Equity Markets Snapshot For The Week:

- Fed policy-meeting outcome

- Outcome of ECB Policy-Meeting

- Domestic investors will watch for Q4Fy21 earnings and Auto sales. This week, Maruti Suzuki, HUL, Reliance Industries, Bajaj Finserv, ABB and Axis Bank will report earnings.

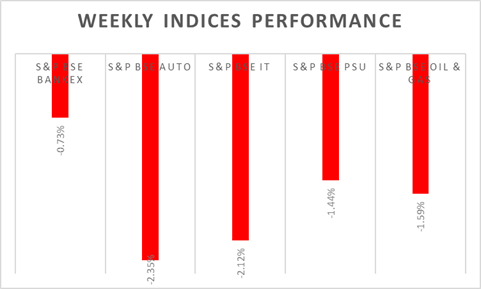

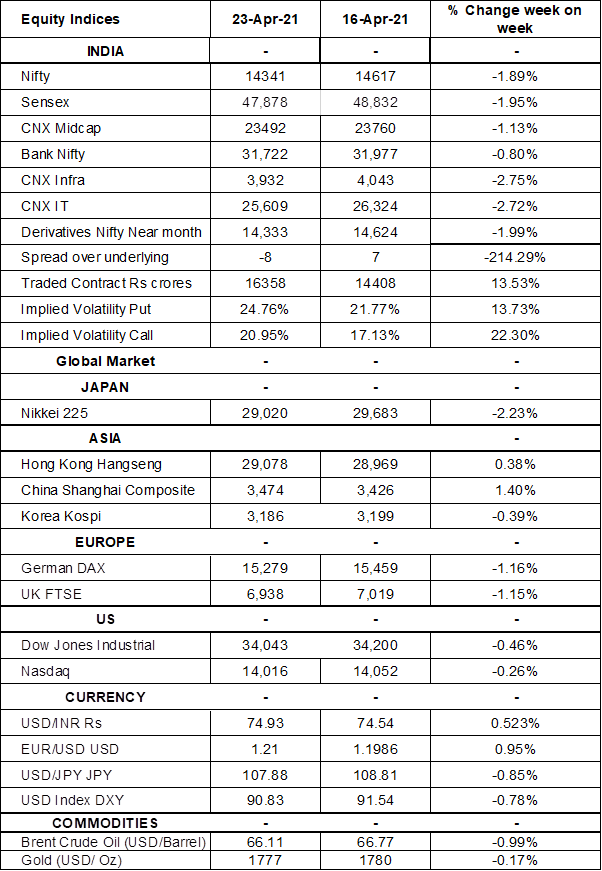

The S&P BSE Sensex dropped 2% over the week to close at 47,878 on Friday, remaining close to an over two-month low of 47,706 hit on Tuesday, amid fears that the second wave of Covid-19 infections in India could further hurt the country's economic recovery.

FIIs/FPIs have bought Indian equity shares worth Rs. 104 billion in March 2021 and sold Rs. 86 billion worth of shares in April 2021. Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Stock Futures and Stock Options. Implied volatility (IV) for put options and for call option rose in the last week. Rise in IV for put option and for call option shows unsteady support for Nifty at present levels.

On the global front, all three main US stock indexes regained ground on Friday, buoyed by the current robust US economic growth, with recent data, including better-than-expected US preliminary PMI readings. During the week, Dow Jones fell by 0.46%, Nasdaq declined by 0.26%, and S&P 500 up by 0.02%.

European stocks closed on negative note, DAX 30 falling 1.2% to 15,280, as investors raised concerns over rising COVID cases and possible of hike in capital gain tax in US. During the week, FTSE fell by 1.15% and DAX declined by 1.16%.

Global Economy

IHS Markit US Services PMI jumped to an all-time high of 63.1 levels in April 2021, from 60.4 levels in the previous month and above market expectations of 61.9 levels.

The number of Americans filing new claims for unemployment benefits dropped to 547,000 in the week ending 17th April 2021, the lowest level since March 2020.

The ECB left monetary policy unchanged during its April 2021 policy-meeting, as officials took a wait-and-see approach after last month’s decision to conduct emergency bond purchases at a significantly higher pace over Q2. Interest rates were kept at record-low levels and the PEPP quota was maintained at €1.85 trillion with the buys to run at least until March 2022. President Lagarde said at the press conference that although inflation has picked up over recent months due to temporary factors, underlying price pressures remain subdued in the context of significant economic slack and weak demand.

The IHS Markit Eurozone Services PMI rose to 50.3 levels in April 2021, from 49.6 levels in the previous month and above market expectations of 49.1 levels. IHS Markit Eurozone Manufacturing PMI increased to a fresh record high of 63.3 levels in April 2021 from 62.5 levels in March and beating market forecasts of 62 levels.

The au Jibun Bank Japan Manufacturing PMI was up to 53.3 levels in April 2021 from a final 52.7 levels a month earlier. This was the third straight month of growth in factory activity and the fastest pace since April 2018, as a recovery in the economy from the COVID-19 pandemic gained traction.

US crude oil inventories rose by 0.594 million barrels in the 16th April week, following a 5.889 million decline in the previous period and compared with market forecasts of a 2.975 million drop, according to the EIA Petroleum Status Report.