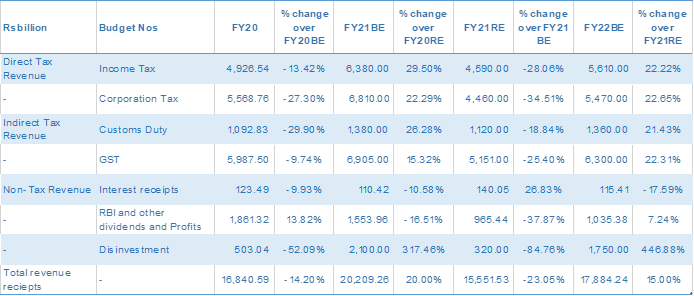

The government has budgeted for a 16.67% increase in total taxes with corporation tax rising by 22.64% and personal income tax rising by 22.22% in the budget for fiscal 2021-22.

On the indirect tax front, the government has budgeted for a 22.306% increase in GST collection, for FY2021-22. Union Excise duty is budgeted to decline by 7.20% and Customs duty is budgeted to grow by 21.429%.

On the Non-Tax Revenue front, dividends from RBI and PSU’s have been budgeted for a 7.244% increase.

Disinvestment target for 2021-22 is budgeted at Rs 1750 billion, a growth of 446%. Total non-tax revenue is budgeted to grow by 15.369%.