RBI wants interest rates to stay low, credit spreads to come off from elevated levels and encourage banks to lend to the economy. However, given market sentiments and volatility and also future uncertainty, markets will take a long while to stabilize.

10-year government bond yields went below 6% post announcement, down 30bps over the last few days. The bond yield will take direction from auction participation in the new borrowing program for FY 21 starting April.

SDL spreads ballooned the last auction by 90bps to 160bps and April, spreads may rationalize depending on market reaction to government borrowing.

OIS yields will stay around or below reverse repo at the short end but will steepen at the longer end on borrowing worries.

Credit markets have been particularly volatile with even high-quality bonds seeing spreads rise by 300bps while the rest of the curve is completely frozen. Spreads may come off for high-quality bonds as government bond markets find levels post-April but the rest of the curve will continue to stay frozen and yields will be all over the place at high double digits.

INR is likely to move on global movements in the USD and will stay volatile.

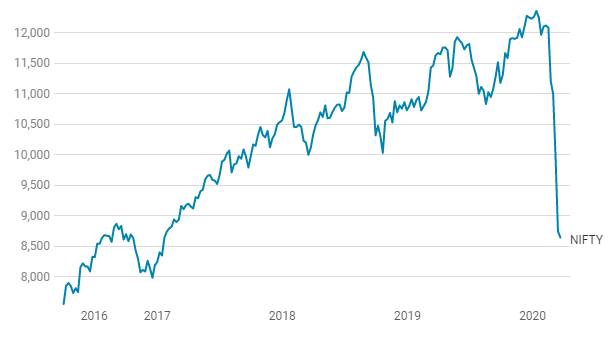

Sensex and Nifty to move on the impact of the Covid-19 on earnings in the longer term but in short term will track global markets.

RBI advanced its MPC by a week and announced its most accommodative policy ever in its history. Repo rate cut by 75bps, reverse repo rate cut by 90bps to increase LAF corridor, CRR cut by 100bps, MSF for banks increased by 100bps, LTRO for Rs 1 trillion for banks to buy corporate bonds and easing loan repayment norms for borrowers and easing provisioning for banks. Liquidity injection is at Rs 3.5 trillion over and above the liquidity injection of Rs 2.5 trillion already done.

RBI is following global central banks in addressing the economic and market effect of the Covid-19 fallout. In his statement today, the RBI Governor Shaktikanta Das stated that outlook for both domestic and world economies is grim and until and unless the end of Covid-19 is clear, the impact cannot be estimated.

The government announced a Rs 1.7 trillion bailout package to the weakest and most affected population due to the 21-day lockdown. RBI policy comes in a day after showing a coordinated fiscal and monetary response to the crisis.

The fiscal and monetary moves were warranted given the enormity of the crisis. There will be more of such policy moves with RBI buying bonds aggressively through OMOs to support a heavily enhanced government borrowing program. Government finances are extremely weak and will get weaker on the economic slowdown. Listen to my podcast on government finances.

NIFTY Movement

USD INR exchange rate movement