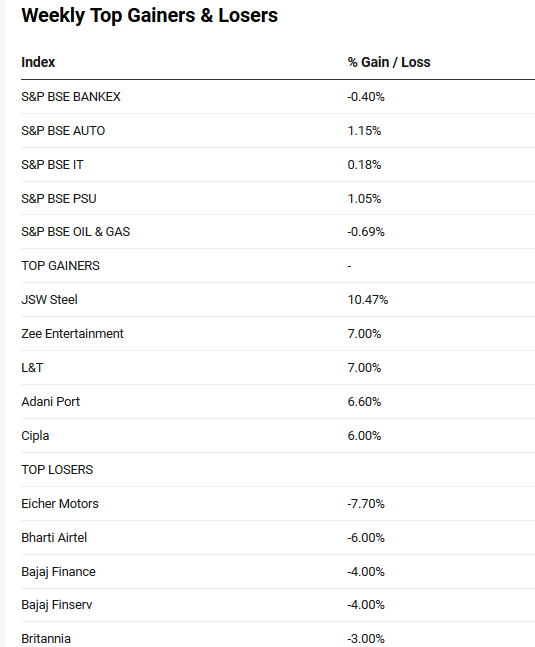

The BSE Sensex index closed on a negative note on Friday as investors community sentiment was dampened by higher inflation data which reduced chances of RBI slashing rate cuts going forward and weak global cues acted as catalyst. During the week, Sensex & Nifty declined by 0.43% & 0.32%. On macro-economic data front, CPI climbed to 6.93% in July 2020 more than market expectations, the reading has come at above than RBI's medium-term target of 4%. WPI dropped by 0.58% in July 2020. India's trade deficit narrowed to USD 4.83 billion in July 2020 from USD 1343 billion in the same month last year and compared to market expectations of USD 2 billion. Exports declined by 10.2% and imports plunged by 28.4%.

On global front, Wall Street closed on a mixed note on Friday, as mixed economic data and policy uncertainty weighed on sentiment. During the week, Dow Jones gained by 1.82%, Nasdaq rose by 0.08% and S&P 500 increased by 0.50%.

European indices closed on negative note on Friday due to weaker global investors sentiment as China reported weaker macro data and uncertainty over US fiscal stimulus bill. During the week, FTSE gained by 0.96% and DAX increased by 1.80%.

During the week, Brent Crude Oil gained by 0.90%. However, sentiment for Brent crude oil was weak amid in global coronavirus infections could hamper fuel demand recovery. The International Energy Agency and the Organization of the Petroleum Exporting Countries slashed their 2020 oil demand forecasts. On the supply side, OPEC eased its production curbs to 7.7 million bpd from August 2020 until December 2020, compared to July's 2020 record 9.7 million bpd cuts.

Gold closed at USD 1945 an ounce on Friday and witnessed its steepest weekly fall since March 2020, following nine weeks of gains. Bullion has been under pressure this weak as uncertainty over US fiscal stimulus bill talks lead to lower investors' appetite for the precious metal. Rising US treasury yields also caused for the fall of Gold prices during the week, as they are inversely co-related.

Global Economy

Total industrial production in the United States rose 3% from a month earlier in July 2020 after increasing 5.7% in June 2020, matching market expectations. Still, the activity remained 8.4% below its pre-pandemic February 2020 level.

The University of Michigan's consumer sentiment for the US stood at 72.8 levels in August 2020, little-changed from the previous month's 72.5 levels and compared to market expectations of 72 levels.

China's industrial production growth stood at 4.8% (Y-o-Y) in July 2020, below market consensus of 5.1%, as the economy recovers from the COVID-19 crisis. Manufacturing and utilities output continued to increase, while mining fell back into contraction territory.

Eurozone's industrial production increased by 9.1% from a month earlier in June 2020, missing market expectations for a second consecutive month and easing from a revised 12.3% jump in May. Forecasts were pointing to a 10% rise. Activity continued to rebound from record slumps seen in March and April as COVID-19 restrictions were eased in the region.

The Eurozone economy shrank 12.1% during June end quarter 2020, the biggest contraction on record and entering a recession. Germany, France, Italy and Spain all posted record declines in GDP as lockdowns imposed to contain the spread of the coronavirus pandemic hit activity and global demand.

The Eurozone's trade surplus widened to EUR 21.2 billion in June 2020 from EUR 19.36 billion in the corresponding month of the previous year and compared with market expectations of a 12.6 billion surplus.

The number of Americans filling for unemployment benefits rose by 963,000 in the week ended 8th August 2020, the least since the pandemic started and compared to market expectations of 1.1 million.

US crude oil stocks slumped by 4.512 million barrels in the week ended 7th August 2020, the third consecutive period of decrease and compared to market expectations of a 2.875 million drop, according to the EIA Petroleum Status Report.