Save better

through bonds

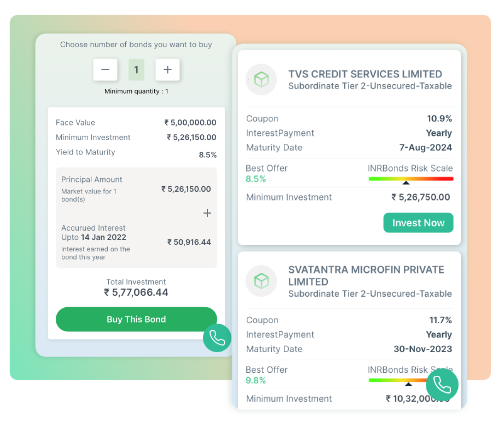

INRBonds makes buying bonds easy, helping you achieve your savings goal.

Learn MoreChoose from a wide range of bonds

Discover a comprehensive range of bonds on INRBonds, including corporate bonds, G-Sec, PSU bonds, tax-free bonds, and InvITs, tailored to your investment horizon and goals. All conveniently available in one place.

Safe and secure

Your transaction money is safe because we use the exchanges platform for settlement, which eliminates the risk of off-market trades.

Complete bond insights

INRBonds provides you with comprehensive information on all Indian bonds, including price, yield, credit rating, and other key metrics. You can get access to unbiased insights from our team of experienced analysts to help you make informed bond choices with confidence.

Simple and Easy transaction process

INRBonds makes it easy to buy and sell bonds with a user-friendly interface and seamless, speedy transactions. INRBonds platform is easy to use, so you can quickly find the bonds that are right for you.

Discover INRBonds, your trusted source for independent bond information and transactions. Gain access to unbiased insights that empower you to make informed bond choices with confidence

Investing in bonds can help you achieve your investment goals

Generate income

Bonds offer a reliable income source with fixed interest rates, which can provide a steady stream of income for investors. Bonds can generate higher returns compared to fixed deposits or debt mutual funds.

Mitigate risk

With lower risk compared to stocks, bonds serve as a valuable tool for investors aiming to reduce overall portfolio risk. This is particularly significant for retirement planning or those prioritising capital preservation.

Diversify portfolio

Incorporating bonds into an investment portfolio helps diversify asset classes beyond stocks. This diversification strategy enhances portfolio performance and lowers overall risk.

Achieve specific financial goals

Bonds are versatile instruments that can be tailored to various financial objectives such as retirement savings, college funding, or tax planning. By selecting suitable bond types, investors can align their investments with specific needs effectively.

Disclaimers:

Investment in the securities market is subject to market risks, read all the related documents carefully before investing. Bond investment carries market risk including interest rate risk, credit risk and liquidity risk.

Prior to investing in bonds, carefully assess your investment objectives, level of experience, and risk appetite.

Zephyr Financial Publisher Private Limited is the owner and operator of INRBonds.com. The CIN is U74120MH2011PTC223971. Registered office is at Plot 124, Flat no.8, Kalakunj, off Shiv Mandir Road,Shiv Ganganagar, Ambernath, Thane-421501.

Address for correspondence is 1st floor, Teerth Techno space, Baner, Bangalore Mumbai Highway, Pune-411045.

Zephyr Financial Publishers Pvt. Ltd. NSE Registration number: 90330; SEBI Registration number: INZ000313336.

Compliance officer is Mr Amarnath Kundu and can be reached at [email protected]. For any complaints pertaining to this website please write to [email protected].

For filing a complaint directly on SEBI SCORES use this link https://scores.gov.in/scores/Welcome.html

We value your privacy. We collect, retain, and use your contact information for business purposes as laid out in our Privacy Policy.