Would you sell your house to buy a car? A house typically appreciates in value over many years, earns rent income or provides a strong foundation for a family. On the other hand a car is a depreciable asset and loses almost all its value over a period of time.

A normal person would not sell his or her house to buy a car. A car is usually bought from income and not by selling assets. However the Government of India in all its wisdom is doing just that, selling its house to buy a car i.e. selling assets to pay for expenditure that does not earn any future income or serves no purpose apart from indulgence. The government indulges itself and its voters in the form of subsidies and this indulgence is not funded through revenues but from selling/milking its assets.

The fiscal year 2013-14 is a clear example of the government falling short of revenues but still paying out subsidies and funding it through reduction in plan expenditure and selling/milking its assets. Plan expenditure is government expenditure that goes into creation of infrastructure and other long term benefit providing assets for the economy.

Government Expenditure for 2013-14

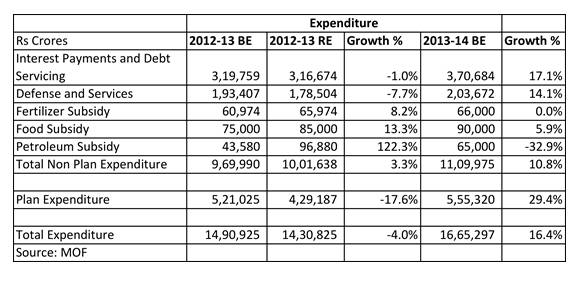

The government in its budget for 2013-14 forecast total expenditure to grow by 16.4% year on year. Non plan expenditure that includes defence services, subsidies and interest payments was budgeted to grow at 10.8% while plan expenditure was budgeted to grow at 29.4%. Table 1 gives the budgeted expenditure of the government for 2013-14.

Table 1. Government budgeted expenditure for 2013-14

Government expenditure does not stick to a budgeted pattern, especially on the non plan expenditure. As of January 2014, the government has largely exceeded its non plan expenditure and has cut its plan expenditure size by 20% (as per reports) to keep down its fiscal deficit in the face of slow revenue growth. The government had already touched 95% of its fiscal deficit target of Rs 5,42,0000 crores in the April-December 2013 period indicating the sharp rise in spending on the back of higher subsidy payouts. Non plan expenditure in the April-December 2013 period was at 73% of budget estimates.

The government has under budgeted for fuel subsidy that is expected at twice the budgeted amount of Rs 65,000 crores. The government is forcing ONGC to pay for the rising oil subsidy with the company being forced to pay a record amount of Rs 13,700 crores as fuel subsidy for the third quarter of 2013-14. ONGC had already paid Rs 26,400 crores as subsidy in the first half of fiscal 2013-14. The government is milking its asset, ONGC for indulgence through fuel subsidies.

Government Revenues for 2013-14

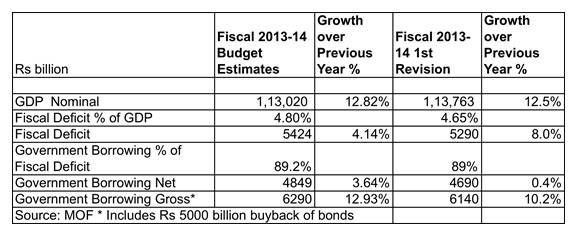

The government had budgeted for a 21.2% growth in total revenues for fiscal 2013-14 with 19% growth in tax revenues and 32.8% growth in non tax revenues. Table 2 gives the budgeted revenues of the government for fiscal 2013-14.

Table 2. Government budget revenues for 2013-14

The latest available figures indicate that direct tax collection growth at 12.5% for the April-December 2013 period is below the 17.5% growth budgeted for the full year. Indirect tax collection at 6.2% for the April-December 2013 period is well below full year budgeted growth levels of 20.3%.

On the non tax receipts front, the government is well short of its disinvest target of Rs 55,800 crores with just Rs 5000 crores being raised. The government could raise an additional Rs 13,000 crores from its plans for disinvestment in the January – March 2014 quarter.

The government is making up the gap in disinvestment by forcing Coal India to pay a special interim dividend of Rs 16,485 crores. The government is milking its assets to pay for shortfall in revenues.

The government is set to meet its spectrum auction target of Rs 23,000 crores as bids for the ongoing spectrum auction has crossed Rs 50,000 crores. Successful bidders need pay around 25% to 33% upfront this fiscal if they choose to pay the amount in instalments.

The bottomline for 2013-14 is that the government has not been able to control non plan expenditure (read subsidies) and with shortfall in tax revenues is resorting to cuts in plan expenditure and selling/milking its assets to keep fiscal deficit from ballooning.