Synopsis: RBI is buying government bonds worth Rs 2.2 trillion in the first half of fiscal 2021-22 and is actively buying USD, adding more liquidity in the system. Corporate bonds, especially high yield bonds will see strong demand as investors search for yields

RBI G-SAP, fx purchases and long term repos for liquidity

RBI maintained its accommodative stance and kept repo rates unchanged in its policy review on the 4th of June 2021. GDP growth is pegged at 9.5% for this year and inflation at 5.1%. 10year gsec yield target is kept below 6%. The second wave of covid 19 is keeping the RBI on maintaining an accommodative stance despite a commodity price boom that is raising inflation expectations.

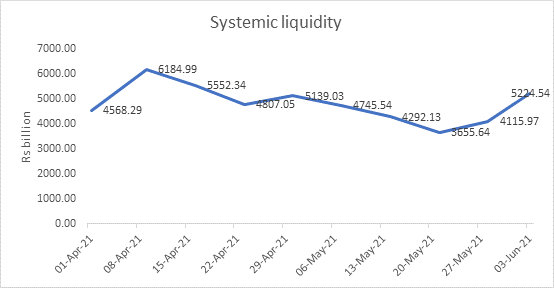

RBI will buy gsecs for Rs 1.2 trillion in the secondary market in the 2nd quarter of this fiscal year. This is in addition to the Rs 1 trillion purchase in the 1st quarter. RBI is actively buying fx as it absorbs capital flows and has indicated that fx reserves have crossed USD 600 billion for the first time ever. The central bank could end up infusing well over Rs 5 trillion this year through fx purchases. In addition to these liquidity infusions, RBI is lending long term funds to banks through long term repos.

Gsecs have nowhere to go

Government bonds are stuck with heavy bond supply through auctions as the central governments funds its fiscal deficit of 6.8% of GDP through borrowing. State governments too are borrowing heavily as they struggle to cope with loss of revenues due to covid lockdowns.

Given fast rising commodity prices, higher fuel prices and supply disruptions, inflation expectations are high and bond markets will not bet on further fall in yields while upside is capped by RBI through its auction signals. RBI has cancelled bond auctions, devolved on underwriters and conducted operation twists to keep the 10 year gsec yield at 6% or below.

Corporate bond party

Bond markets will not find any joy in government bonds as they have nowehere to go. The focus will shift to corporate bonds, especially bonds that offer high yields as the markets search for yields. Pick up in economic activity will see more and more corporates accessing the bond market to fund working capital and capex and this will lead to a boom in credit markets.

Key Highlights

Ø Inflation -CPI inflation is projected at 5.1% during FY22, 5.2% in Q1, 5.4% in Q2, 4.7% in Q3 and 5.3% in Q4 of 2021-22.

Ø GDP growth-GDP growth is projected at 9.5% in FY22, consisting of 18.5% in Q1, 7.9% in Q2, 7.2% in Q3 and 6.6% in Q4 of FY22.

Ø G-SAP 1.0- It has been announced that purchase of G-Secs of Rs 400 billion will be conducted on June 17, 2021. Of this, Rs 100 billion would constitute purchase of state development loans (SDLs). It has also been decided to undertake G-SAP 2.0 in Q2:2021-22 and conduct secondary market purchase operations of Rs 1.20 trillion to support the market.