The budget 2013-14 documents will have thousands of numbers floating around and the numbers are bound to confuse even a seasoned budget analyst. The markets will react to every number that is released in the budget starting from GDP growth estimates for 2013-14. Hence it is necessary to have a cheat sheet, which is a summary sheet of budget numbers that are considered important by the markets.

The budget 2013-14 cheat sheet will help you focus on the numbers that your require to know in order to understand market movement post budget. The important numbers are defined and then put out in a table for you to fill up as the budget speech by the FM progresses.

Important budget numbers defined

GDP growth

The GDP growth estimates play an important part in the union budget as most of the items are measured as a percentage of GDP. GDP growth has to be looked at in nominal terms for budget purposes. Nominal GDP is GDP growth at current market price. Real GDP is growth at constant price (2004-05 base year) and is growth arrived at after the nominal GDP is adjusted by a number known as the GDP deflator. The GDP deflator is inflation in the true sense but is more comprehensive than the WPI (Wholesale Price Index) and the CPI (Consumer Price Index).

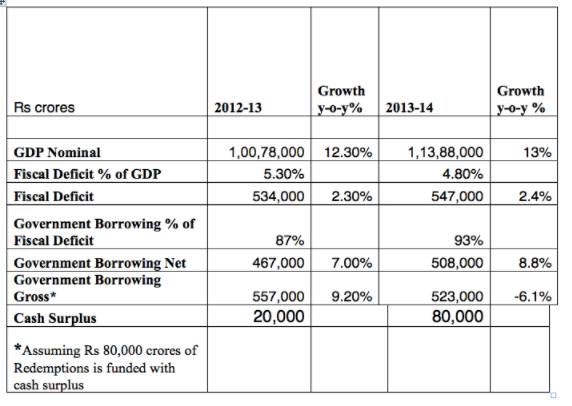

GDP (nominal) growth for 2011-12 was Rs 89,75,000 crores, a growth of 15.1% over the year. GDP for 2012-13 is placed at Rs 1,00,28,000 crores a growth of 11.7% over the year by the CSO (Central Statistical Office). The advance 2012-13 estimate of the CSO is likely to be revised upwards by the government by around 0.5%. The government is likely to place the GDP for 2012-13 at Rs 1,00,78,000 crores, a growth of 12.3% over the year.

The government is likely to place nominal GDP growth for 2013-14 at around 13% (real GDP growth of 6.5% plus inflation of 6.5%). Nominal GDP is expected to be placed at Rs 1,13,88,000 crores.

Fiscal Deficit

The fiscal deficit is shown as a percentage of GDP and the markets will be keenly watching the budget estimate for the same. Fiscal Deficit is the difference between revenues and expenditure of the government.

Fiscal deficit for 2012-13 is estimated at 5.3% of GDP, which is an absolute amount of Rs 534,000 crores based on estimated GDP of Rs  1,00,78,000 crores. Fiscal deficit for 2013-14 is expected at 4.8% of GDP, which is an absolute amount of Rs 547,000 crores going by 2013-14 GDP estimate of Rs 1,13,88,000 crores.

Government borrowing

The government financed its estimated 2012-13 fiscal deficit of Rs 534,000 crores through market borrowings. The government borrowed a net amount of Rs 467,000 crores through issue of dated government securities in 2012-13. Government borrowing constituted 87% of fiscal deficit in 2012-13 against budget estimate of 93% of fiscal deficit. The government in fact borrowed less than targeted amount of Rs 479,000 crores in 2012-13

The government will finance its fiscal deficit for 2013-14, estimated at Rs 547,000 crores, predominantly through issuance of dated government securities. Government borrowing would constitute 93% of fiscal deficit for 2013-14 and net borrowing will be around Rs 508,000 crores. The Rs 508,000 crores of net borrowing will be higher by Rs 41,000 crores over the actual net borrowing of Rs 467,000 crores for fiscal 2012-13.

The government is expected to go into fiscal 2013-14 with a cash surplus of around Rs 80,000 crores to Rs 100,000 crores. The government can use the cash surplus to fund bond redemptions of Rs 95,000 crores and if that is true, the gross borrowing of the government will be at or around the net borrowing of Rs 508,000 crores. The gross borrowing of the government was Rs 557,000 crores in fiscal 2012-13. Gross borrowing is net borrowing plus bond redemption for the year.

GDP Growth, Fiscal Deficit and Government Borrowing are the key numbers to watch out for in budget 2013-14. Table 1 gives the Cheat Sheet for you to use during the budget presentation.