Equity Markets Snapshot For The Week:

- Central bank in the US will be deciding on monetary policy.

- US will publish GDP growth data.

- IMF will release world economic outlook and growth figures.

- Investors in India will watch developments on Budget.

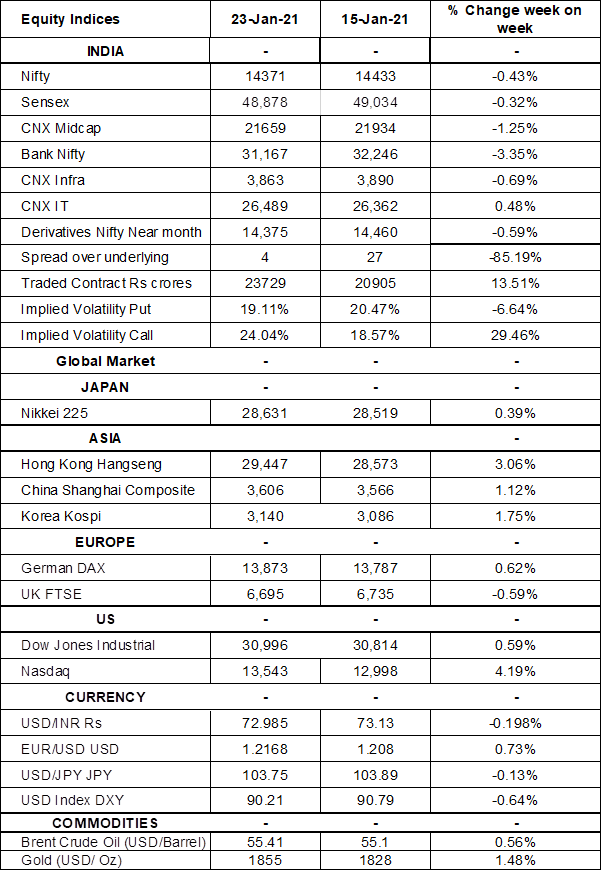

- Implied volatility (IV) for put and call at the money options stood at 19% and 24% levels, respectively.

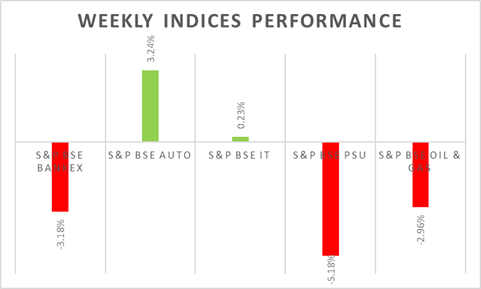

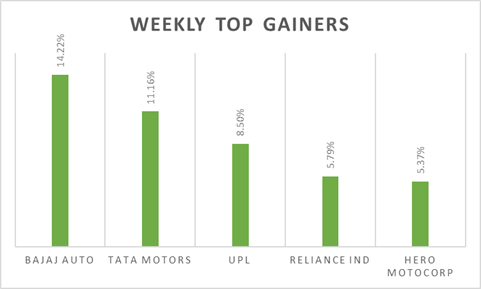

S&P BSE SENSEX shed 750 points on Friday, as investors booked profits after touching all time highs of 50,000-mark, banking stocks were the biggest losers. On corporate results front, Bajaj Auto reported 17% YoY revenue growth, net profit up by 24%. Volume growth stood at 10%. 2-wheeler exports rose at 26% and 3 wheeler volume declined 36%. Share price of Bajaj Auto gained by 14% during last week.

FIIs/FPIs have bought Indian equity shares worth Rs. 620 billion in December 2020 and bought Rs. 244 billion in January 2021 (as of 24th January 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Futures, and Stock Options.

The Nifty Index futures witnessed fall in open interest by 11% for the January series and rise in open interest by 66% for the February series. Implied volatility (IV) rose for call option and fell for put option in the last week. Rise in IV for call option and fall in IV for put option shows unsteady support for Nifty at present levels.

On the global front, Wall Street indices closed on negative note as earnings sessions continued with mixed trends. On stimulus front, growing number of Republicans have expressed doubts over the need for another stimulus bill. During the week, Dow Jones gained by 0.59%, Nasdaq surged by 4%, and S&P 500 rose by 1.4%.

European stocks closed lower on Friday amid PMI data showed business activity across the Europe fell for the 3rd month led by Weakening conditions in the service and manufacturing sectors. During the week, FTSE declined by 0.60% and DAX gained by 0.62%.

Brent crude fell to around USD 55.5 a barrel on Friday, after the latest EIA report showed a surprise crude oil inventory build in the US and amid persistent demand concerns due to the coronavirus pandemic. During the week, Brent crude price gained by 0.60%.

Global Economy

The European Central Bank left monetary policy unchanged during its January 2021 meeting, as policymakers took a wait-and-see approach following last month's decision to expand and extend its pandemic emergency programme.

IHS Markit Eurozone Services PMI fell to 45 levels in January 2021 from 46.4 levels in the previous month but slightly above market expectations of 44.5 levels. IHS Markit Eurozone Manufacturing PMI edged down to 54.7 levels in January 2021 from 55.2 levels in December 2020.

Japan's consumer prices declined 1.2% (Y-o-Y) in December 2020, after falling 0.9% in the previous month, as the pandemic continued to drag consumption heavily. The decline was bigger than expected and was the sharpest since April 2010.

Japan Manufacturing PMI was down to 49.7 levels in January 2021 from a final 50 levels in the prior month. Japan Services PMI declined to 45.7 levels in January 2020 from a final 47.2 levels in December 2020.

IHS Markit US Services PMI rose to a two-month high of 57.5 levels in January 2021 from 54.8 levels in the previous month, beating market expectations of 53.6 levels. IHS Markit Manufacturing PMI for the US jumped to 59.1 levels in January 2021 from 58.3 levels in December 2020 and well above market forecasts of 56.5 levels.

US crude oil inventories jumped by 4.351 million barrels in the week ended 15th January 2021, the first increase in six weeks and compared to market forecasts of a 1.167 million fall, according to the EIA Petroleum Status Report.

The number of Americans filing for unemployment benefits declined to 900,000 in the week ended 16th January 2021, from the previous week's five-month high of 926,000 and below market expectations of 910,000. Still, claims remained well above pre-pandemic levels and will likely remain elevated for some time as the number of COVID-19 infections continue to rise at record rates, prompting many US states to impose restrictive measures to respond to the outbreak.