INRBONDS Retail High-Yield Bond Index

NAV Update- 15th June 2025

Fixed-income securities are highly suitable for retail investors who prefer steady income by way of regular coupons. It protects their portfolio against the risk of volatility, fluctuation, and unpredictability. Bonds typically react differently to market conditions compared to equity stocks, thereby helping investors balance the overall portfolio risk. Fixed-income securities are debt instruments that pay a fixed interest or coupon rate over a specified period, and they include various options such as government bonds, corporate bonds, municipal bonds, and certificates of deposit (CDs). The retail investor's biggest concern is to earn more than the current inflation rate. Therefore, herein we focus on Corporate Bonds below AAA category offering higher yields targeted to beat the inflation. To build a Fixed Income Portfolio, a retail investor would typically require knowing the current market prices of various corporate securities, yield rates, etc.

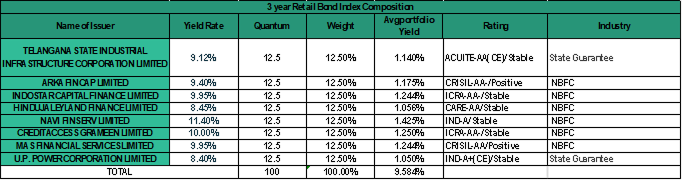

INRBONDS Retail High-Yield Bond Index shall therefore act as a guide and performance indicator to all retail investors. It shall serve them as a reference point of current market price and the yield rates, market returns, and the performance of select, good fundamental and stable corporate bonds over the period. INRBONDS Retail High-Yield Bond Index is a diversified set of eight (8) bond securities with a three-year constant maturing index considering that there is enough liquidity and making it a desirable investable portfolio.

- The INRBonds HY fortnight Index Yield stood at 9.58% while 3 Yrs Gsec yield traded at 5.63%. The spreads marginally increased from 382 basis points to 395The Index NAV on 15th June was Rs. ₹100.266

- The Portfolio Yield of select Bond securities is as below –

The INRbonds HY Index VS 3 Yrs Gsec graph as on 15th June 2025 is as below –

Disclaimers:

Investment in the securities market is subject to market risks, read all the related documents carefully before investing. Bond investment carries market risk including interest rate risk, credit risk and liquidity risk.

Prior to investing in bonds, carefully assess your investment objectives, level of experience, and risk appetite.

Zephyr Financial Publisher Private Limited is the owner and operator of INRBonds.com. The CIN is U74120MH2011PTC223971. Registered office is at Flat No. 502, Chaitanyapuri Society, SN 12, Behind Kothrud Stand, Dahanukar Colony, Kothrud, Pune City, Pune - 411038, Maharashtra, India

Address for correspondence is 1st floor, Teerth Techno space, Baner, Bangalore Mumbai Highway, Pune-411045.

Zephyr Financial Publishers Pvt. Ltd. NSE Registration number: 90330; SEBI Registration number: INZ000313336.

Compliance officer is Mr Amarnath Kundu and can be reached at [email protected]. For any complaints pertaining to this website please write to [email protected].

For filing a complaint directly on SEBI SCORES use this link https://scores.sebi.gov.in/

We value your privacy. We collect, retain, and use your contact information for business purposes as laid out in our Privacy Policy.

Investor Awareness:Dear Investor, beware of fraud sms and emails offering you fraudulent investment schemes and any unsolicited investment advise and tips offering unreasonable profits