The government is likely to close 2012-13 with a revenue shortfall on the back of slowdown in GDP growth and on the back of lower collections in spectrum auction. The shortfall in revenue is likely to be in the range of 8% to 10% of budget estimates. The question is where will the government raise revenues for fiscal 2013-14 given that it is likely to show a muted GDP growth estimate for the coming fiscal.

The scope for higher revenues is limited for the government this year. Taxes cannot be raised at a time when the economy is slowing down while it cannot be broadened as elections are due in 2014. The fact that the government is committed to lower fiscal deficit by reducing expenditure will also limit its scope for raising taxes. The indirect tax reform in the form of GST (Goods and Sales Tax) has been pushed to fiscal 2014-15.

The government has projected lower spectrum auction inflows for fiscal 2013-14 at Rs 25,000 crores. Disinvestment targets could be placed higher at around Rs 40,000 crores as capital markets look more stable in 2013 than what it was at the time of presenting the budget in 2012. However an increase of Rs 10,000 crores in capital receipts is not going to shore up overall government revenues for the fiscal.

The government given its lack of visibility on revenue growth is focusing on the expenditure side to bring down fiscal deficit. However lower government spending will impact growth negatively and that could further impact revenues. The FM will be thinking deeply on this factor as he presents the budget on the 28th of February 2013.

Revenuegrowthwillbeimpactedin2013-14

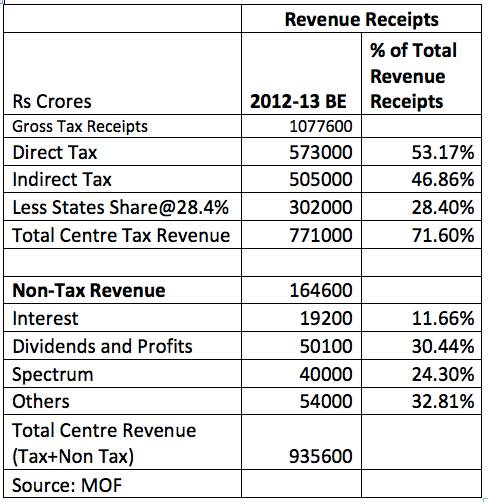

Revenue growth will be difficult to achieve in fiscal 2013-14. The government will show a modest GDP growth rate of around 6.5% for the coming fiscal as against budget 2012-13 growth forecast of 7.6%. The BE (Budget Estimates) for revenues in 2012-13 was on a 7.6% growth estimate. Table 1 gives the BE for revenue receipts for 2012-13.

Table 1. Budget Estimates for 2012-13

The economy has not grown as per budgeted and the government has revised its growth forecast to 5.5%. Tax collections are impacted due to GDP growth slowdown as India’s Tax to GDP ratio is sticky at around 10% levels and any slowdown in GDP growth has a negative repercussion on tax revenues. Tax revenues account for 82% of total revenue receipts of the government.

Tax revenue growth in fiscal 2012-13 is reflecting the GDP growth slowdown with direct taxes growing at 12.5% levels in the April-January 2012-13 period against growth estimate of 15% for full year 2012-13. Indirect tax revenue growth for the April-November 2012 period was 16.8% against a growth of 26% budgeted for full year 2012-13.

The government is falling short on non-tax receipts as well with spectrum auctions raising just Rs 9400 crores against a budgeted amount of Rs 40,000 crores. The government could raise more through spectrum auctions by end March 2013 but it will not be anywhere close to the balance amount of Rs 30,600 crores left to raised.

On the capital receipts side, the government has been more successful by raising Rs 21,500 crores from disinvestments against a budgeted amount of Rs 30,000 crores. The government is likely to sell more shares of its companies by end March 2013 to come close to the total disinvestment target.

The government has to look at other sources of income for fiscal 2013-14 given that has limited or no room on raising tax revenues. It remains to be seen if the government will tap more revenue sources in this budget.