RBI in its policy review last week said that surging capital flows has led to heavy USD purchases to prevent a sharp appreciation of the INR. USD purchases have led to huge liquidity infusion in the system. Fx reserves are at record highs and RBI fx intervention has resulted in addition of over Rs 2 trillion of liquidity.

Inflation is running higher than central bank forecasts and to keep down inflation expectations, RBI will have to allow the INR to strengthen.

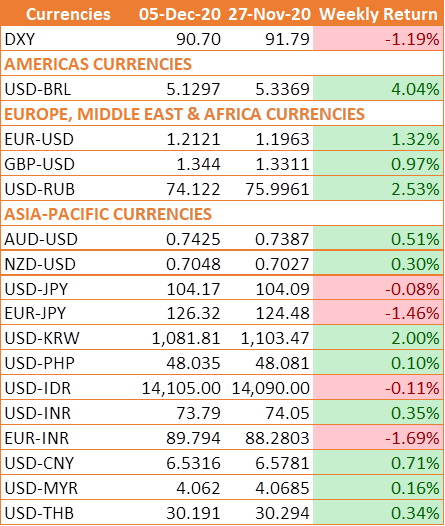

Expectations of recovery in global economies on covid vaccine, heavy money printing by the Fed have led to rise in risk appetite that has resulted in a sharp rise in UST yields that are up sharply from lows. USD has weakened considerabley as money moved into higher yielding currencies.

On Tuesday, US Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi discussed a fresh bipartisan coronavirus relief proposal worth USD 908 billion, and Mnuchin reportedly said that the proposal will be reviewed. It includes new emergency assistance for small businesses, unemployed people, airlines, and other industries hit by the pandemic.

US Senate leader Mitch McConnell said that Congress must pass a targeted USD 1.4 trillion spending bill, including a fresh stimulus aimed at heading off a government shutdown in the midst of a pandemic.

With a range of emergency lending programs by the US Fed expiring on Dec 31, market participants are watchful of whether the central bank will shift to purchasing longer-term securities or increase the quantum of its current USD 120 billion-a-month pace of purchases at its monetary policy meeting on Dec 15-16.

INR Trades High Against USD

INR strengthened last week largely boosted by foreign fund inflows to equities, though market participants remain wary of central bank intervention to prevent a sharp rally in the INR.

The RBI has been mopping up USD from the spot market relentlessly for the past couple of months to check the INR sharp gains. A spot intervention essentially increases INR liquidity in the system that is already in a huge surplus.

The mood in the market has deteriorated following comments from US President-elect Joe Biden, keeping a check on INR gains. The incoming US President warned that he would not immediately undo the Phase 1 trade agreement with China. His comments shed some light on his approach to Beijing and it seems that Biden could take a tougher stance towards China with relations taking longer to normalize than initially expected.

RBI leave rates unchanged at 4%

The RBI as expected has kept its key interest rate unchanged at 4%, whilst stressing that it will continue to ensure liquidity to stressed sectors to keep the economic recovery on track. The RBI opted to keep its accommodative stance for at least this financial year and into the next in order to support economic growth.

The RBI Governor Shaktikanta Das said that the Indian economy was rebounding faster than expected as it recovers from the COVID-19 hit. However, he also warned that the recovery was far from broad-based.

The central bank believes that inflation will remain elevated owing to the rising food prices which constrain monetary policy.

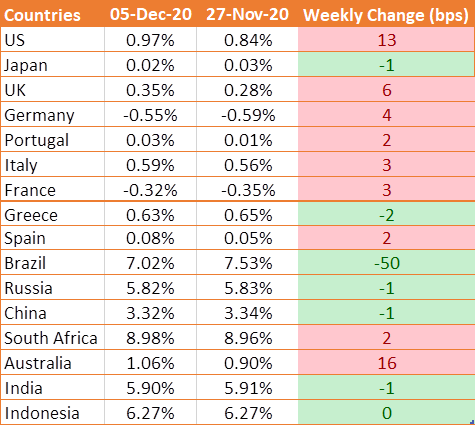

UST yields rise to a 3-week high after U.S. jobs report

US 10-year benchmark bond yield rose by 13 bps to 0.97% after a disappointing November employment report added to pressure for Washington to pass a new round of stimulus to help the coronavirus-battered economy.

US Nonfarm Jobs Growth Moderates in November

US Labour Department said non-farm payroll employment rose by 245,000 jobs in November after jumping by a downwardly revised 610,000 jobs in October. The weaker than expected job growth was partly due to the loss of 99,000 government jobs amid a decline in the number of temporary census workers. The report also showed a decrease in retail employment as well as a significant slowdown in the pace of job growth in the leisure and hospitality sector. The reported US unemployment rate fell to 6.7% in November from 6.9% in October.