Equity Markets Snapshot For The Week:

- US will publish Non-farm payroll data.

- OPEC+ meeting that is expected to offer guidance into the coalition's production plan from May 2021.

- Eurozone will publish on inflation data.

- Japan will report industrial production.

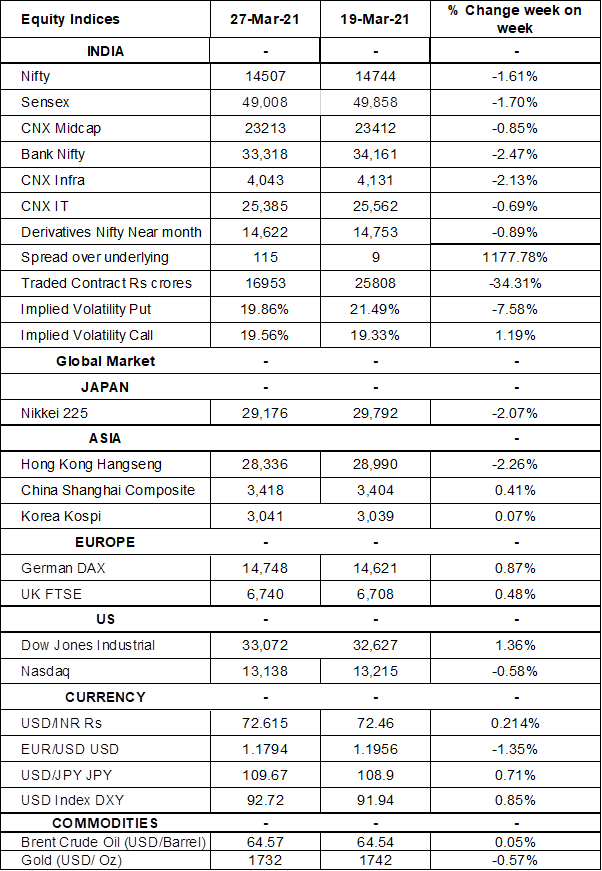

- Implied volatility (IV) for put and call at the money options stood at 20% and 19% levels, respectively.

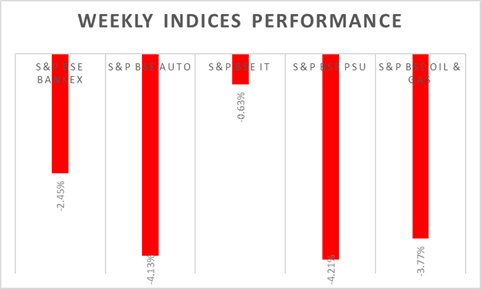

S&P BSE Sensex & Nifty gained as much as 1% on Friday, rebounding from a near two-month low in the previous session and snapping a two-day losing streak. Covid cases in India continued to rise at faster pace especially in Maharashtra State which could spook investors sentiment in coming week. Indian markets will remain shut on Monday and Friday on Holi & Good Friday, respectively. On weekly basis, Sensex & Nifty declined by 1.6% and 1.7% respectively.

FIIs/FPIs have bought Indian equity shares worth Rs. 257 billion in February 2021 and sold Rs. 105 billion worth of shares in March 2021. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a fall in the open interest across Index Options and Stock Options.

The Nifty Index futures witnessed fall in open interest by 224% for the April series and rise in open interest by 65% for the April series. Implied volatility (IV) fell for put option and rose for call option in the last week. Fall in IV for put option and rise in IV for call option shows steady support for Nifty at present levels.

On the global front, US indices closed on a positive note on Friday, announced that restrictions on bank holding company dividends and share repurchases currently in place will end for most firms after 30 June 2021. On the macro front, PCE figures showed that personal income fell less than expected. During the week, Dow Jones gained by 1.4%, Nasdaq fell by 0.6%, and S&P 500 rose by 1.5%.

European & UK indices closed on positive note on Friday, despite the uncertainty around rising infection rates and the slow rollout of vaccines. During the week, FTSE rose by 0.58% and DAX gained by 0.87%.

Brent crude prices bounced back to levels of USD 64 per barrel due to Suez Canal blockage which could possibly create Crude Oil shortage.

Global Economy

The IHS Markit US Services PMI rose to 60 levels in March 2021 from 58.8 levels in February 2021 and in line with market expectations. The latest reading pointed to the strongest expansion in the service sector since July 2014. New orders rose sharply amid stronger client demand and the loosening of COVID-19 restrictions in some states.

US current account gap widened by USD 7.6 billion to USD 188.5 billion in Q4 2020, which is equivalent to 3.5% of the GDP. It is the biggest current account gap since Q2 2007 as the goods deficit widened and the services surplus declined.

The number of Americans filing for unemployment benefits dropped to 684,000 in the week ended 20th March 2021, its lowest since the pandemic hit the labor market in March 2020 and well below market expectations of 730,000, adding to signs of a gradual job recovery.

The IHS Markit Eurozone Services PMI rose to 48.8 levels in March 2021 from 45.7 levels in the previous month and above market expectations of 46 levels.

Jibun Bank Japan Services PMI went up marginally to a three-month high of 46.5 levels in March 2021 from a final 46.3 levels in February 2021. This was the 14th straight month of contraction in the service sector, amid ongoing restrictions on movement due to coronavirus.