Equity Markets Snapshot for The Week:

- Global investors will watch out for reform of the global tax system ahead of the highly anticipated G7 leaders’ summit.

- US and China will report inflation data.

- Eurozone will hold monetary policy meeting.

- Domestic investors will watch out for industrial output data.

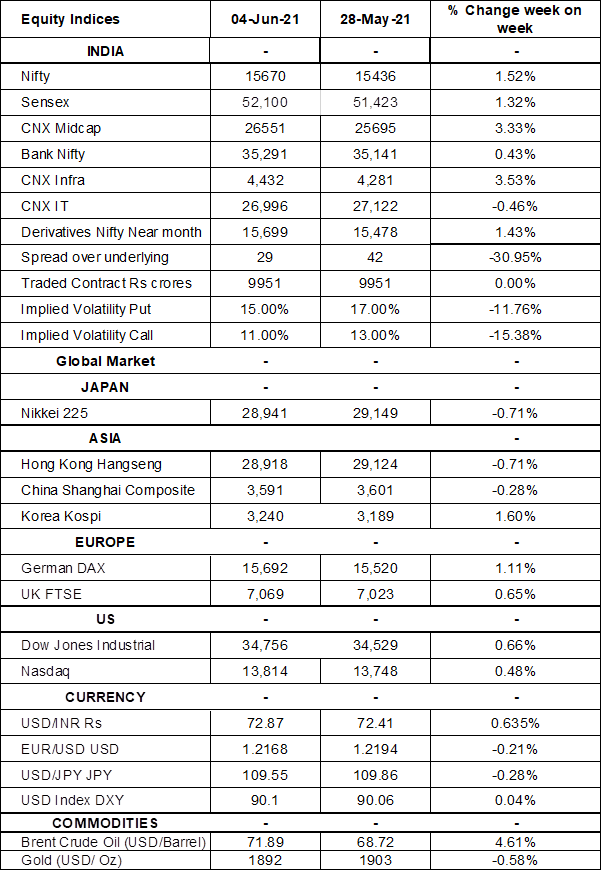

The BSE Sensex & Nifty 50 closed the week on strong note, gained as much as 1.5% during the week. Market sentiment improved after RBI’s expanded version of QE to support economic growth. RBI maintained its accommodative stance and kept repo rates unchanged in its policy review on the 4th June 2021. Click here to read our RBI policy-meeting analysis. On macro-data front, IHS Markit India Services PMI declined to 46.4 levels in May 2021 from 54 levels in the previous month, and below market expectations of 49 levels. The reading pointed to the first-time contraction in the sector since last September 2020, amid a resurgence of COVID-19 cases. PMI levels in India declined to 48.1 points in May 2021 from 55.4 points in the previous month. This was the lowest reading since last August 2020.

FIIs/FPIs have sold Rs. 29 billion in May 2021 and invested Rs. 79 billion in June 2021 (as of 06th June 2021). Foreign Institutional Investors (FIIs) Derivative Statistics have shown a rise in the open interest across index options and Stock Options. Implied volatility (IV) fell for both put options and for call options in the last week. Fall in IV for put option and for call option shows steady support for Nifty at present levels.

Wallstreet indices witnessed volatile session on Friday before closing on a positive note, tech stocks were top gainers. Weak non-farm payroll data eased worries of inflation. So, markets expect FED to continue with ultra-lose monetary policy until the economy is recovered to pre-Covid levels. During the week, Dow Jones gained by 0.66%, Nasdaq up by 0.5%, and S&P 500 rose by 0.84%.

Expectations over Eurozone economy rebounding at faster pace helped DAX to touch fresh all-time highs during the week. Macro-data earlier this week showing a solid expansion in European factory activity in May 2021 offered more evidence that the Eurozone could be recovering from a double-dip recession. During the week, FTSE up by 0.65% and DAX up by 1.11%.

Brent Crude prices gained by 5% during last week amid optimism of global economic outlook, higher demand levels seen in Europe on the back of summer travel and US president USD 6 trillion budget in 2022 boosted sentiment.

Gold prices bounced back on Friday on the back of lower-than-expected US unemployment data which pushed dollar and UST lower. However, on weekly basis Gold prices down by 0.58%.

Global Economy

The annual inflation rate in the Eurozone accelerated to 2% in May 2021 from 1.6% in April and above market forecasts of 1.9%. The inflation topped the ECB’s target of 2% but policymakers are expected to keep monetary policy unchanged during coming week policy-meeting.

IHS Markit Eurozone Services PMI was at 55.2 levels in May 2021 and pointing to the strongest pace of expansion since June 2018. All nations recorded an improvement in activity since April 2021.

The US economy added 559,000 jobs in May 2021, above an upwardly revised 278,000 in April 2021 but below market forecasts of 650,000. That leaves employment about 7.6 million jobs below its peak in February 2020. The US unemployment rate dropped to 5.8% in May 2021, the lowest since March 2020.

The number of Americans filing new weekly claims for unemployment benefits dropped by another 20,000 to 385,000 in the week ending 29th May 2021, falling below the 400,000 mark for the first time since March 2020, when the pandemic hit the economy.

The ISM Services US PMI increased to 64 levels in May 2021 from 62.7 levels in April 2021, breaking a fresh record high and beating market forecasts of 63 levels.

US crude oil inventories dropped by 5.08 million barrels in the 28th May 2021 week, following a 1.662 million decrease in the previous period and compared with market forecasts of a 2.443 million fall, data from the EIA Petroleum Status Report showed.

The au Jibun Bank Japan Services PMI was revised upward to 46.5 levels in May 2021 from a preliminary reading of 45.7 levels and compared with a final 49.5 levels in April 2021.