Sensex and Nifty closed the week on a positive note despite giving up Friday gap-up gains. Equity markets likely discounted RBI�s 75 bps rate hike in the upcoming June policy-meeting and investors will keenly observe central bankers take on inflation growth.

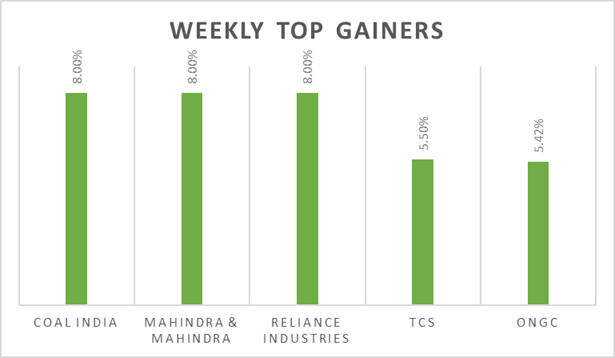

�Reliance Industry share price rose by 8% during the week based on better Q2 earnings outlook as the GRM levels remain elevated. On the monsoon front, investors will track progress of rains which would crucial factor for food prices. On the macro front, India Services PMI increased to 58.9 level in May 2022, the highest since April 2011, from 57.9 levels seen in April 2022.

�In the coming week, investors will watch out for ECB policy-meeting outcome and China inflation growth figures. �Domestic investors will keenly look out for RBI policy-meeting outcome as the central bank is likely to hike interest rates by 75 bps and reset it to pre-covid levels.

To know more details about upcoming RBI policy-meeting, do follow us on Twitter, YouTube and LinkedIn.

Equity Market Summary:

� In domestic markets FIIs/FPIs sold 399 billion in May 2022 and sold Rs. 22 billion in June 2022 (as of 06th May 2022).

� US indices closed sharply down on Friday, as the May NFP data growth reported stronger than expected. Tight labor market would force Fed to hike rates more aggressively to contain inflation growth.

� US unemployment rate was unchanged at 3.6% in May 2022. Average hourly wage growth slowed to 0.3% MoM compared to 0.5% growth in previous month.

� US ISM Services PMI fell to 55.9 levels in May 2022 from 57.1 levels in April 2022, below market forecasts of 56.4 levels.

� European stocks closed lower on Friday, DAX down 0.3% after a strong US jobs report strengthened expectations for aggressive monetary policy tightening by the Fed.

� Eurozone Services PMI was revised lower to 56.1 levels in May 2022 from April levels of 57.7.

� Retail sales in the Eurozone decreased 1.3% MoM in April 2022, the first decline so far this year and compared to market forecasts of a 0.3% rise.

� China General Manufacturing PMI increased to 49.1 levels in May 2022 from April's 26-month low of 46 levels and beating market forecasts of 48 levels.

� Brent crude futures traded above USD 120 per barrel on Friday, amid keenly anticipated OPEC+ meeting delivered only a modest increase in output despite speculations of a bigger supply boost.