RBI to continue with rate hikes to catch up with the yield curve

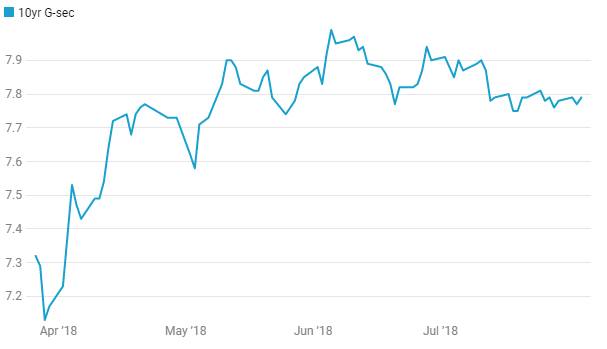

· 10 year government bond yield to trade in a 7.70% to 8% range going into October 2018

· AAA corporate bond yields to come off from higher levels on easing risk premium

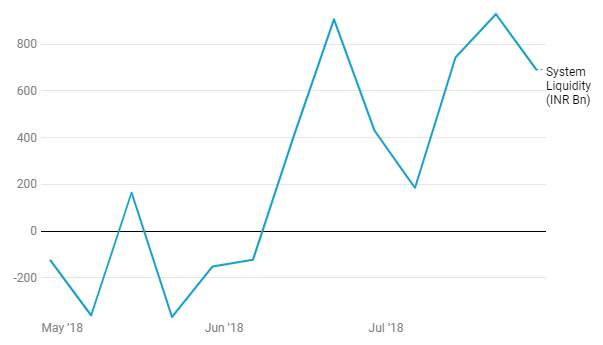

· CP, CD yields to fall on improved liquidity

· OIS yield curve to flatten on rate hike expectations

· Sensex and Nifty to gain on economic optimism

Repo rate at 6.50% post rate hike hike today is still 125bps below the 10 year benchmark government bond yield and given that factors point to an improving economy that has almost closed the output gap, pricing power returning to manufacturers of goods and services, withdrawal of accommodation by Fed and ECB and higher spending by the government and other political parties given general elections in 2019, the repo rate has to reflect the inflation premium priced into the 10 year government bond yield.

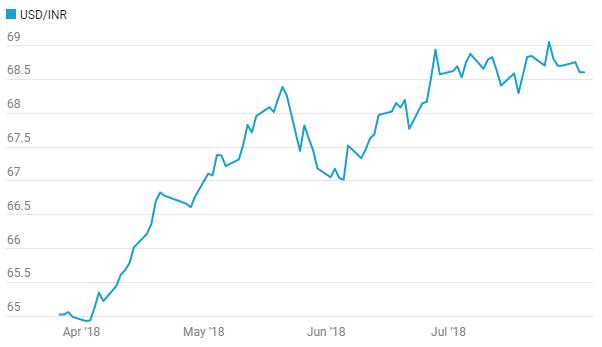

The positive aspect of RBI rate hike is that inflation expectations are not rising sharply and risks are evenly balanced with factors such as good monsoons and GST rate cuts negating MSP hike, global financial market volatility and higher oil prices. A weakening INR that touched all time lows last week on FII selling of domestic bonds and equities, rising trade deficit on higher oil import bill and a broad emerging market weakness on global risk aversion are factors that can take up inflation expectations.

The bond market will trade cautiously going into October 2018 where government borrowing will be heavier given that government did not front load borrowing in the first half of this year. Rate hike expectations coupled with higher bond supply will keep yield from trending down.

Corporate bond yields have backed up sharply on FII selling of INR bonds and this trend will reverse as FII ease selling as the INR stabilizes on growth optimism. The flat AAA corporate bond yield curve should see steepening as markets buy into a better risk return profile in 3 and 5 year AAA yields. Similalry CP, CD yields at over 8 % for one year maturity papers should come off as liquidity outlook improves on easing FII sales, rising equity markets and stable INR.

OIS yield curve is steep with one year OIS yield at 6.9% and 5 year OIS yield at 7.23%. The yield curve will rise and flatten as it rises on rate hike expectations.

Strong Q1 FY 19 corporate earnings, higher urban and rural consumption and government spending will help equity markets trend higher.

RBI mentioned trade wars many times in its policy statement, which it sees as a big risk. US, EU and China going to the negotiating table will mitigate the risk significantly.

RBI followed the 25bps rate hike in its Junepolicy meet with a 25bps rate hike in its August review. The rate hike was largely expected, though we did argue for a 50bps rate hike ( Read our note RBI has leeway for a 50bps rate hike in August). All MPC members except one voted in favour of the rate hike.

Markets are largely stable post the rate hike and RBI’s tone suggests that rate hikes will be gradual and there is no sudden acceleration in inflation expectations.

Core inflation excluding HRA impact was at 6.4% in June against 5.3% in April , which has prompted RBI to revise inflation estimates for FY 19 to 4.6% in Q2 from 4.8% to 4.9% in H1 and 4.8% in H2 from 4.7% and forecast at 5% for Q1 of fiscal 2019-20. Excluding HRA impact inflation is forecast at 4.4% in Q2 (against 4.6% in H1) and 4% to 4.8% in H2 (against 4.7%) and 5% in Q1 of fiscal 2019-20.

GDP growth for FY 2019 is maintained at 7.4% and is projected at 7.5% in QI FY 20.

Chart 1

USD/INR

Chart 2

10yr Benchmark G-sec (%)

Chart 3