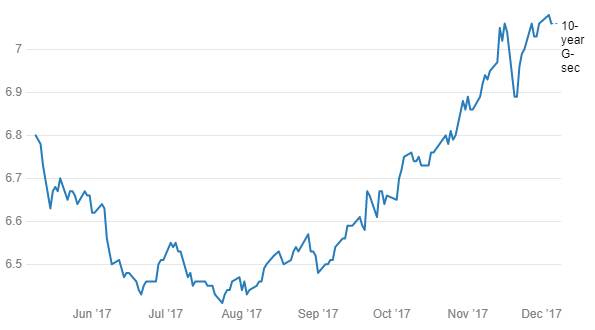

The 10 year benchmark bond, the 6.79% 2027 bond, saw yields trade at over one year high levels at 7.07% pre RBI Policy statement release. The yield on the 10 year bond is likely to trend higher on the back of a lack of positive cues from the policy, worries of higher government borrowing this fiscal year and apprehension over fiscal deficit targets in the budget for fiscal 2018-19. RBI’s next policy review is on the 6th and 7th of February 2018, post the Union Budget.

RBI maintained rates status quo in the policy review on the 5th and 6th of December 2017 and maintained a neutral policy stance. However the tone of the MPC was distinctly hawkish on inflation and the statement “ However, keeping in mind the output gap dynamics, the MPC decided to continue with the neutral stance and watch the incoming data carefully”. This statement came on the back of the RBI noting that inflation trajectory needs to be monitored carefully due to factors such as a) rising food and fuel inflation leading to rising inflation expectations amongst households, which has already risen b) rising input costs being passed on to consumers c) fiscal slippages on account of farm loan waivers, reduction of duty on petroleum products and lowering of GST rates on several goods and services and d) Global financial markets instability as monetary policy accommodation eases in developed economies. Falling food prices and lowering of GST rates have temporarily mitigated inflation risks.

This gives an uncomfortable feeling that the MPC may have deliberated on changing the policy stance from neutral to tight.

RBI raised CPI inflation range from 4.2% to 4.6% to 4.3% to 4.7% in the second half of this fiscal year while risks to core inflation is on the higher side on the back of 7th pay commission impact on rents, higher fuel prices and rising input costs.

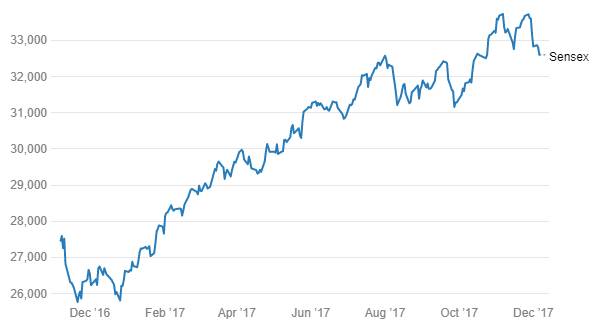

RBI maintained GDP growth forecast at 6.7% and is hopeful that the bank recapitalization plan will improve credit growth, which has started to rise. Global economic growth especially in US and Eurozone is on stronger footing based on falling unemployment rates, higher manufacturing activity and rising consumer and business sentiments.

On the liquidity front, RBI has sucked out Rs 900 billion from OMO sales and Rs 1000 billion from issue of MSS bonds. RBI has an outstanding forward purchase contract of USD 31 billion, which is a potential Rs 2200 billion of liquidity. Rising fx flows on account of higher growth prospects will add to fx purchases and RBI will continue with OMO sales and MSS bonds to suck out liquidity.

Bond yields will rise on worries of policy tone while INR will move on USD, which is trading closer to year low levels. Read our weekly currency for USD movements. Sensex & Nifty will await Gujarat poll results and 3rd quarter results for further cues on direction.

10-year G-sec Movement