Dear Mr. Arun Jaitley, this is yours and your Prime Minister Mr. Narendra Modi’s first union budget. There are a whole lot of expectations on the 10th of July from both the Indian public that have overwhelmingly voted you to run the government for the next five years and from domestic and global investors who have taken up the Sensex and Nifty to record highs.

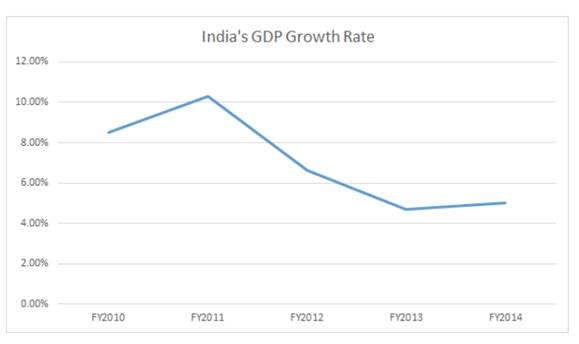

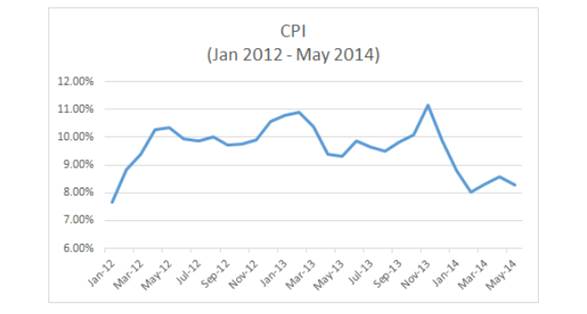

We understand that your job is not easy in the current environment where the average Indian is suffering from inflationary pangs and low economic growth. There is a strong need to contain inflation and push up economic growth. Inflation as measured by the CPI (Consumer Price Index) has averaged around 9.5% over the last five years while GDP growth has come off from 8.4% levels to below 5% levels over that last few years.

Unfortunately, given that CPI still does not reflect the true inflation in the economy due to subsidies, your job becomes even more difficult now. Subsidies may suppress headline inflation numbers but that inflation is reflected in value of the Indian Rupee and in the cost of borrowing to the government. Financial markets are usually many steps ahead of policies, and in case of subsidy policy the markets have clearly given a thumbs down for subsidies.

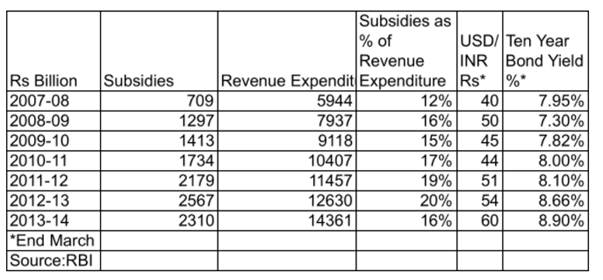

Table 1. shows the rising subsidy payout of the government and the falling value of the Indian Rupee (INR) and rising yields on ten year government bond yields.

Table 1. Subsidy Payouts, INR and Bond Yields

Thankfully, off balance sheet subsidies through issuance of oil bonds have been discontinued. The UPA government had issued oil and fertilizer bonds worth over Rs 2000 billion unto 2008-09, from which time it was discontinued. Off balance sheet subsidy accounting distorts the subsidy figures even further.

What have the subsidies done to the general public? Nothing but brings in more pain. Pain in the form of rising inflation and falling economic growth. Subsidies have brought down the value of the INR as markets factored in suppressed inflation into the currency value. Government borrowing costs have risen on higher government debt brought about by subsidies. (View our two minute concept series video on rising government debt).

Mr. Jaitley, as seen in Table 1., suppressed inflation through subsidies is your key enemy and your budget must focus on putting it down. There will be hue and cry as administered prices are released as it is seen as inflationary but true inflation is better than suppressed inflation and more easily controllable. Economic growth follows low inflation as the currency strengthens brining in capital flows and interest rates fall incentivising domestic investments.