RBI devolves auction on to underwriters on sharp rise in yields

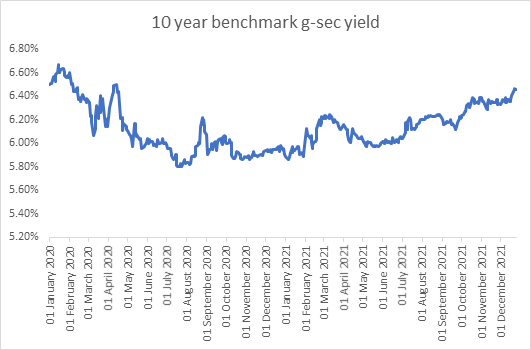

RBI devolved 78% of the 5 year gsec auction last week as yields shot up to in the auction last week. The cut off was at 5.83%, the highest level seen in many months and would have been much higher if RBI had not intervened. Other bonds saw yields touch 2 year highs with 10 year and 15 year bond yields shooting up to 6.47% levels and 15 year bond yields rising to 6.90%. Bond yields rose on nervousness on inflation, omicron and INR volatility.

Global central banks are turning wary of high inflation levels and are tightening monetary policy even as omicron variant of the covid is causing fresh lockdowns and travel restrictions in many countries. This has an inflationary impact as supply chains that are already disrupted will get disrupted further.

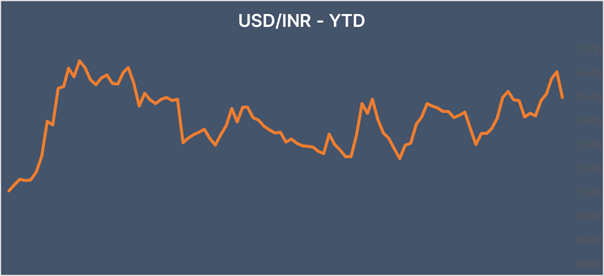

The INR saw selling pressure with FIIs pulling money out of equities and levels trended to record low levels before RBI stepped in with aggressive selling of USD. INR gained from lows on RBI intervention and got supported later from improved market sentiments globally on reports that omicron is not as bad as delta.

Going forward, gsec yields and INR will stay volatile on still uncertain economic environment with inflation hurting growth prospects.

Government bonds, SDL and OIS yield movements

During last week, 6.10% 2031 yield rose by 5 bps to 6.46% while 5.85% 2030 yield increased by 6 bps to 6.49%. 5-year benchmark bond, 5.63% 2026 yield gained 10 bps to 5.82%. 6.64% 2035 yield rose by 10 bps to 6.9%. 6.57% 2033 increased by 8 bps to 6.73%. Long-term paper, 7.16% 2050 yield rose by 10 bps to 7.08%.

The spread of 10-year bond over 5-year bond declined to 64 bps from 69 bps in previous week. The 15-year benchmark over 10-year benchmark spread rose to 27 bps from 24 bps, while 30-year benchmark over 10-year benchmark spread increased to 58 bps from 57 bps on weekly basis.

10-year SDL auction cut-off soared to 7% from 6.85% in previous week. Consequently, spread rose to 53 bps from 49 bps in previous week.

On weekly basis, 1-year OIS yield rose by 6 bps to 4.35% while 5-year OIS yield increased by 1 bp to 5.35%.

We would love to hear back from you. Please Click here to share your valuable feedback