RBI is showing its concern on high liquidity, high fiscal deficit and rising equity prices by taking baby steps towards liquidity management. The CRR hike is the first step and more will follow in coming policy meets including repo rate hikes.

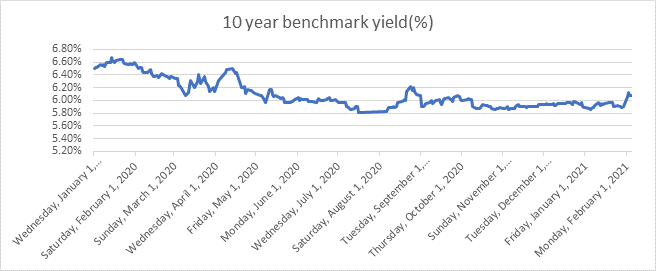

RBI is also likely to allow bond yields to rise and it will not actively manage the yield curve, as it further normalises policy. Bond markets will test RBI in auctions by bidding at higher levels of yields. 10yr bond yield is likely to trend up going forward on policy normalisation.

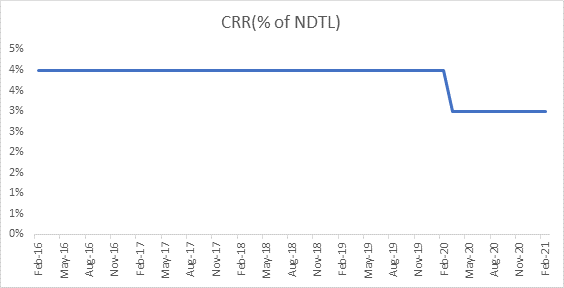

In the MPC meeting In February, RBI left repo rate unchanged while increasing the cash reserve ratio (CRR) in a phased manner in the next 4 months from its current level of 3%, on the assessment of systemic liquidity position. It will be hiked by 50 bps to 3.5% effective from 27th March 2021 and further increase of 50 bps to 4% from 22nd May 2021. This is expected to curb elevated inflation levels in near future. As per RBI’s prediction, consumer inflation is likely to be at 5.2% during Q4FY21 and at 5.2%-5% in H1FY22, which is still above targeted inflation level of 4%. Regarding GDP growth, RBI forecast growth at 10.5% in FY22 and in a range of 26.2% to 8.3% in H1FY22 and 6.05% in Q3FY22.

Considering the current systemic liquidity level, it stood at a surplus level of Rs 6.71 trillion as of 4th Feb 2021. Reserve money rose by 14.5% y-o-y (on January 29, 2021), led by currency demand. Money supply (M3) rose by 12.5% as on January 15, 2021.

Owing to the higher fiscal deficit, RBI’s foremost priority is to curb inflation while supporting growth. Therefore, while maintaining accommodative stance amid comfortable liquidity position, central bank decided to restore cash reserve ratio at pre-covid level.

We would love to hear back from you. Please Click here to share your valuable feedback