Equity Markets Snapshot For The Week:

- Fed and Ecb will publish monetary minutes.

- Flash PMI surveys for the US, UK, Eurozone, Japan and Australia will give an insight about the state of the global economy.

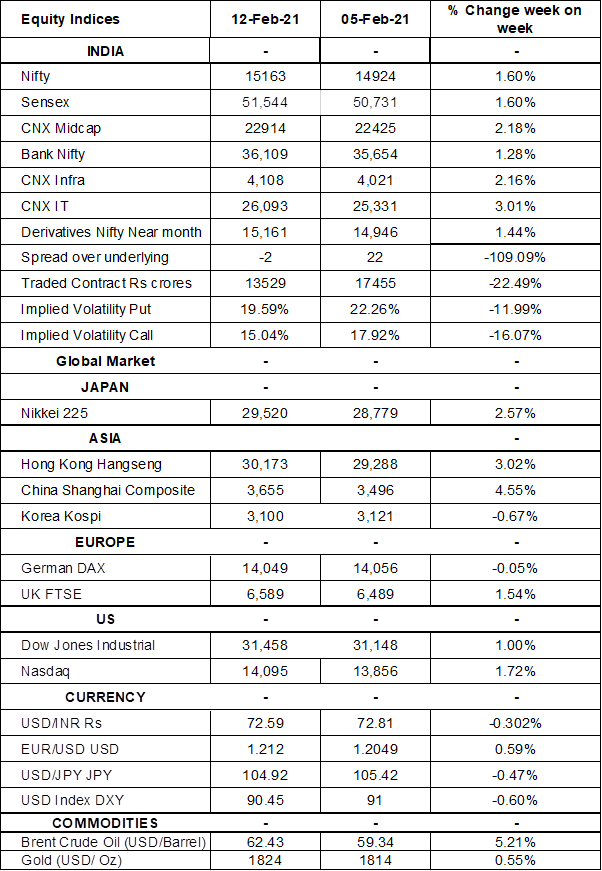

- Implied volatility (IV) for put and call at the money options stood at 19% and 15% levels, respectively.

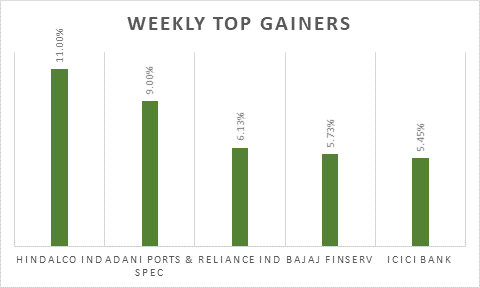

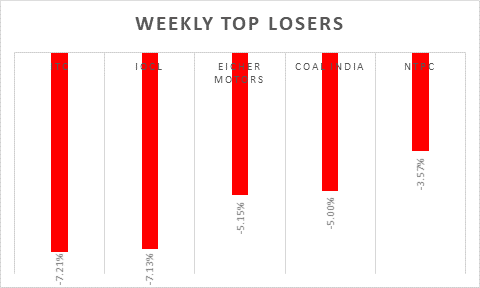

S&P BSE Sensex & Nifty ended on a strong weekly gain of 1.60% each. ICICI Bank, Infosys and Axis Bank were among the best performers, while ITC, ONGC and Sun Pharma led the losses. On macro front, India's industrial production rose 1% from a year earlier in December 2020, partially recovering from a revised 2.1% decline in the previous month and easily beating market expectations of a 0.2% contraction. Retail price inflation in India fell to 4.06%in January of 2021 from 4.59% in December 2020. It is the lowest reading since September 2019 and below market forecasts of 4.45%.

FIIs/FPIs have bought Indian equity shares worth Rs. 194.73 billion in January 2021 and bought Rs. 205 billion in February 2021 (as of 13th February 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Futures, Index Options and Stock Options.

The Nifty Index futures witnessed fall in open interest by 26% for the February series and rise in open interest by 33% for the March series. Implied volatility (IV) fell for call option and for put option in the last week. Fall in IV for call option and for put option shows steady support for Nifty at present levels.

On the global front, Wall Street indices closed on positive note. Fresh stimulus expectations boosted market sentiment as Nasdaq reached all-time highs. During the week, Dow Jones gained by 1%, Nasdaq surged by 1.8%, and S&P 500 rose by 1%.

European stocks booked strong weekly gains, on hopes that coronavirus vaccination rollout and extra stimulus in the US would boost the economic recovery. During the week, FTSE gained by 1.5% and DAX closed on a flat note.

Brent crude surged by 5% during last week to USD 62 booked the 9th positive day in the last 10 days, as hopes of a stimulus bill in the US nudged sentiment higher. OPEC gave negative outlook on globe oil demand to recover in 2021, cutting its forecast to 110,000 barrels per day to 5.79 million bpd.

Global Economy

The US posted a budget deficit of USD 163 billion in January 2021, compared with a USD 32.6 billion gap in the same period last year and surpassing market expectations of USD 150 billion.

Britain's gross domestic product shrank by 7.8% in Q4Fy20, following a revised 8.7% contraction in the previous three-month period and compared with market expectations of an 8.1% fall.

Industrial production in Germany stalled in December 2020, following an upwardly revised 1.5% rise in November 2021 and compared to market forecasts of a 0.3% increase, amid new coronavirus lockdowns in Germany and other European countries.

The European Commission lowered its GDP forecasts for 2021, saying that the resurgence in COVID-19 infections since the autumn, together with the appearance of new, more contagious variants of the virus, have forced many countries to reintroduce or tighten containment measures.

The number of Americans filing for unemployment benefits fell to 793,000 in the week ended February 6th, from the previous week's revised figure of 812,000 and compared to market expectations of 757,000.

US crude oil inventories fell by 6.644 million barrels in the week ended February 5th, 2021, a third consecutive week of decline and compared to market forecasts of a 0.985 million rise, according to the EIA Petroleum Status Report.