Equity Markets Snapshot For The Week:

- US and China will publish Inflation Growth data.

- Investors in India will watch for Industrial Production & CPI Inflation Data.

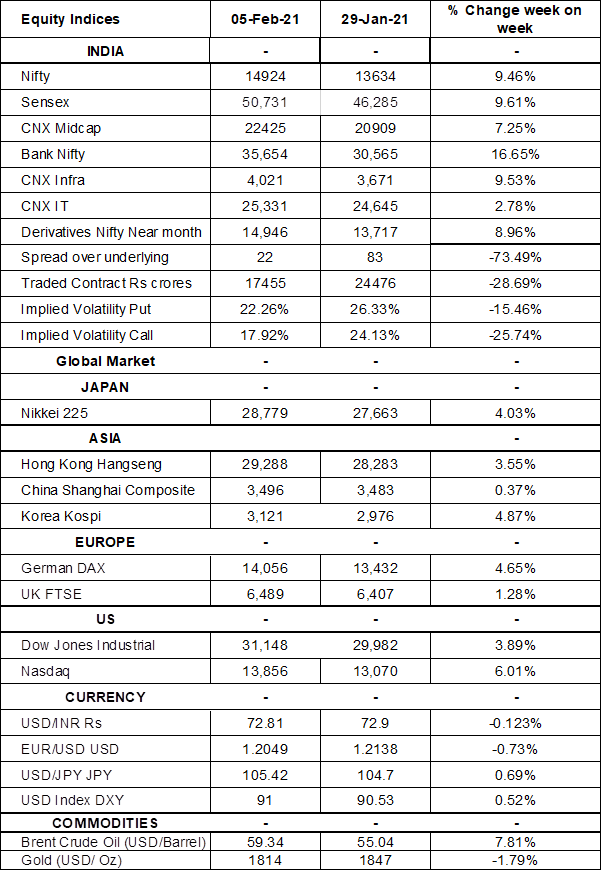

- Implied volatility (IV) for put and call at the money options stood at 22% and 18% levels, respectively.

S&P BSE Sensex closed on a positive note on Friday at all time high levels of 50,731 amid investors digested India's Union Budget and a batch of stronger-than-expected earnings. On the budget front, owing to higher government borrowing in FY21 to mitigate impact of Corona crisis, fiscal deficit for FY21 surged to 9.5% of GDP as per revised estimation. For next fiscal year it has been pegged at 6.8% of GDP. On monetary policy front, RBI left repo rate unchanged while increasing the cash reserve ratio (CRR) in a phased manner in the next 4 months from its current level of 3%. Click here to read our analysis on latest RBI Policy Note.

Domestic macro-data front, The IHS Markit India Services PMI increased to 52.8 levels in January 2021 from 52.3 levels in the previous month, but below market expectations of 53 levels. India trade deficit narrowed slightly to USD 14.75 billion in January 2021 from USD 15.3 billion a year earlier and a 2-year high gap of USD 15.44 billion in December 2020. Exports increased 5.4% (Y-o-Y) to USD 27.24 billion and imports rose 2% (Y-o-Y) to USD 42 billion.

FIIs/FPIs have bought Indian equity shares worth Rs. 194.73 billion in January 2021 and bought Rs. 107.93 billion in February 2021 (as of 07th February 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across Index Futures, Index Options and Stock Options.

The Nifty Index futures witnessed rise in open interest by 61% for the February series and rise in open interest by 56% for the March series. Implied volatility (IV) fell for call option and for put option in the last week. Fall in IV for call option and for put option shows steady support for Nifty at present levels.

On the global front, Wall Street indices closed on positive note despite weak job data. Disappointing January jobs report increased hopes for stimulus package. Labor Department said the US added only 49,000 jobs in the first month of 2021, while December’s losses were revised to 227,000 from the initial 140,000, triggering concerns over the state of the economy. During the week, Dow Jones gained by 3.89%, Nasdaq surged by 6%, and S&P 500 rose by 4%.

European stocks booked strong weekly gains, with DAX 30 closing up near all-time high of 1, on hopes that coronavirus vaccination rollout and extra stimulus in the US would boost the economic recovery. During the week, FTSE gained by 1.3% and DAX surged by 4.65%.

Brent crude surged by 8% during last week to USD 59 a barrel amid OPEC+ maintained its oil output policy at a meeting on Wednesday. Saudi Arabia to cut output voluntarily by 1 million barrels per day In February and March 2021.

Global Economy

The US unemployment rate dropped to 6.3% in January 2021, down 0.4% point from the previous month and well below market expectations of 6.7%, as the number of unemployed persons decreased to 10.1 million.

The IHS Markit US Services PMI was revised higher to 58.3 levels in January 2021 from a preliminary of 57.8 levels and 54.8 levels reported in December 2020.

The US trade deficit narrowed to USD 66.6 billion in December 2020 from a revised USD 69 billion in the previous month and compared to market expectations of USD 65.7 billion. Exports increased 3.4% to USD 190 billion, while imports rose 1.5% to USD 256.6 billion.

Annual inflation rate in the Euro Area jumped to 0.9% in January 2021, the highest rate since February 2020, and ending 5 months of deflation.

Jibun Bank Japan Services PMI came in at 46.1 levels in January 2021, compared with a preliminary reading of 45.7 levels and a final 47.2 levels in December 2020.

The Bank of England voted unanimously to keep its benchmark interest rate on hold at a record low of 0.1% and left its bond-buying programme unchanged during its February 2021 meeting. Policymakers noted it would be appropriate to start the preparations so that it could set a negative rate in 6 months, but stressed it should not be interpreted as a signal.

The number of Americans filing for unemployment benefits declined to 779,000 in the week ended 30th January 2021, from the previous week's revised figure of 812,000 and well below market expectations of 830,000.

US crude oil inventories fell by 0.994 million barrels in the week ended 29th January 2021, compared to market forecasts of a 0.446 million barrels increase, according to the EIA Petroleum Status Report.