Equity Markets Snapshot For The Week:

- Fed and ECB policy-meeting minutes will be released next week.

- PMI surveys for the US, UK, Eurozone and Australia will be published.

- China will publish industrial profits.

- Domestic market participants will look out for Q2Fy21 Corporate Earnings.

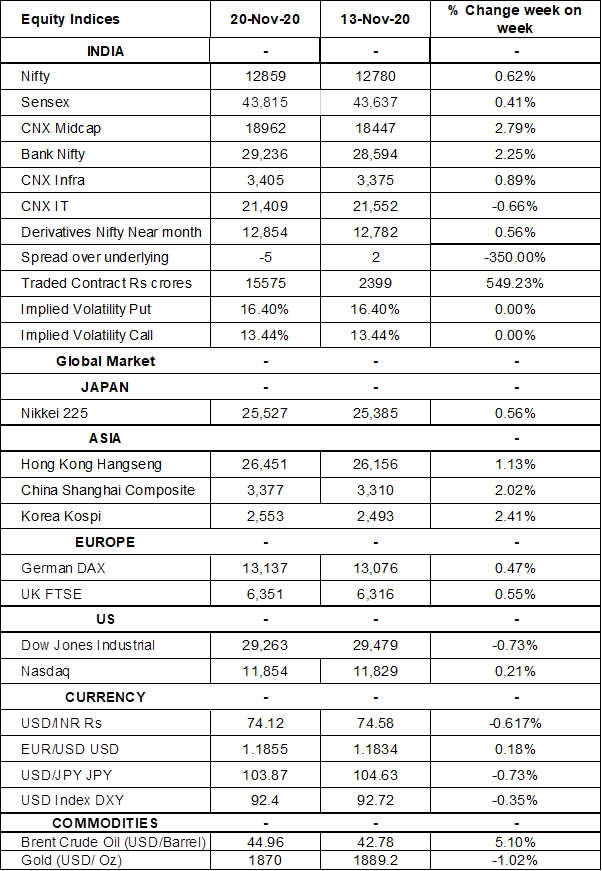

- Implied volatility (IV) for put and call at the money options stood at 16.40% and 13.44% levels, respectively.

FIIs/FPIs have sold Indian equity shares worth Rs. 195 billion in October 2020 and bought shares worth Rs. 443 billion in November 2020. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Options and Stock Options.

The Nifty Index futures witnessed a fall in open interest by 7% for the November series and rise in open interest by 67% for the December series. Implied volatility (IV) fell for call option and put option in the last week. Fall in IV for put option and for call option shows steady support for Nifty at present levels.

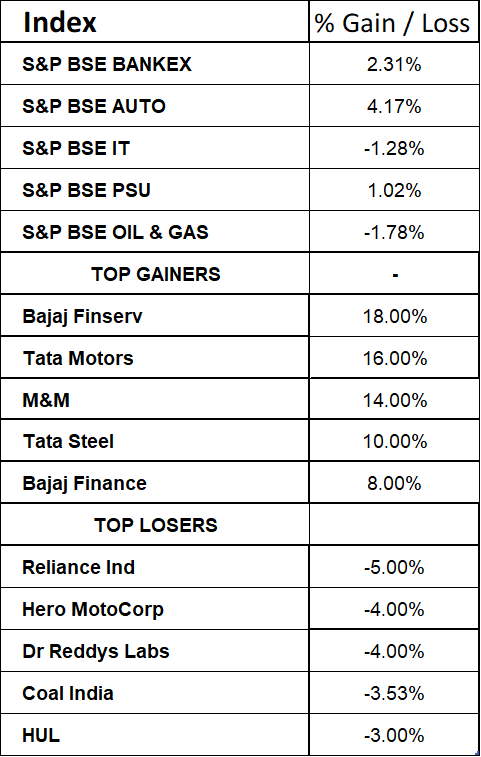

S&P BSE Sensex gained 280 points on Friday, due to Covid-19 vaccine effectiveness and expectation of faster economy recovery as the festive season have shown positive demand trends. On weekly basis, Sensex & Nifty gained by 0.41% & 0.62% respectively.

On the global front, Wallstreet indices traded on a negative note on Friday, as Fed disagreed over the continuation of funding for some of the emergency programs implemented during the recession. Also, spike in Covid-19 cases dented market sentiment. During the week, Dow Jones fell by 0.8%, Nasdaq rose by 0.21%, and S&P 500 declined by 1%.

European stock markets moved higher after a negative start on Friday, snapping a two-day sell-off. Market sentiment dented as EU leaders made no progress toward resolving a dispute to unlock a Euros 1.8 trillion budget and pandemic recovery package. On weekly basis, DAX gained by 0.50% and FTSE rose by 0.55%.

Brent Crude Oil prices gained by 5% during the week, boosted by prospects for effective COVID-19 vaccines and hopes that OPEC+ would delay a planned rise in oil output.

Global Economy

Industrial production rose 1.1% from a month earlier in October 2020, rebounding from a revised 0.4% drop in September and slightly beating market expectations of 1%.

The Eurozone current account surplus narrowed to EUR 33.5 billion in September 2020 from EUR 38.3 billion in the corresponding period of the previous year, as the services surplus declined to EUR 11.7 billion from EUR 20.1 billion.

Japan Manufacturing PMI dropped to 48.3 levels in November 2020, from a final of 48.7 levels in the prior month and missing market consensus of 49.4 levels.

Japan recorded a trade surplus of JPY 872.9 billion in October 2020, compared with a JPY 11.2 billion surplus a year earlier and market expectations of a JPY 250 billion surplus.

Japan Services PMI dropped to 46.7 levels in November 2020 from 47.7 levels a month earlier, indicating a sharp decline in output across the service sector.

The People's Bank of China left its benchmark interest rates steady for the seventh straight month at its November policy-meeting.

The number of Americans filing for unemployment benefits rose to 742,000 in the week ended 14th November 2020, from the previous week's revised level of 711,000 and well above market expectations of 707,000. It was the first rise in initial claims in over a month amid rising COVID-19 cases and new lockdowns across the country.

US crude oil inventories rose by 0.768 million barrels in the week ended 13th November, 2020, following a 4.278 million increase in the previous period and compared with market expectations of a 1.65 million advance, according to the EIA Petroleum Status Report.