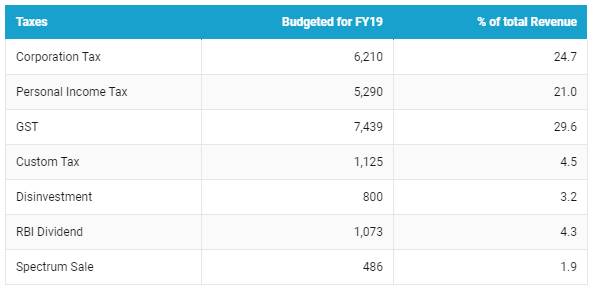

The government has budgeted for a 13% increase in total taxes with corporation tax rising by 13% and personal income tax rising by 17% in the interim budget for fiscal 2019-20.

On the indirect tax front, the government has budgeted for a 18% increase in GST collection, for FY2018-19, GST collection has been lowered by Rs 1000 billion (GST implementation will bring Excise Duty and Service Tax under its fold). Union Excise duty is budgeted to remain flat this year. Customs duty is budgeted to grow by 12%.

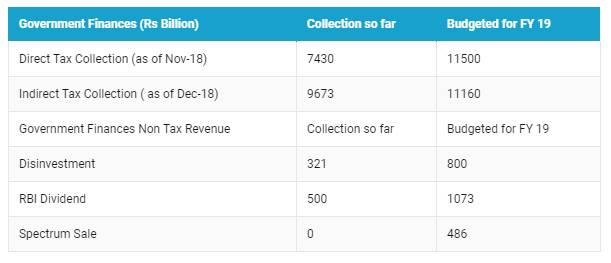

On the Non-Tax Revenue front, dividends from RBI and PSU’s has been budgeted for a 15% increase. Spectrum auctions and license fees revenues were revised by 19% for this fiscal year and is budgeted to grow by 6% in next fiscal year.

Disinvestment for last fiscal year is expected to meet its target. Disinvestment target for 2019-20 is budgeted at Rs 900 billion, a growth of 12.50%. Total non-tax revenues is budgeted to grow by 13%.

Government Revenue Collection