· RBI August 2017 Policy Stance to Benefit Credit Spreads the Most

· Markets to search for yields amidst high liquidity and low rates

· Gsecs will see yield curve plays

· INR, Sensex, Nifty to gain on FII flows

RBI as widely expected, cut rates by 25bps in its policy review meet on the 1st and 2nd of August 2017. RBI cited lower June 2017 headline inflation than projected, fall in core inflation to 4% levels and smooth implementation of GST and normal monsoons for its rate cut. RBI did not change its policy stance from neutral and is adopting a wait and watch policy on inflation trajectory till its next policy review in October 2017.

RBI neutral policy stance, low rates with the Repo Rate down by 200 bps over the last two and half years and high system liquidity is highly positive for corporate bonds and credit spreads. Low rates and high liquidity will force the market to search for yields and that search for yields will lead them to credits as they offer higher yields than government bonds.

On the government bond front, market will trade in a range and search for opportunities along the yield curve. Spreads of long dated bonds and off the run bonds will trend down as traders and investors look for carry. Read our Gsec Yield Curve Spread Analysis.

The INR is 2 year lows against the USD on the back of FII flows that crossed USD 25 billion calendar year to date. INR will continue to see strength as FII’s buy into a strengthening currency through bonds. RBI has given separate limit of INR 50 billion for IRF over and above the limit for gsecs. Read our note on FII gsec limits.

Sensex and Nifty are trading at close to record highs and will continue to see strength on liquidity and low rates driving up expectations of higher demand in the economy. Global risk aversion at lows as seen by record high equities will drive FII flows into Indian equities.

Gsecs were largely muted post policy with the 10 year gsec yield hardly unchanged at 6.44% levels. 10 year gsec will trend down to repo rate levels if August inflation data is lower than expected as markets will start to factor in another 25bps rate cut in October.

On the global front, Fed’s uncertain inflation expectations has led to the USD weakening. ECB and BOJ will keep their policy accommodative though ECB is likely to contemplate winding down of its bond purchase program of Euro 60 billion a month. Global bond yields have risen but are still way below highs.

RBI has maintained its inflation forecast of 2% to 3.5% for 1st half of fiscal 207-18 and 3.5% to 4.5% for the 2nd half. RBI is cautious on base effect rise, seasonal spike in vegetables prices, impact of 7th pay commission on rents and fiscal slippages of states due to farm loan waivers .

CPI Inflation(Y-O-Y in %)

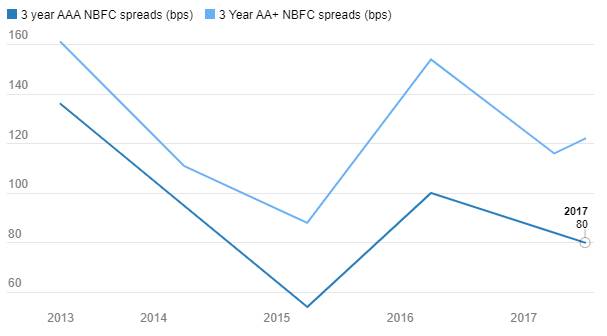

NBFC Credit Spreads chart (bps)