Inflation no worry, demand focus to continue

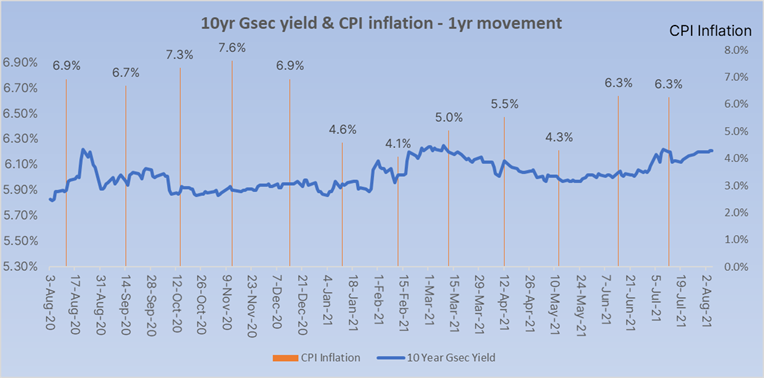

CPI inflation trending above 6% is not seen as a worry by RBI and it is forecast to come off to below 6% by the end of this financial year. Supply shocks on continued covid related lockdowns is blamed for higher inflation.

RBI is keeping policy rates accommodative to push aggregate demand and with government spending at high levels, demand is likely to rise even as supply lags behind. However, with both easing covid restrictions on higher vaccination coverage across the globe and higher investments in capacities to meet demand, supply will pick up and prices are expected to ease.

G-sec is a public good

The RBI governor Shaktikanta Das in his statement today reiterated that the government bond yield curve is a public good and hence has to be managed to keep down volatility. This is of high significance to bond markets as it no longer has any control on where bond yields should go. Hence traders have to look at all other yield curves to trade as government bonds are not likely to benefit them.

Why the lack of market interest in benchmark bonds?

RBI once again gave underwriters almost 80% of the Rs 110 billion of benchmark 5 year G-sec on offer. Last auction and many auctions prior to last, RBI has been giving underwriters the 5 & 10 year bonds in auctions or has even cancelled many auctions due to lack of demand at market yields.

The 5 year and 10 year benchmark bonds have seen bidding at yields higher than market yields in the bond auctions. RBI has been unwilling to give the yields the market wants and has resorted to devolvement of the auctions on to the underwriters or even cancelling a few auctions.

The market shunning benchmark bonds is despite RBI buying Rs 1 trillion of bonds every quarter to offset the huge government borrowing program where supply of government and state government bonds average over Rs 400 billion a week. RBI is purchasing bonds in the medium to long tenor as well as issuing floating rate bonds to reduce the duration risk of rising interest rates for investors.

The bond market has not been allowed to set market rates on benchmark bonds given that RBI is managing the yield curve and this is making markets nervous on buying and trading the bonds. Hence the lack of interest in the benchmark bonds.

Current liquidity stood at Rs 7753.66 billion as of 5th August.

Key Highlights

Ø Key rates-Policy repo rate kept unchanged at 4% while the reverse repo rate also remained unchanged at 3.35%.

Ø Inflation -CPI inflation is projected at 5.7% during FY22, 5.2% in Q1, 5.4% in Q2, 4.7% in Q3 and 5.3% in Q4 of 2021-22. CPI inflation for Q1:2022-23 is projected at 5.1%.

Ø GDP growth-GDP growth is projected at 9.5% in FY22, 21.4% in Q1, 7.3% in Q2 and 6.3% in Q3, 6.1% in Q4 of FY22. Real GDP growth for Q1FY23 is projected at 17.2%.

Ø G-SAP 2.0- Under G-SAP 2.0, two more auctions of Rs 250 billion each on August 12 and August 26, 2021 has been announced.

Ø Extension of Deadline TLTRO Scheme- It has been decided to extend the on-tap TLTRO scheme till December 31, 2021.

We would love to hear back from you. Please Click here to share your valuable feedback