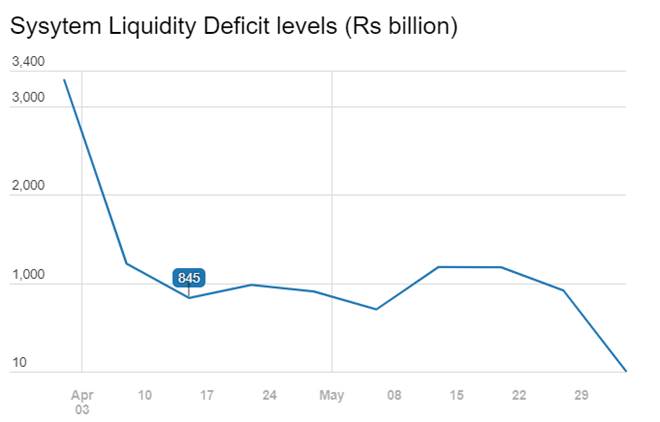

Corporate Bonds will see fall in yields as markets buys into the spreads. Liquidity has eased considerably since the beginning of April Chart 1, overnight rates are trading at below the Repo Rate of 6.5% and corporate sentiment is improving on pick up in economic activity.

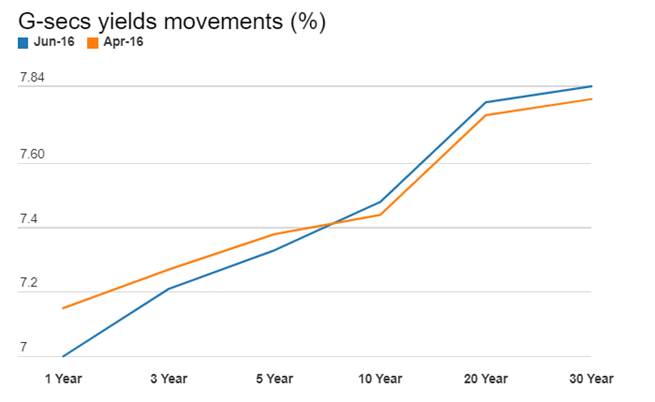

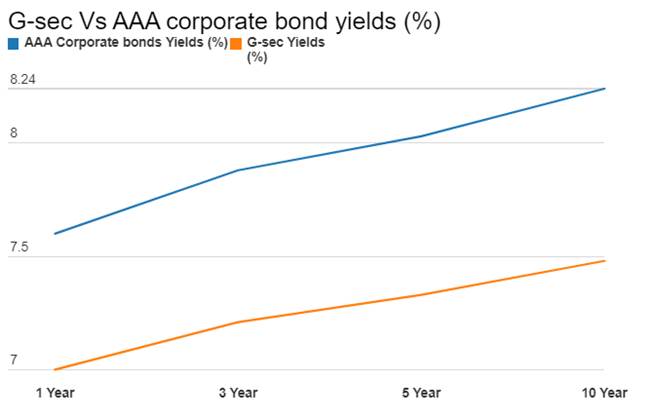

The government bond yield curve has steepened Chart 2 and is likely to stay at current levels as markets factor in a longish period of stable Repo Rate. The government is continuously supplying bonds (Rs 150 billion a week) and that will keep government bond yields from trending down too sharply. On the other hand, corporate bonds still offer spreads over government bonds Chart 3 and with easy liquidity and low cost of liquidity, markets will buy into corporate bonds across the rating curve.

RBI as expected maintained rates status quo in its policy today on the 7th of June. The Central Bank also guided towards policy rate stability with an accommodative stance. The uncertainty over the extension of the Term for Governor Dr. Rajan will also keep RBI from taking any major policy steps in its next policy meet on the 9th of August.

RBI, while keeping the Repo Rate at 6.5% has reaffirmed its commitment to bring down liquidity from a deficit of 1% of NDTL to neutral. The Central Bank to a large extent has achieved its objective, with liquidity deficit as of 3rd June at just Rs 20 billion as compared to deficit of around Rs 950 billion seen at the end of May. RBI has bought bonds worth Rs 700 billion through OMO (Open Market Operations) bond purchase auctions.

On the economy front, RBI has noted improvement in economic activity with increased activity in ports, rising capacity utilization across industries and higher passenger air and freight traffic. Globally, economic uncertainty is seen as slowly coming off though inflation expectations are still down. US latest job numbers that showed job creation in May at its weakest level in six years has been highlighted.

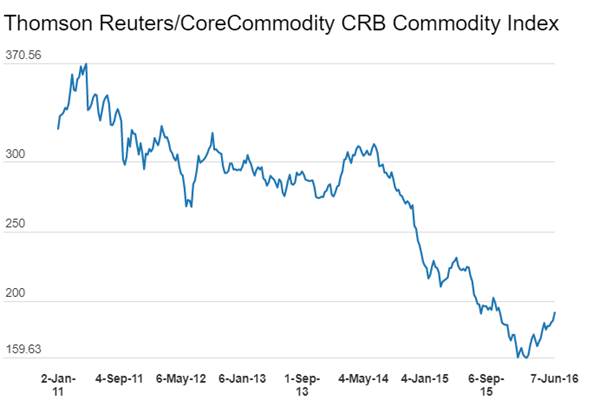

Inflation concerns have emerged in this policy review. CPI inflation printing at 5.39% in April from 4.83% in March has raised eyebrows. The Central Bank has noted that the uptick in commodity prices globally with oil prices doubling from lows and broad commodity indices higher Chart 4 and Chart 5 could impact inflation though at this point of time there is enough slack in the economy to absorb rise in raw material prices.

Food inflation has ticked up with pulses that have shows sharp rise in prices seeing an uptrend once again as production has come off for the second consecutive year. Services inflation too has risen on account of rise in rents, education costs and other household costs. Core inflation after taking off fuel has been sticky at around 5% levels.

RBI has maintained its inflation target of 5% for this fiscal year but will be watchful of inflationary pressures.