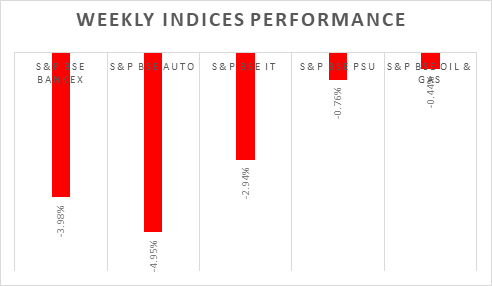

Sensex & Nifty declined by 4% during the week amid global central bankers tightening monetary policy more aggressively than expected. Out of the blue, RBI hiked interest rates by 40bps & CRR rate by 50bps and sounded concerned over rising food & commodity prices. Every key domestic sector was under selling pressure and broader markets shows declined more than the benchmark indices. Global bond yields have risen sharply and causing sharp sell-off in equities amid higher inflation expectations. Volatility is expected to elevate in the coming week, Nifty VIX up by 13% in previous s week.

In the coming week, investors will watch out for US and China inflation data. Domestic investors will watch out for earnings and key macro-economic data points.

Equity Market Summary:

� In domestic markets FIIs/FPIs sold 171 billion in April 2022 and sold Rs. 64 billion in May 2022 (as of 8th May 2022).

� US indices witnessed sharp sell off on Friday amid higher inflation levels and tightening monetary policy.

� US economy added 428,000 jobs in April, unemployment rate remained at 3.6% and average hourly earnings increased 0.3% against forecast of a 0.4% rise.

� UST which is gauge for inflation expectation touched 3.14% on Friday, level which was seen 2018.

� European indices closed sharply lower on Friday amid weak global cues.

� BOE hiked interest rates by 25bps to 13-year high, sees inflation hitting 10%.

� The FAO Food Price Index eased by 0.8% MoM to 158.5 points in April 2022 but remained close to a record high of 159.7 points in March 2022.

� DXY index almost touched 2 decades highs of 104 levels in previous week.

� Crude oil prices booked weekly gains amid concerns about tight global supply ahead of the European Union's impending embargo on Russian oil.