Equity Markets Snapshot For The Week:

- India will publish industrial output data.

- US will publish inflation data.

- Japan will publish current account data.

- Market participants will look out for ECB policy-meeting outcome.

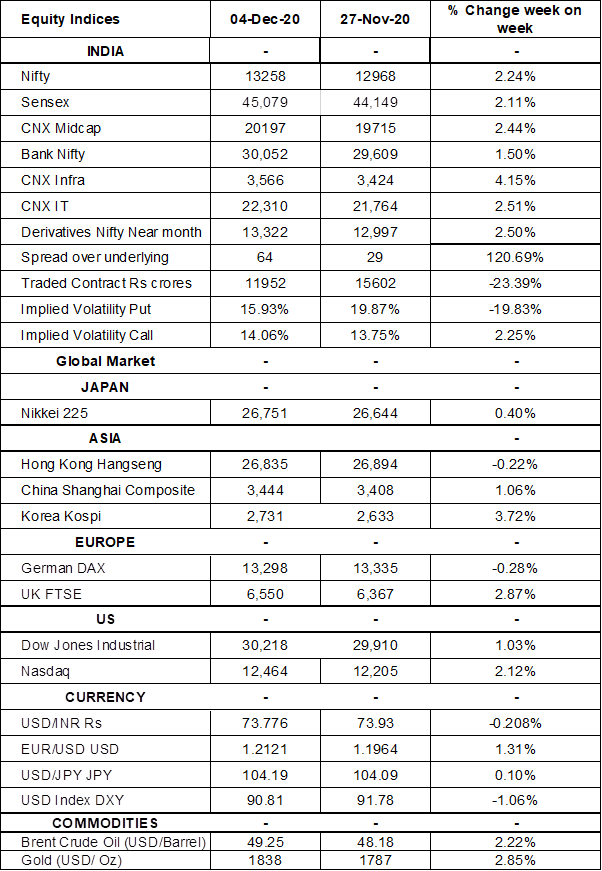

- Implied volatility (IV) for put and call at the money options stood at 20% and 13.75% levels, respectively.

FIIs/FPIs have bought Indian equity shares worth Rs. 603 billion in November 2020 and bought shares worth Rs. 165 billion in December 2020. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Options and Stock Options.

The Nifty Index futures witnessed a rise in open interest by 5% for the December series and fall in open interest by 42% for the January series. Implied volatility (IV) rose for call option and put option in the last week. Fall in IV for put option and rise in IV for call option shows unsteady support for Nifty at present levels.

S&P BSE Sensex gained 400 points crossed 45,000 on Friday amid RBI’s accommodative stance for as long as necessary to support economic recovery and ensure that inflation remains within the target going forward. Reserve Bank of India kept its benchmark repurchase rate at 4 percent during its December meeting. Click here to read our RBI policy-meeting analysis. IHS Markit India Services PMI decreased to 53.7 levels in November 2020 from 54 levels in the previous month, and below market expectations of 55.5 levels.

On the global front, US indices reached record high as investors hope that the dismal jobs report puts additional pressure on Congress to approve new stimulus measures. US economy added only 245,000 jobs in November 2020, well below forecasts of 469,000 dragged down by a fall in government and retail employment. During the week, Dow Jones gained by 1%, Nasdaq surged by 2.12%, and S&P 500 rose by 1.80%.

European stock markets closed on positive note on Friday, better than expected Germany factory orders data boosted market sentiment. Market participants expect stimulus package to be announced on 7th December 2020. On weekly basis, DAX declined by 0.28% and FTSE surged by 2.87%.

Brent Crude Oil prices gained by 2% during the week, OPEC and Russia agreed to raise crude output by only 500,000 barrels a day in January 2021, far below the 2 million barrels a day initially proposed and failed to come to a compromise on a broader policy for the rest of next year. Oil prices have also been supported by news of the rollout of COVID-19 vaccines and prospects of a bigger US stimulus package.

Global Economy

The US economy added 245,000 jobs in November 2020, easing from a downwardly revised 610,000 in the previous month, and well below market expectations of 469,000.

The US unemployment rate edged down to 6.7% in November 2020, from the previous month's 6.9% and compared with market expectations of 6.8%.

The US trade deficit widened to USD 63.1 Billion in October 2020 from a revised USD 62 billion in the previous month and compared to market expectations of USD 64.8 billion. Exports increased 2.2% to USD 182 billion in 2020, while imports rose 2.1% to USD 245.1 billion.

US Services PMI was revised higher to 58.4 levels in November 2020, up from a preliminary estimate of 57.7 levels and compared with October's final 56.9 levels. The latest reading signaled the steepest expansion in service output since March 2015, boosted by the fastest increase in new orders.

Eurozone Services PMI was revised higher to 41.7 levels in November 2020, from a preliminary estimate of 41.3 levels and compared with October's final 46.9 levels.

China Services PMI rose to 57.8 levels in November 2020 from 56.8 levels in October 2020, pointing to the second fastest growth in services activity in over a decade, amid a further recovery in consumer demand after the country curbed its COVID-19 outbreak.

Japan Services PMI was at 47.8 levels in November 2020, compared with flash data of 46.7 levels and a final 47.7 levels in October 2020. The latest reading pointed to the weakest contraction in the sector that began in February 2020, with export sales dropping the least since June 2020, while new business falling for the tenth consecutive month on the back of a third wave of COVID-19 infections in the country.

The number of Americans filing for unemployment benefits dropped to 712,000 in the week ended 28th November 2020, from the previous week's revised level of 787,000 and well below market expectations of 775,000. Still, initial claims remained well above pre-pandemic levels, amid rising COVID-19 cases and new lockdowns across the country.

US crude oil inventories dropped by 0.679 million barrels in the week ended 27th November 2020, following a 0.754 million decrease in the previous period and compared with market expectations of a 2.358 million fall, according to the EIA Petroleum Status Report.