Equity Markets Snapshot For The Week:

- PMI surveys for the US, UK, Eurozone, Japan and Australia will be keenly watched.

- Outcome of ECB Policy-Meeting

- Domestic investors will watch for Q4Fy21 earnings and inflation data. This week, ICICI Bank, Nestle, Cyient, Tata Elxsi, HCL Tech and ACC will report earnings.

Earnings from Infosys & TCS were under market expectations resulting in almost 5% correction in stock price, Nifty IT index declined by 4% during last week. Asian Paints, Cipla, HCL Tech, Nestle, Tata Motors and UltraTech Cement were among the best performers during last week.

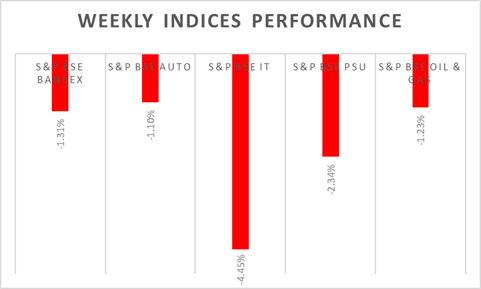

S&P BSE Sensex & Nifty declined by 1.53% and 1.46% on weekly basis respectively, as covid cases continued to surge in the last week. India's trade gap widened to USD 13.93 billion in March 2021 from USD 9.98 billion a year earlier, and compared to preliminary estimates of a higher USD 14.11 billion gap. India's wholesale prices rose by 7.39% (Y-o-Y)in March 2021, accelerating from a 4.17% gain in the prior month and above market consensus of 5.9%.

FIIs/FPIs have bought Indian equity shares worth Rs. 104 billion in March 2021 and sold Rs. 46 billion worth of shares in April 2021. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Futures and Stock Options. Implied volatility (IV) for put options rose and fell for call option in the last week. Rise in IV for put option and fall in IV for call option shows unsteady support for Nifty at present levels.

On the global front, US indices closed on a positive note on Friday, Dow Jones and S&P 500 touching all-time highs on the back of strong earnings from banks. During the week, Dow Jones gained by 1.18%, Nasdaq rose by 1%, and S&P 500 up by 1.48%.

European stocks booked a seventh straight week of gains, the longest winning streak since May 2018, with Frankfurt's DAX 30 ending at a new all-time high on the back of rollout of vaccines & stronger economic data from US and China boosted sentiment. During the week, FTSE gained by 1.5% and DAX gained by 1.48%.

Global Economy

Industrial production in the US increased 1.4% from month earlier in March 2020, missing market expectations of 2.8% growth and following a drop of 2.6% in February 2021.

Industrial production in the Euro Area dropped 1% from a month earlier in February 2021, following a 0.8% increase in January and compared with market expectations of a 1.1% fall. It was the largest decline in industrial activity since April's record contraction, as many countries across Europe remained under strict coronavirus restrictions.

Eurozone's trade surplus narrowed to EUR 17.7 billion in February 2021 from EUR 23.4 billion in the corresponding month of the previous year. Exports fell 5.5% from a year earlier to EUR 178.6 billion while imports declined at a softer 2.7% to EUR 161 billion.

The consumer price inflation rate in the Euro Area was confirmed at 1.3% (Y-o-Y) in March 2021, the highest since January 2020

The Chinese economy advanced 18.3% (Y-o-Y) (low base) in the March quarter 2021, accelerating sharply from a 6.5% growth in the fourth quarter and compared with market consensus of 19%.

The industrial capacity utilization rate in China jumped to 77.2% in the first quarter of 2021 from 67.3% in the same period a year earlier.

The number of Americans filing for unemployment benefits fell by 193,000 from a week earlier to 576,000, well below market expectations of 700,000.

US crude oil inventories fell by 5.889 million barrels in the week ended on 16th April 2021, following a 3.522 million decline in the previous period and compared with market forecasts of a 2.889 million drop, according to the EIA Petroleum Status Report.