Equity Markets Snapshot For The Week:

- US will publish Fy2022 budget

- China will publish industrial profits

- F&O expiry would result in higher volatility

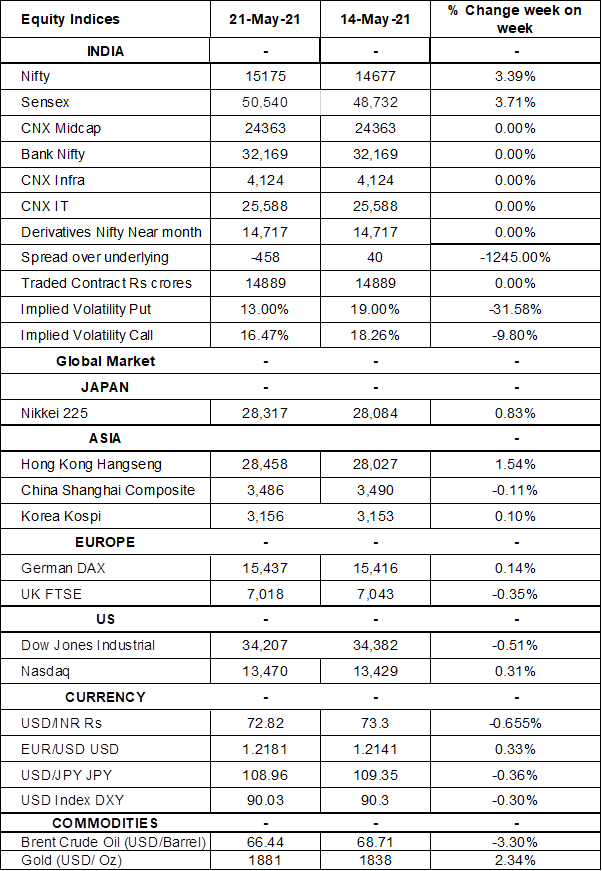

The S&P BSE Sensex & Nifty closed on an extraordinarily strong note for the week. Reports on lower-than-expected unemployment benefits in US market pushed Sensex as much as 2% on Friday. Covid-19 cases trend in India have come down from 4 lakh cases during peak in first week of May 2021 to 2.4 lakhs cases per day as of 22nd May 2021. Domestic Q4 quarterly earnings have come in-line for most of the companies, commodity stocks have seen re-rating amid strong earnings and commodity prices up-swing. Positive global cues, major companies earnings winding down and lower covid-19 cases would result in easing restrictions in most of the states, is positive for Sensex & Nifty in this week.

FIIs/FPIs have sold Rs. 96 billion worth of shares in April 2021 and sold Rs. 63 billion in May 2021 (as of 23rd May 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Stock Futures and Stock Options. Implied volatility (IV) fell for put options and for call options in the last week. Fall in IV for put option and call option shows steady support for Nifty at present levels.

US indices closed on mixed note on Friday despite reporting better than expected PMI data. Minutes from the Federal Reserve's last policy meeting showed that some policymakers are already comfortable discussing a tapering plan for ongoing bond purchase program. During the week, Dow Jones declined by 0.51, Nasdaq up by 0.31%, and S&P 500 slipped by 0.31%.

European stock markets closed on positive note on Friday amid strong PMI data. Markit data also showed the US and UK private sector economies expanded at record rates. Meanwhile, ECB President Christine Lagarde said it was too early for the European Central Bank to discuss winding down its EURO 1.85 trillion Pandemic Emergency Purchase Programme. During the week, FTSE up by 2.28% and DAX declined by 1.74%.

Bitcoin extended losses to below USD 35,000 on Friday and is down 50% during last 1 month. The crypto currency fell as much as 30% at one point on Wednesday, after Chinese regulators signaled a crackdown on the use of such assets, warning financial institutions about accepting cryptocurrencies as payment. Digital assets were already under pressure after Tesla has suspended vehicle purchases using Bitcoin.

Global Economy

Fed officials consider that if the economy continues to pick up strongly, it might be appropriate at some point in upcoming meetings to begin discussing a plan for tapering ongoing bond purchases, minutes from the last FOMC meeting showed.

The number of Americans filing new claims for unemployment benefits dropped by 34,000 to 444,000 in the week ending 15th May 2021, the lowest since mid-March 2020 and below market expectations of 450,000.

The Eurozone current account surplus widened to EUR 31.0 billion in March 2021 from EUR 24.6 billion in the same month of the previous year, as the services account posted a surplus of EUR 9.1 billion, compared with a deficit of EUR 5.4 billion last year.

The Euro Area economy shrank 0.6% on quarter in January-March 2021, entering a double-dip recession, as several countries across the region imposed social distancing and lockdown measures to curb the spread of the coronavirus pandemic.

Eurozone's trade surplus narrowed to EUR 15.8 billion in March 2021 from EUR 29.9 billion in the corresponding month of the previous year. Imports surged 19.2% from a year earlier and exports rose at a slower pace 8.9%.

The People's Bank of China left its benchmark interest rates for corporate and household loans steady for the 13th straight month at its May policy-meeting.

Japan's economy shrank at an annualized rate of 5.1% in the first quarter of 2021, worse than market forecasts of a 4.6% contraction and following a downwardly revised 11.6% growth in the previous period.

Japan posted a trade surplus of JPY 255.3 billion in April 2021, reversing from a deficit of JPY 936.9 billion in the same month a year earlier and well above market consensus of a surplus of JPY 140 billion. Exports jumped 38% (Y-o-Y) while imports rose at a softer pace 12.8%.