The months of February and March are typically tight liquidity months for the system. Demand for funds goes up across the system as banks; corporates and the government look to balance their books for the fiscal year end. Hence the 25bps repo rate and CRR (Cash Reserve Ratio) cut of the RBI will not immediately translate into lower lending rates of banks or lower deposit rates. Banks will in fact raise deposit rates to improve their liquidity profile, as they would not want to be seen as heavy borrowers from the RBI on the last day of March 2013.

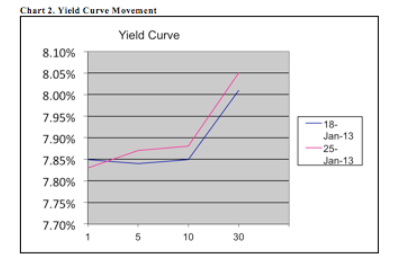

The liquidity situation eases considerable in April when all the hoarded liquidity in the system is released. April is when deposit rates will tumble and lending rates get reduced. In effect despite positive sentiments of rate cuts, the next two months will see yields on short term instruments such as CP’s (Commercial Papers) and CDs (Certificate of Deposits) being pressured on higher demand for liquidity. However markets will pull down yields at the longer end of the curve on expectations of rate cuts in March and on expectations of an easy policy regime in the coming fiscal. The yields on longer maturity bonds will fall on strong demand.

What does it mean for investors in liquid funds and income funds? Investors in liquid funds will face volatility in returns over the next two months as demand for liquidity pushes up yields at the short end of the curve while investors in income funds will see returns trending up as bond prices go up on the back of falling yields.

In this scenario investors in liquid funds will have to have an investment horizon of at least one month in order to ride out the volatility. Investors in income fund should hold on or add to their investments to take advantage of an expected fall in yields on longer maturity bonds.

The yield on one year benchmark CD is around 8.7% while the yield on a ten year corporate bond is also around 8.7%. Investors can expect ten year corporate bond yields to fall and one year CD yields to stay sticky or even trend up marginally over the next two months. Investments can be positioned on the basis of this trend playing out.