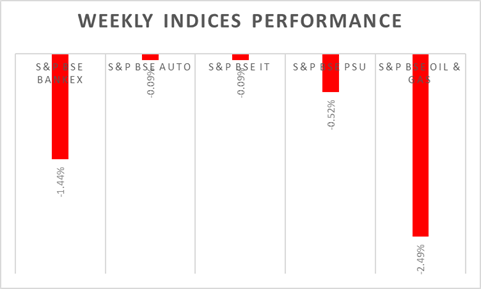

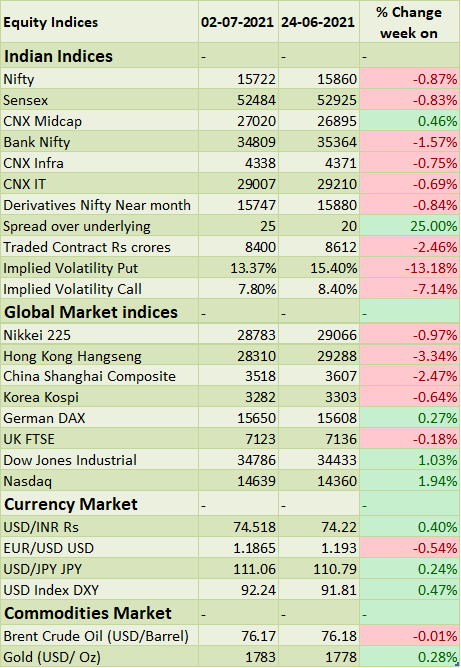

The BSE Sensex & Nifty 50 declined by 0.83% and 0.87% respectively, as concerns of third wave and higher inflation dampened the market sentiment. During the week, Indian Finance Minister announced new stimulus measures to combat the impact of the Covid-19 second wave, boost exports, improve employment, and prepare the distressed sectors to brace for an impact of a possible third wave. New stimulus measures would increase fiscal deficit and inflationary pressures. On macro front, IHS Markit India Manufacturing PMI fell to 48.1 levels in June 2021 from 50.8 levels a month earlier. The latest reading pointed to the first contraction in the manufacturing sector since July last year, as a harsh resurgence of COVID-19 and stricter lockdown measures negatively impacted demand.

Next week, domestic investors will watch out for Q1 earnings release from TCS, Avenue Supermart & Delta Corp, and monsoon rainfall, IMD guided for normal rainfall for the July month. India Pesticide will debut on domestic bourses on 5th July 2021, Clean Science & Tech, and GR Infra Projects will come out with IPOs. Global investors will watch out for policy-meeting minutes from FED & ECB, and worldwide services PMIs.

FIIs/FPIs have invested Rs. 172 billion in June 2021 and sold Rs. 12.34 billion in July 2021 (as of 04th July 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across index options, stock options and stock futures. Implied volatility (IV) fell for put options and for call options in the last week. Fall in IV for call option and put option shows steady support for Nifty at present levels.

Wallstreet indices closed on a strong note on Friday, S&P 500 & Nasdaq touched new highs. The US economy added 850,000 jobs in June 2021, well above forecasts of 700,000. Wages increased slightly less than expected while the unemployment rate surprisingly edged up to 5.9% from 5.8%. Market sentiment was boosted as investors are less concerned on inflation (wage growth and unemployment rate are lower). During the week, Dow Jones gained by 1%, Nasdaq rose by 2%, and S&P 500 up by 1.58%.

European indices are close to record highs amid strong economic data and positive global cues. The vaccination drive in the country is supporting the short-term economic growth. During the week, FTSE fell by 1.18% and DAX up by 0.27% .

Brent crude oil future prices remained flat on weekly basis amid OPEC+ agreed to add more barrels from August 2021 and extend the duration of the deal until the end of 2022 instead of April 2022. US crude oil inventories dropped by 6.718 million barrels during the week ended, a sixth consecutive period of decline and compared with market consensus of a 4.686 million fall, data from the EIA Petroleum Status.

Global Economy

The US unemployment rate edged up to 5.9% in June 2021, little-changed from May's 14-month low but still well above pre-pandemic levels, as the number of unemployed people increased by 168,000 to 9.48 million.

The American economy added 850,000 jobs in June 2021, the strongest job growth in 10 months, and well above market forecasts of 700,000.

The number of Americans filing new claims for unemployment benefits dropped to a new pandemic low of 364,000 in the week ending 26th June 2021, falling back below the 400,000 level for the first time in three weeks and compared with market expectations of 390,000.

The trade deficit in the US widened to USD 71.2 billion in May 2021 from an upwardly revised USD 69 billion in April 2021 and compared to market forecasts of USD 71.4 billion as the goods deficit increased by USD 2.3 billion to USD 89.2 billion and services surplus was up marginally to USD 17.9 billion. Imports were up 1.3% and exports edged up 0.6%.

The au Jibun Bank Japan Manufacturing PMI was at 52.4 levels in June 2021, compared with final 53 levels a month earlier. This was the weakest reading since February 2021, amid renewed curbs in some parts of the country following the latest wave of local COVID-19 infections.

Industrial production in Japan declined by 5.9% (M-o-M) in May 2021, worse than market consensus of a 2.4% fall and after a final 2.9% gain a month earlier. This was the first drop in industrial output since February 2021.

Annual inflation rate in the Euro Area eased to 1.9% in June 2021 from a 2-1/2-year high of 2% in May 2021, in line with market forecasts.