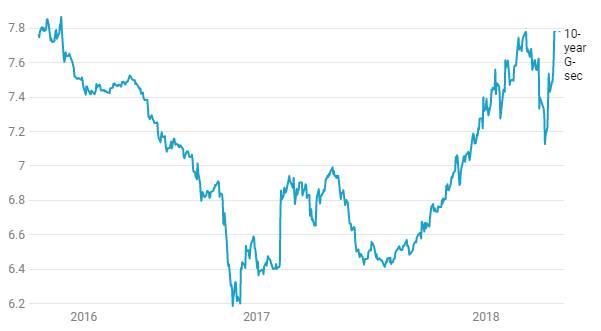

The 2 month yield movement in the 10 year benchmark bond , the 7.17% 2028 bond is a literal see-saw. The bond yield fell from 7.75% levels to 7.15% levels and has climbed again to 7.78% levels. The upwards move from 7.15% to 7.78% has happened in just 9 trading sessions.

Bond markets are rattled, rightly so, and buyers have completely disappeared. The market saw a glimpse of hope on a dovish RBI policy but the minutes have put paid to the dovishness, with 2 RBI MPC members favouring rate hikes. The minutes have gone completely against the perceived guidance of status quo on rates for a longer period of time.

RBI will find it very difficult to manage the government borrowing especially with states borrowing heavily in the 1st quarter of the fiscal year. Governments efforts to keep yields down with lower first half borrowing have not worked and borrowing costs will only rise.

10-year G-sec bond yields rose to 7.78%, the highest level since March 2016, after RBI policy minutes suggested a very hawkish tone. Bond yields started to rise sharply after media report suggested that PSBs are reluctant to buy bonds and are net seller of bonds. State borrowing came in more than expected at levels of Rs 1.15 trillion to Rs 1.25 trillion, which is almost as high as the government borrowing. Crude oil prices have also acted as a catalyst for the bond sell-off.

RBI deputy governor Viral Acharya said he will shift decisively to vote for the start of the “withdrawal of accommodation” in the next meeting in June. Acharya said an inflation targeting central bank needs to separate “signal” from “noise” in the data. Inflation is down because of easing of vegetable prices, which is due to seasonality factor and not due to durable supply management. Core inflation has strengthened steadily from a trough of 3.8% last June to 4.4% in February (excluding the estimated impact of Centre House Rent Allowance increase). This rise has been broad-based. Inflation trajectory over the entire twelve-month period is projected, despite the soft print in February, to remain above the MPC target rate of 4%, on a quarter on quarter basis. Besides rising oil prices, another primary concern is the risk of fiscal slippages, at both the Centre and State levels. Food price-support measures, on which further clarity is needed, clearly induce an upside bias to potential inflation risks

Acharya will join RBI Executive Director Michael Patra in seeking tighter monetary policy in an attempt to bring inflation down the mid-point of the MPC’s flexible inflation target of 4 (+/- 2)%. Patra voted for a 25 basis point hike in the repo rate at the February and April meetings.

10-year G-sec