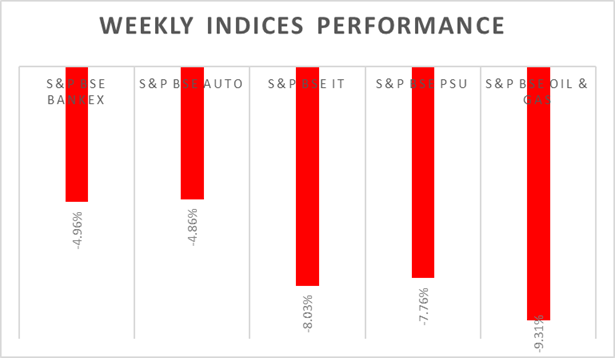

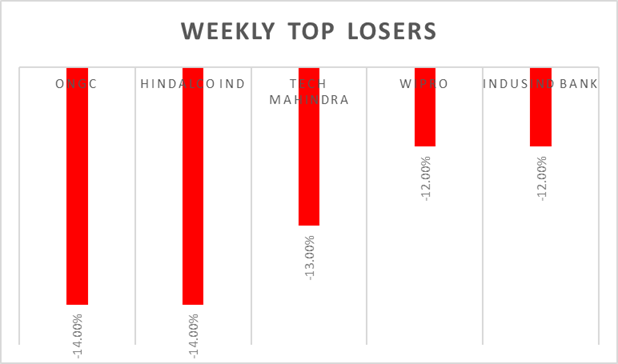

Sensex and Nifty declined by more than 5% during the week as the market participants spooked over the decade high inflation growth and central banks hiking rates aggressively. Relentless FIIs/FPIs selling, flattening UST yield curve (fears of economic downturn) and crude prices over USD 100 per barrel are major headwinds for Sensex & Nifty. Safe-haven asset Gold as well declined during the current market rout.

On the macro-economic data front, domestic CPI was reported lower at 7.04% compared to previous month and WPI growth edged up to 15.88%. Net direct tax collections till mid-June 2022 this fiscal increased 45%.

�In the coming week, investors will watch out for global PMI levels and inflation data from Japan.

Equity Market Summary:

� In domestic markets FIIs/FPIs sold 399 billion in May 2022 and sold Rs. 314 billion in June 2022 (as of 19th May 2022).

� US indices declined for the third consecutive week, investors grew concerned that rising inflation and higher interest rates would drag the nation�s economy.

� Fed hiked rates by 75bps to 1.5%-1.75% during its June 2022 policy-meeting, after the inflation rate unexpectedly accelerated last month to 41-year highs.

� US crude oil inventories rose by 1.956 million barrels in the week ended 10th June 2022.

� Industrial production in the US rose 0.2% from a month earlier in May 2022, following an upwardly revised 1.4% growth in April 2022.

� European stocks partly gave up losses on Friday amid pullback from US equities. ECB concerns over inflation spooked markets.

� ECB said policymakers are likely to hike rates in July and September policy-meeting to contain decade high of inflation growth.

� Industrial production in Eurozone increased 0.4% MoM in April 2022, rebounding from a downwardly revised 1.4% drop in March 2022.

� The Bank of England raised its rates by 25bps to 1.25% during its June 2022 meeting, a fifth consecutive rate hike and pushing borrowing costs to the highest in 13 years.

� Industrial production in Japan declined by 1.5% MoM in April 2022, compared with the flash figure of a 1.3% fall.