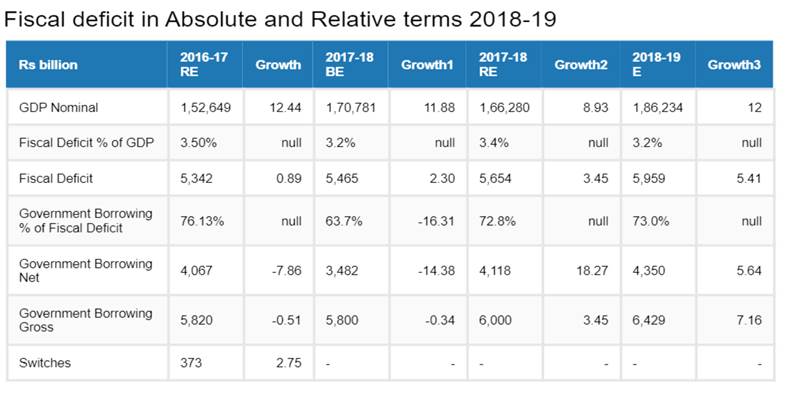

The government has overshot it’s budgeted borrowing for fiscal 2017-18 by RS 200 billion for this fiscal year, taking up gross borrowing to Rs 6000 billion. Net of redemptions of Rs 1882 billion, the net borrowing is Rs 4118 billion, which is around 73% of gross fiscal deficit. Fiscal deficit is higher than budgeted levels of 3.2% of GDP at 5.4% of GDP. GDP (nominal) has been revised from Rs 170 trillion to Rs 166 trillion, a growth of 8.9%.

The government is likely to show a nominal GDP growth of 12% for fiscal 2018-19, which is around Rs 186 trillion. Fiscal deficit is likely at around 3.2% of GDP, as the government will slightly veer away from FRBM target of 3% due to spending compulsions to pull up economic growth. Assuming that the government will fund 73% of fiscal deficit through market borrowings (same as last fiscal), net borrowings will work out to around Rs 4.3 trillion. Redemptions of Rs 2.07 trillion will take gross borrowing to Rs 6.4 trillion (excluding potential switches). Table 1 & 2

Government Budgeted Estimates for Fiscal 2017-18

The government has projected a fiscal deficit of 3.2% of GDP for fiscal year 2017-18 from a fiscal deficit of 3.5% of GDP for fiscal year 2016-17. The absolute level of fiscal deficit is Rs 5465 billion against Rs 5342 billion, a growth of 2.3%. The higher absolute level of fiscal deficit despite a lower fiscal deficit to GDP ratio is due to growth in nominal GDP, which is pegged at 11.75% by the government.

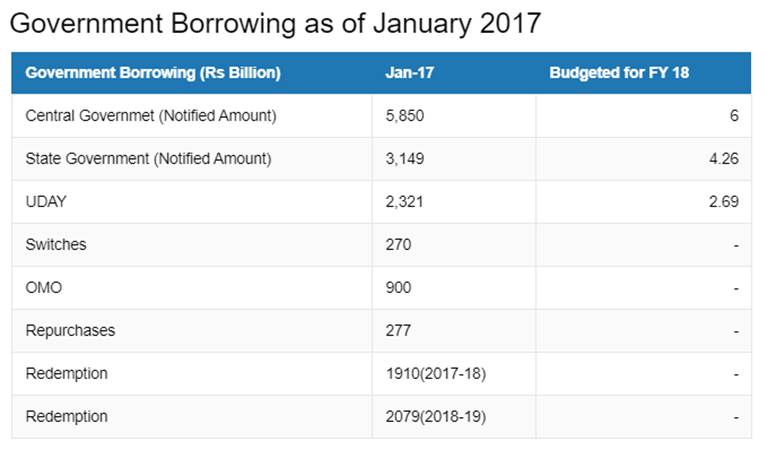

The fiscal deficit is normally financed largely by market borrowings through issue of dated government securities. Market borrowings financed 92%. 87% and 83% of the fiscal deficit in FY 2013, FY 2014 and FY 2015. In FY 2016, market borrowing was estimated to finance 80% of fiscal deficit. Budgeted market borrowing was Rs 4251 billion, however with the government lowering the borrowing program by Rs 180 billion, the net borrowing to finance fiscal deficit was Rs 4067 billion. Correspondingly, gross borrowing too dropped by Rs 180 billion to Rs 5820 billion. Government bought back bonds for Rs 332 billion in fiscal 2016-17.

The government has shown a net market borrowing of Rs 3482 billion to finance the fiscal deficit of Rs 5465 billion, which is 63.7% of fiscal deficit. The market borrowing to finance the deficit is a sharp drop from previous year’s levels including the revised level for last year.

How can the government show such a sharp drop in net borrowings?

The increase in inflows into the NSSF (National Small Savings Fund) has changed the borrowing dynamics. The government has also discontinued investments of NSSF receipts into state government securities and all investments are made in central government securities. NSSF saw inflows of Rs 903 billion as against budgeted inflows of Rs 221 billion in fiscal 2016-17. NSSF inflows are budgeted at Rs 1001 billion for fiscal 2017-18. The government has also budgeted for higher inflows through other receipts at Rs 535 billion against Rs 99 billion seen last year.

Government is pegging the gross borrowing at Rs 5800 billion. After carrying out bond switches for Rs 373 billion with the RBI, bond redemptions for 2017-18 work out to Rs 1910 billion. Deducting gross borrowing of Rs 5800 and redemptions of Rs 1910 billion, net borrowing works out to Rs 3890 billion which is higher by Rs 408 billion than government estimates of Rs 3482 billion. Expected bond buybacks and switches explain the lower net borrowing number.

Fiscal Deficit, Revenue Deficit and Primary Deficit

Fiscal deficit is the difference between total revenues and total expenditure of the government. Given that the Indian government spends more than it earns it runs a fiscal deficit, which is financed by market borrowings. Government borrowing every year adds to the stock of outstanding debt that is at close to Rs 50 trillion. Given rising government debt, interest cost for the government rises every year (Read our note on Expenditure Budget) that in turn puts pressure on government finances, which in turn leads to fiscal deficit, which again leads to government borrowing and increase in stock of outstanding debt. A classical self-fulfilling cycle.

Fiscal deficit is the difference between total expenditure and total revenue of the government while primary deficit is fiscal deficit less interest costs.

Revenue deficit is the difference between expenditure and revenue on the revenue account. Revenue expenditure does not go into creation of capital assets and hence it is non productive. Effective revenue deficit, which was introduced in 2011-12, reduces from the revenue deficit, government grants to states and other bodies for creation of capital assets.

The government is conscious of the need to bring down levels of fiscal and revenue deficits and has adopted the FRBM (Fiscal Responsibility and Budget Management) Act that sets targets for revenue and fiscal deficit as percentage of GDP. FRBM target for 2015-16 is effective revenue deficit of 0%, revenue deficit of 2.2% and 1.6% and fiscal deficit of 3.6% and 3% respectively. Table 3.