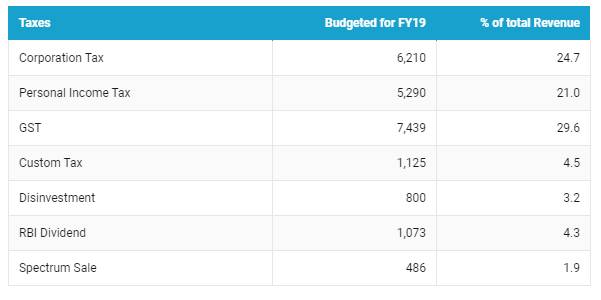

The government will present an interim budget for fiscal 2019-20 to the parliament on the 1st of February 2019. The budget will provide details of all sources of revenues and growth in revenues for the fiscal year, which in turn will determine the fiscal deficit and government borrowing that influences interest rates and liquidity in the economy.

The provisional figures of Direct Tax collections up to December 2018 show that gross collections are at Rs. 8740 billion which is 14.1% higher than the gross collections for the corresponding period of last year. Refunds amounting to Rs.1.30 billion have been issued during April 2018 to December 2018 which is 17.0% higher than refunds issued during the same period in the preceding year.

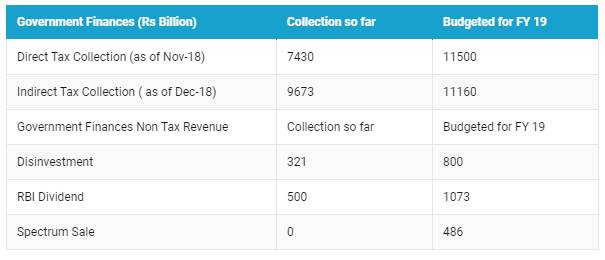

Net collections (after adjusting for refunds) have increased by 13.6% to Rs. 7430 billion during April – December 2018. The net Direct Tax collections represent 64.61% of the total Budget Estimates of Direct Taxes for F.Y. 2018-19 (Rs. 11500 billion).

Net indirect tax collections represent 86.7% the total Budget Estimates. Indirect tax collection includes GST, Customs and other taxes.

On disinvestment front, the government is likely to miss its disinvestment target for the current fiscal 2018-19. The government has earned only Rs 321 billion or 43% of the budgeted Rs 800 billion from PSU stake sales in the first nine months of FY19, till December.

On RBI dividend front, RBI has paid Rs 500 billion to the government so far which represent 46.6% of the total budget estimates. However, various news agencies have reported RBI will pay around Rs 300-400 billion as an interim dividend to the government by March 2019.

Government Revenue Collection